- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX) Is Up 5.1% After Peer-Reviewed Study Highlights INGREZZA’s Clinical Profile

Reviewed by Sasha Jovanovic

- On November 20, 2025, Neurocrine Biosciences announced the publication of a comprehensive peer-reviewed narrative review consolidating over a decade of clinical research on the FDA-approved VMAT2 inhibitors INGREZZA and deutetrabenazine for tardive dyskinesia.

- The review highlights key differences in pharmacologic, dosing, and clinical profiles between the two treatments, providing practitioners with updated evidence derived from double-blind, placebo-controlled trials and long-term studies.

- We'll examine how new, peer-reviewed evidence supporting INGREZZA's unique clinical profile could affect Neurocrine Biosciences' investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Neurocrine Biosciences Investment Narrative Recap

To own shares in Neurocrine Biosciences, you’d need confidence in the company's ability to maintain INGREZZA’s leadership in tardive dyskinesia and to expand its CNS pipeline, balancing growth prospects with pricing and payer challenges. The recent publication of a narrative review reinforcing INGREZZA's distinct clinical profile may support its standing among physicians, but unless it leads to materially increased uptake or payer coverage, the most significant short-term catalyst, prescription growth amid ongoing access barriers, remains largely unchanged. The primary risk continues to be sustained pricing pressure and tighter reimbursement, which could weigh on margin expansion and future revenue growth.

Among recent announcements, the October KINECT-4 study results are especially relevant, as they provide longer-term evidence of sustained symptom improvements in TD patients treated with INGREZZA. This clinical dataset, combined with the new peer-reviewed review, positions Neurocrine’s flagship product favorably, reinforcing the company's current growth drivers while highlighting both the promise and challenges tied to payer access, formulary decisions, and practitioner adoption.

In contrast, investors should be aware that aggressive Medicare contracting for INGREZZA is contributing to...

Read the full narrative on Neurocrine Biosciences (it's free!)

Neurocrine Biosciences' outlook anticipates $3.8 billion in revenue and $976.5 million in earnings by 2028. This is based on a 14.6% annual revenue growth rate and reflects a $628.2 million increase in earnings from the current $348.3 million.

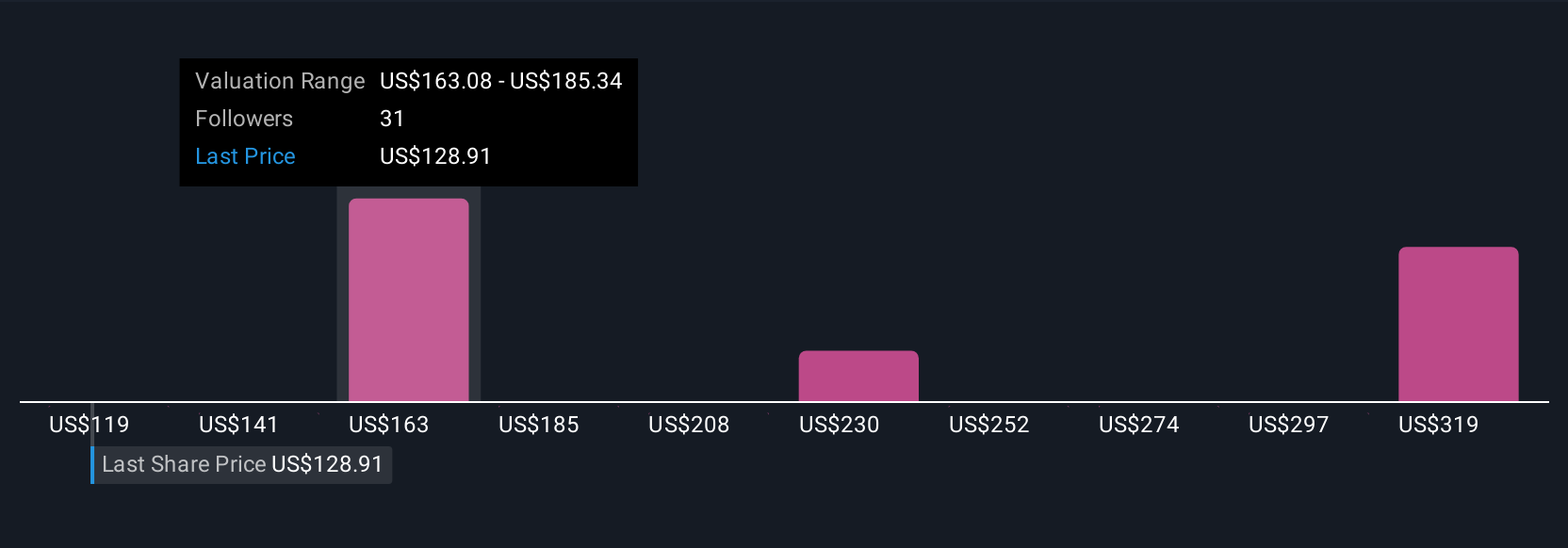

Uncover how Neurocrine Biosciences' forecasts yield a $174.62 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Neurocrine Biosciences range from US$118.58 to US$249.25 across five unique perspectives, illustrating broad variation in investor outlook. Against this backdrop, concerns about pricing pressure and tighter health plan scrutiny could become central to how the company’s performance is judged in months ahead.

Explore 5 other fair value estimates on Neurocrine Biosciences - why the stock might be worth as much as 65% more than the current price!

Build Your Own Neurocrine Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neurocrine Biosciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Neurocrine Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neurocrine Biosciences' overall financial health at a glance.

No Opportunity In Neurocrine Biosciences?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026