- United States

- /

- Biotech

- /

- NasdaqGM:MIRM

A Fresh Look at Mirum Pharmaceuticals (MIRM) Valuation as Investors Eye Rare Disease Pipeline Progress

Reviewed by Simply Wall St

See our latest analysis for Mirum Pharmaceuticals.

Mirum Pharmaceuticals’ share price has climbed over 73% year-to-date as investors respond to steady commercial execution and optimism around its rare disease therapies. Recent sessions have seen a modest pullback. The one-year total shareholder return remains robust at 58%, highlighting momentum driven by the company’s progress and market confidence in its pipeline.

If the rally in rare disease stocks has you seeking more opportunities, you might want to explore leaders across the healthcare sector with our See the full list for free.

With Mirum trading well below analyst price targets and delivering impressive long-term returns, the real question is whether investors are underestimating its potential, or if the recent momentum means future growth is already reflected in the price.

Most Popular Narrative: 17% Undervalued

Mirum Pharmaceuticals’ prevailing narrative puts its fair value well above the last close price. A chorus of analysts see transformative catalysts ahead, but execution risks remain.

Multiple late-stage pipeline catalysts, including three pivotal study readouts (VISTAS, VANTAGE, EXPAND) over the next 24 months and the initiation of the Phase II Fragile X study, set the stage for further product label expansions and new indication launches. This underpins future revenue diversification and potential earnings acceleration.

How can a story of pipeline expansion, fresh clinical milestones, and rapid market access lead to such an ambitious fair value? The analysts have made bold assumptions about how fast margins and revenues will surge. Wondering what future growth rates and profit projections justify this narrative? The details behind this towering valuation will surprise you. Find out what numbers are powering this view.

Result: Fair Value of $87.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trial timelines or increased regulatory scrutiny could quickly dampen sentiment and stall the current rally in Mirum shares.

Find out about the key risks to this Mirum Pharmaceuticals narrative.

Another View: Multiples Tell a Cautionary Tale

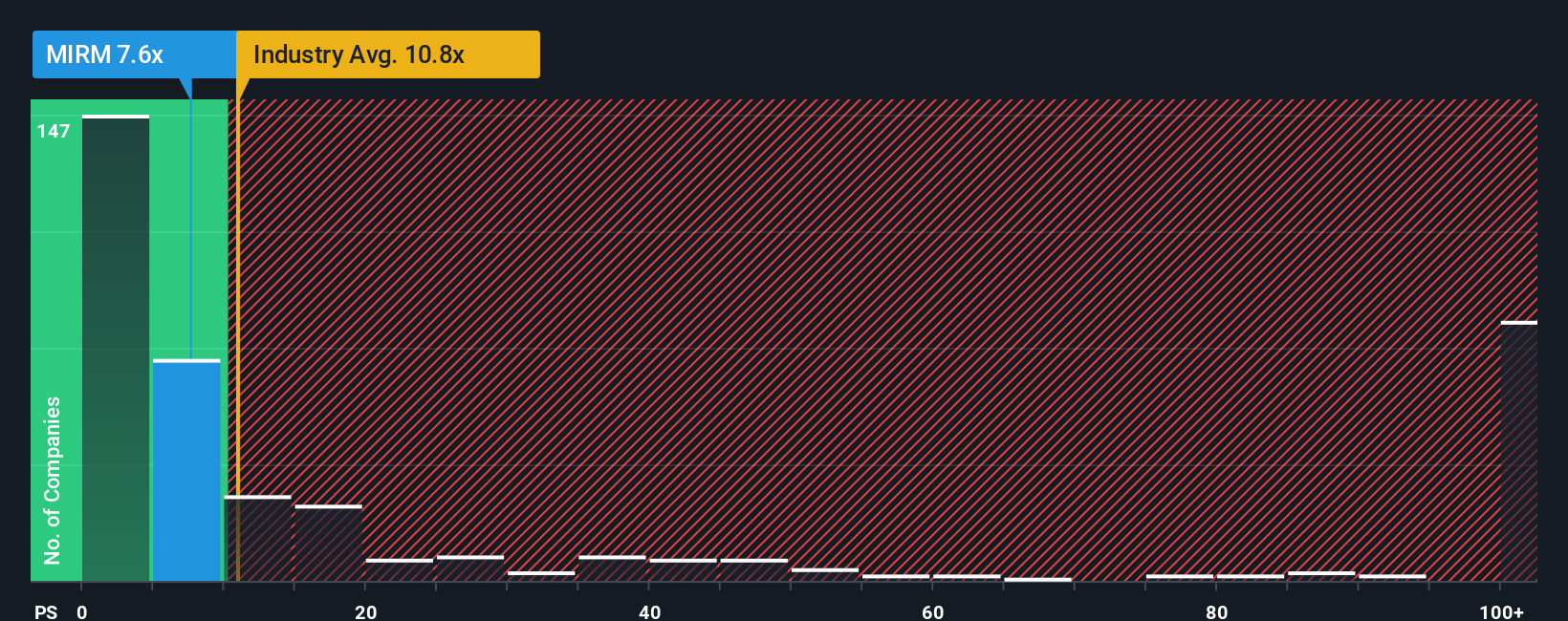

On the other hand, looking at the valuation through the price-to-sales ratio paints a different picture. Mirum trades at 8x revenue, which is higher than both the industry average of 6.2x and the fair ratio of 7x. This suggests investors could be paying a premium, increasing valuation risk if growth expectations are not met. Should investors be concerned about the potential for the market to re-rate the stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirum Pharmaceuticals Narrative

If you want to dive deeper or challenge this perspective, you can explore the numbers and craft your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mirum Pharmaceuticals.

Want Even More Winning Ideas?

Smart investors never stop looking ahead. Don’t miss the chance to uncover stocks built for tomorrow, using some of the most popular strategies on Simply Wall Street.

- Scoop up opportunities for strong passive income by checking out these 15 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Get ahead of tech disruption by narrowing in on these 25 AI penny stocks with real exposure to artificial intelligence and automation trends.

- Capitalize on potential bargains by targeting these 920 undervalued stocks based on cash flows with share prices that look attractive relative to their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MIRM

Mirum Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.