- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Should Moderna’s (MRNA) New US$1.5 Billion Term Loan Amid Tighter FDA Scrutiny Prompt Investor Action?

Reviewed by Sasha Jovanovic

- In November 2025, Moderna entered a Credit and Guaranty Agreement with Ares Capital for a US$1.50 billion term loan facility, including US$600 million drawn upfront and US$900 million in delayed-draw loans tied to timelines and late-stage regulatory milestones, secured against assets and subject to weekly minimum liquidity requirements.

- At the same time, Moderna and other vaccine makers are facing potential FDA moves toward stricter vaccine approval standards, a shift that could make this new, relatively expensive debt more important in supporting longer and possibly more complex development and approval cycles.

- We’ll now examine how heightened FDA scrutiny of vaccine approvals could reshape Moderna’s investment narrative built around pipeline expansion and efficiency.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Moderna Investment Narrative Recap

To own Moderna, you have to believe its mRNA platform can turn a shrinking, seasonal COVID and RSV franchise into a broader, durable pipeline, despite ongoing losses. The immediate catalyst remains progress in late stage vaccine programs, while the biggest risk is that tighter FDA standards slow approvals and keep revenues volatile. The recent reports of stricter vaccine scrutiny appear material mainly because they directly touch both that pipeline and Moderna’s regulatory burden.

The new US$1.50 billion Ares Capital credit facility looks most relevant here, as it ties US$900 million of delayed draw capacity to late stage regulatory milestones. In the context of heightened FDA review, this financing could give Moderna additional room to fund longer trials and post marketing commitments without relying solely on internally generated cash, which may be important if respiratory vaccine revenues remain lumpy while new products work through a more rigorous approval process.

But investors should also be aware that stricter FDA standards could interact with Moderna’s existing regulatory and pricing risks in ways that...

Read the full narrative on Moderna (it's free!)

Moderna's narrative projects $3.5 billion revenue and $498.6 million earnings by 2028.

Uncover how Moderna's forecasts yield a $37.32 fair value, a 46% upside to its current price.

Exploring Other Perspectives

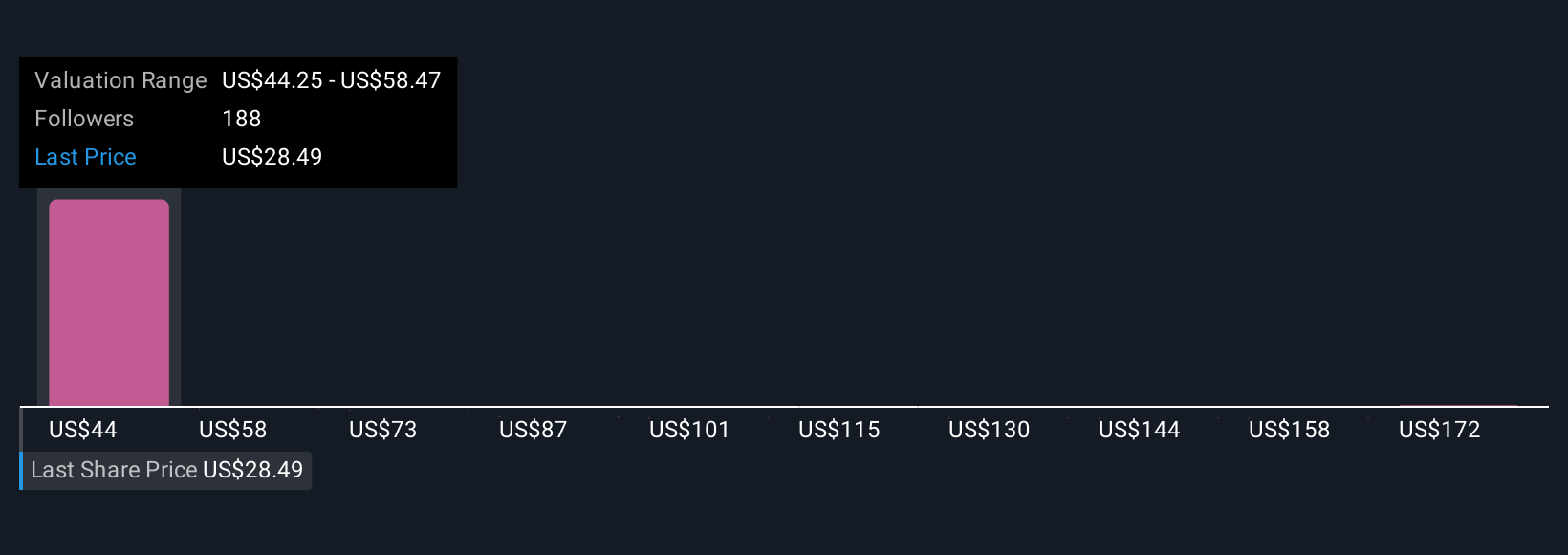

Twenty six members of the Simply Wall St Community value Moderna between US$35.78 and US$175 per share, underscoring how far opinions can diverge. Set against rising regulatory scrutiny that could delay launches and pressure margins, it is worth comparing several of these views before deciding how Moderna might fit into your portfolio.

Explore 26 other fair value estimates on Moderna - why the stock might be worth over 6x more than the current price!

Build Your Own Moderna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moderna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Moderna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moderna's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026