- United States

- /

- Biotech

- /

- NasdaqGM:NRIX

Is the Upcoming NX-5948 Clinical Data Update Shaping the Investment Case for Nurix Therapeutics (NRIX)?

Reviewed by Sasha Jovanovic

- Nurix Therapeutics announced it will host a live webcast on December 8, 2025, to review new and updated clinical data from its ongoing Phase 1a/1b trial of the BTK degrader bexobrutideg (NX-5948) and to provide a corporate update.

- This upcoming presentation, which will focus on relapsed/refractory chronic lymphocytic leukemia and Waldenström macroglobulinemia, has drawn interest due to the potential significance of new clinical findings in these challenging disease areas.

- We’ll explore how investor expectations around the NX-5948 clinical data update are shaping the company’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Nurix Therapeutics' Investment Narrative?

Being a shareholder in Nurix Therapeutics often comes down to a belief in the transformative potential of its clinical pipeline, especially the ongoing development of molecules like bexobrutideg (NX-5948). The recently announced webcast on updated clinical data now stands as a near-term catalyst, potentially influencing how the market views Nurix’s pipeline value and the probability of future approvals. While the company has attracted attention for positive regulatory designations and high revenue growth forecasts, it remains unprofitable with widening losses, and has recently diluted shareholders through equity offerings. The webcast could sharpen focus on the progress and promise of NX-5948, but it doesn’t fundamentally alter the biggest risks: sustained negative earnings, high price-to-sales valuations, and lack of a clear path to profitability in the near future. Investors should watch whether trial updates lead to any material shift in sentiment or risk. On the other hand, persistent losses and dilution are issues to keep an eye on.

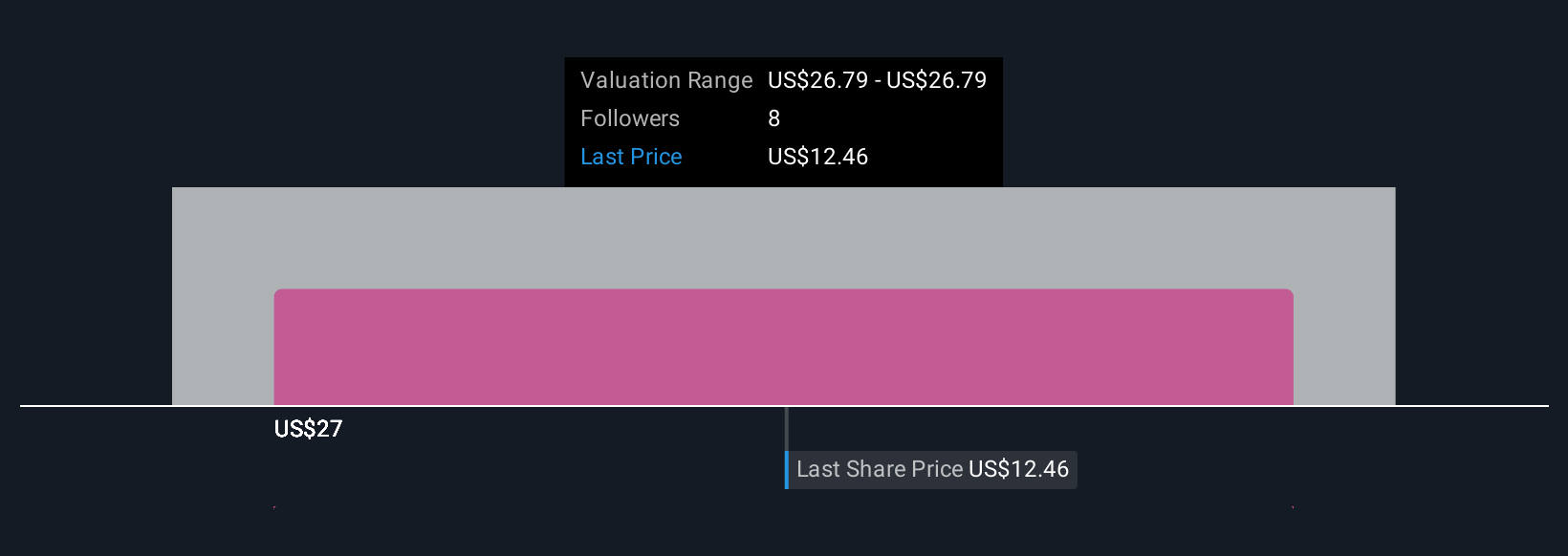

Our valuation report unveils the possibility Nurix Therapeutics' shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Nurix Therapeutics - why the stock might be worth as much as 61% more than the current price!

Build Your Own Nurix Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nurix Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Nurix Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nurix Therapeutics' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nurix Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NRIX

Nurix Therapeutics

A clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and antibody therapies for the treatment of cancer, inflammatory conditions, and other diseases.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026