- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX) valuation update after NBI-1070770 Phase 2 trial failure reshapes pipeline expectations

Reviewed by Simply Wall St

Neurocrine Biosciences (NBIX) just shared a key clinical update, revealing that its investigational depression drug NBI-1070770 missed the primary efficacy endpoint in a Phase 2 trial, raising new questions about the company’s broader pipeline strategy.

See our latest analysis for Neurocrine Biosciences.

Despite the setback, Neurocrine’s share price has held up reasonably well, with the stock at $155.51 and showing a 90 day share price return of 8.14 percent. Its 1 year total shareholder return of 21.36 percent signals that longer term momentum remains intact.

If this pipeline news has you rethinking your healthcare exposure, it could be worth exploring other healthcare stocks that are quietly reshaping the sector.

With the shares still up strongly over one and five years and trading below analyst targets, is Neurocrine quietly offering value after this trial setback, or has the market already priced in years of future growth?

Most Popular Narrative Narrative: 36.5% Undervalued

Neurocrine’s last close of $155.51 sits well below the narrative’s fair value of $244.80, setting up a sizable valuation gap investors will want to examine.

📌 Earnings Expectations (Preliminary) for Neurocrine Biosciences' Q2 2025 earnings

• Consensus EPS Estimate: Around $0.97 per share.

• Expected Revenue: Approximately $653.09 million. Neurocrine continues to focus on treatments for neurological, neuroendocrine, and neuropsychiatric disorders. Their portfolio includes FDA-approved drugs like Ingrezza and Orilissa, and they are advancing multiple compounds in mid- to late-stage clinical trials.

Want to see how a rich future earnings multiple, ambitious revenue expansion, and rising profit margins combine into that punchy upside target? The full narrative reveals the playbook.

Result: Fair Value of $244.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if key pipeline trials stumble again or if pricing and reimbursement pressures hit cornerstone drugs like Ingrezza and Crenessity.

Find out about the key risks to this Neurocrine Biosciences narrative.

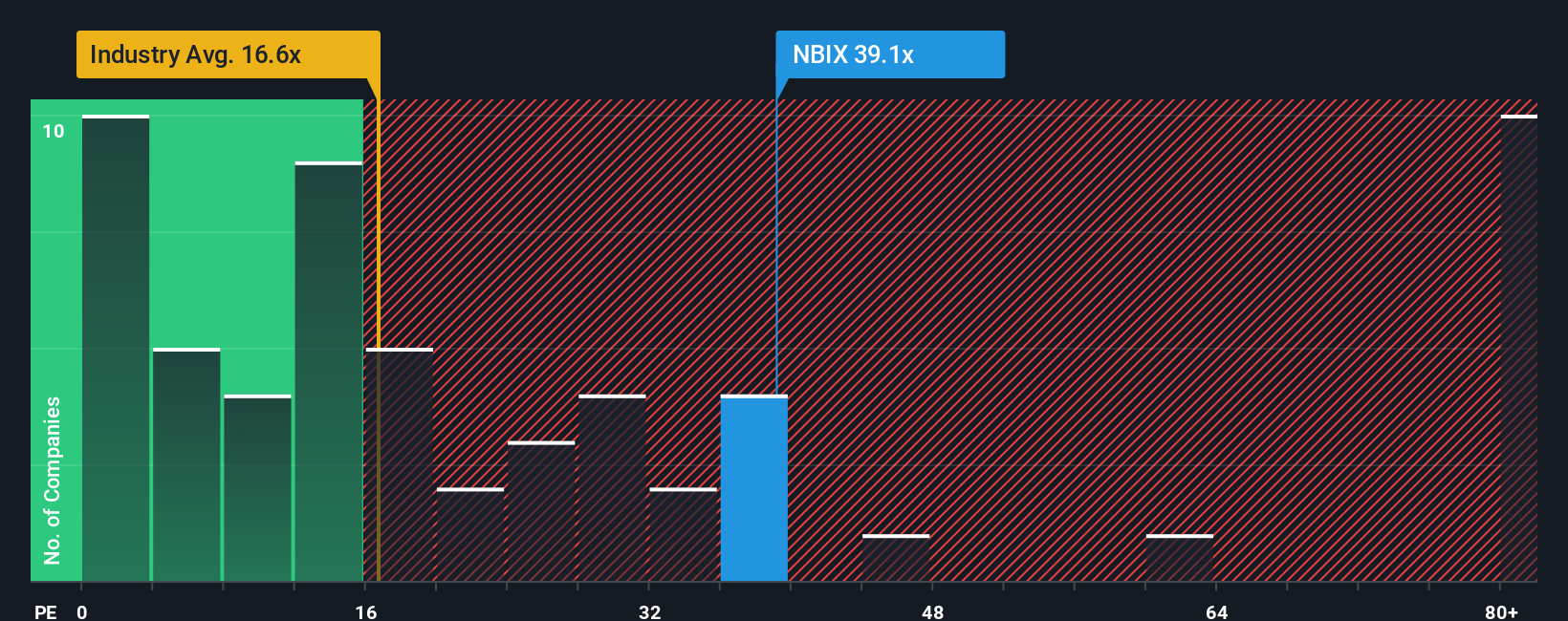

Another View: Multiples Signal Caution

That upbeat fair value contrasts with how the market is pricing Neurocrine against earnings today. The stock trades on a 36.2 times earnings multiple, far richer than the US biotech average of 19.1 times and a fair ratio closer to 25.9 times. If sentiment cools or growth disappoints, that premium could unwind faster than investors expect.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for more investment ideas?

Before the next headline hits, you can explore potential opportunities on Simply Wall Street’s screener and identify trends that others may not have noticed yet.

- Capture potential mispricings by targeting companies trading below their intrinsic value through these 907 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Focus on innovation driven names using these 26 AI penny stocks that could reshape entire industries with scalable AI solutions.

- Filter for reliable payers via these 15 dividend stocks with yields > 3% to help strengthen your portfolio’s income stream with attractive, recurring cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026