- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

Why MannKind (MNKD) Is Up 6.2% After FDA Accepts FUROSCIX ReadyFlow Autoinjector sNDA Filing

Reviewed by Sasha Jovanovic

- MannKind Corporation recently announced that the FDA has accepted its supplemental New Drug Application for the FUROSCIX ReadyFlow Autoinjector, an under-10-second subcutaneous furosemide delivery option for adults with edema due to chronic heart failure or chronic kidney disease, with a PDUFA target action date of July 26, 2026.

- Backed by bioequivalence data showing comparable diuretic effects to IV furosemide, ReadyFlow could meaningfully upgrade at-home management versus the current five-hour FUROSCIX on-body infusor.

- We’ll now examine how the potential shift to ultra-rapid, at-home diuretic delivery with ReadyFlow might influence MannKind’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MannKind Investment Narrative Recap

To own MannKind, you have to believe it can turn a focused portfolio in inhaled and specialty therapies into durable, diversified cash flows while managing high investment needs and competition. The ReadyFlow sNDA acceptance is encouraging, but it does not change that Afrezza adoption and concentration in a few key products remain the most important near term drivers and risks for the story.

The ReadyFlow news sits alongside MannKind’s recent string of profitable quarters, including Q3 2025 revenue of US$82.13 million and net income of US$7.99 million, which highlight the company’s progress in scaling its existing portfolio. How well MannKind can leverage FUROSCIX, Afrezza and its partnership with United Therapeutics into broader uptake now becomes the key question for investors watching upcoming catalysts.

However, against this backdrop of new products and growing revenue, MannKind’s dependence on a small set of core assets is a risk investors should be aware of, because...

Read the full narrative on MannKind (it's free!)

MannKind's narrative projects $437.5 million revenue and $70.4 million earnings by 2028.

Uncover how MannKind's forecasts yield a $9.39 fair value, a 65% upside to its current price.

Exploring Other Perspectives

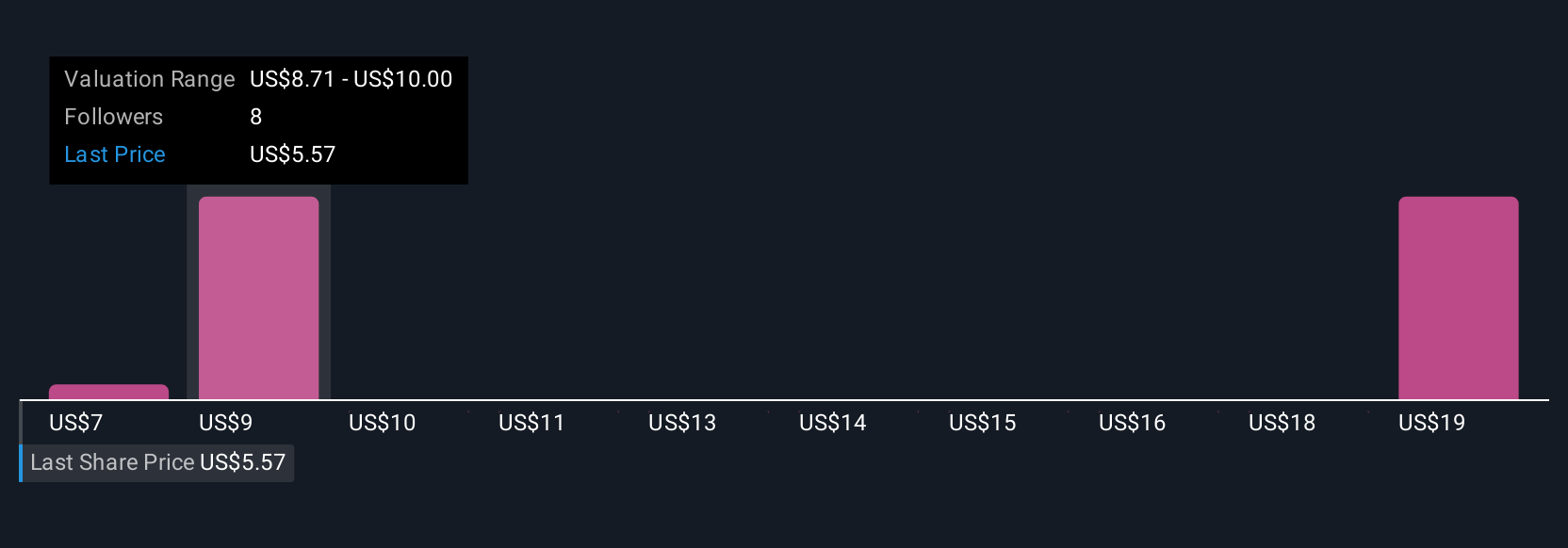

Four Simply Wall St Community fair value estimates for MannKind currently range from US$7.42 to about US$18.27, showing how far apart individual views can be. You may want to weigh these against the concentration risk in Afrezza and Tyvaso DPI royalties, which could influence how the company handles any future product setbacks or slower than expected uptake.

Explore 4 other fair value estimates on MannKind - why the stock might be worth over 3x more than the current price!

Build Your Own MannKind Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MannKind research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free MannKind research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MannKind's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026