- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

A Look at MannKind (MNKD) Valuation Following Strong Revenue Beat and scPharmaceuticals Acquisition

Reviewed by Simply Wall St

MannKind (MNKD) delivered upbeat third-quarter results, with revenue topping forecasts due to stronger Afrezza sales and higher Tyvaso DPI royalties. The company also closed its acquisition of scPharmaceuticals, setting the stage for broader commercial growth.

See our latest analysis for MannKind.

Over the past year, MannKind’s share price has experienced some swings, but momentum has accelerated recently, with a 64.6% gain over the past 90 days and a strong 15.4% 1-month share price return. Even though the one-year total shareholder return sits at -23.4%, this uptick follows upbeat earnings, successful product launches, and the acquisition of scPharmaceuticals. These are signals that investors are warming to its long-term growth story.

If recent biotech milestones have you interested in what's next, there's no better moment to discover See the full list for free.

After such a sharp rebound in the stock, the key question is whether MannKind remains undervalued based on its prospects or if the recent rally has already priced in all of the future growth potential.

Most Popular Narrative: 46.7% Undervalued

MannKind is trading at $5.63, while the widely followed narrative puts its fair value at a much higher $10.57. This sizable gap has become a talking point for those watching the company’s next moves.

Afrezza's continued double-digit prescription growth, international expansion efforts, upcoming pediatric indication launch, and a broadened salesforce footprint are set to accelerate market penetration amid a rising global diabetes burden and an aging population. These factors directly support revenue and earnings growth. Multiple late-stage pipeline programs (inhaled clofazimine for NTM and nintedanib DPI for IPF) are progressing toward key regulatory and clinical milestones, benefiting from expedited pathways and growing unmet need in chronic respiratory diseases. This has the potential to significantly diversify and expand future revenues.

There’s a bolder narrative just beneath the surface. Why are analysts banking on acceleration from MannKind? The answer involves high-octane growth assumptions, fresh indications, and surprising future profit upgrades. The projections driving this target may surprise you. Find out what’s fueling such a confident valuation.

Result: Fair Value of $10.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as limited Afrezza adoption and increased competition in rare lung diseases could quickly put pressure on MannKind’s growth outlook.

Find out about the key risks to this MannKind narrative.

Another View: Is the Market Overpaying?

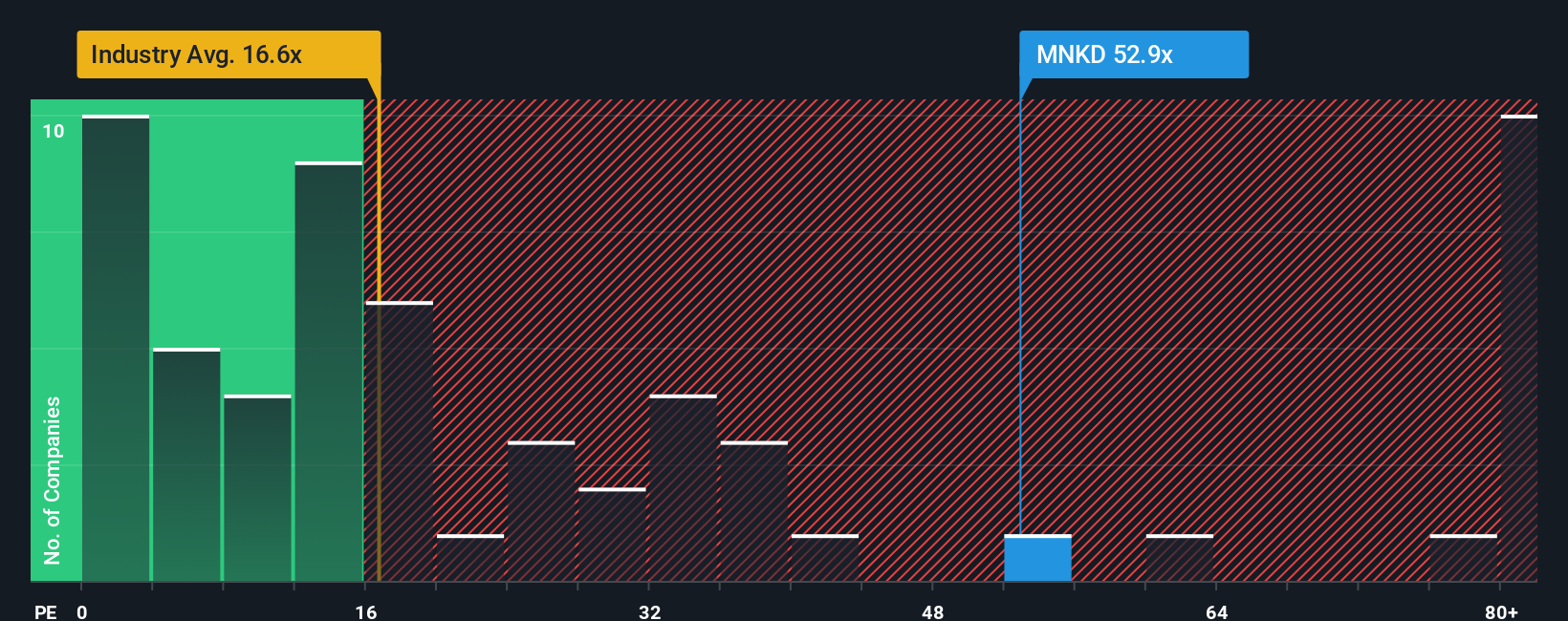

Looking beyond fair value estimates, MannKind's current price-to-earnings ratio of 59.1x is steep. This is substantially higher than the US Biotechs industry average of 17x and the company's fair ratio of 26.8x. This wide gap hints at heightened valuation risk if market optimism fades. Could downside follow, or is further upside justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MannKind Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own take on MannKind’s story in just a few minutes. Do it your way

A great starting point for your MannKind research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now’s your chance to gain an edge by zeroing in on areas where others might not be looking. The right opportunities could be just a click away, waiting for you to take action and step ahead of the crowd.

- Tap into high-growth potential with these 25 AI penny stocks and discover companies pushing the boundaries of artificial intelligence and next-generation software.

- Unlock hidden gems showing real value by screening for these 876 undervalued stocks based on cash flows, where companies may be flying under the radar and ready for a price surge.

- Boost your income with these 16 dividend stocks with yields > 3% in your portfolio. These picks offer attractive yields and the consistency that seasoned investors seek.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives