- United States

- /

- Biotech

- /

- NasdaqCM:MDXG

How Investors May Respond To MiMedx Group (MDXG) Raising 2025 Sales Outlook After Strong Q3 Results

Reviewed by Sasha Jovanovic

- MiMedx Group reported strong third quarter 2025 results, with sales rising to US$113.73 million and net income reaching US$16.75 million, both higher than the prior year period.

- The company also raised its full-year 2025 net sales growth guidance to the mid-to-high teens percentage range, highlighting momentum in operational performance.

- We'll now explore how MiMedx's third quarter sales growth and increased guidance affect its long-term earnings outlook and risks.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

MiMedx Group Investment Narrative Recap

To own MiMedx Group stock, you need to believe the company can defend and expand its presence in advanced wound care despite Medicare reimbursement shifts set for 2026. The recent quarterly earnings beat and updated full-year sales outlook improve confidence in MiMedx’s short-term growth, but do not fundamentally change the biggest catalyst, whether demand remains strong ahead of regulatory changes, or the main risk, which is uncertainty surrounding the new reimbursement rules. Of MiMedx’s recent announcements, the October 2025 launch of EPIXPRESS® stands out as most relevant here, since new products could help diversify revenue streams and soften future impacts from Medicare pricing reform. This development relates closely to the top short-term catalyst: portfolio expansion and product innovation, which offer potential resilience as the reimbursement environment evolves. By contrast, investors should watch for how fixed-rate Medicare reimbursement could...

Read the full narrative on MiMedx Group (it's free!)

MiMedx Group's narrative projects $487.0 million revenue and $67.0 million earnings by 2028. This requires 10.2% yearly revenue growth and a $35.0 million earnings increase from $32.0 million today.

Uncover how MiMedx Group's forecasts yield a $12.20 fair value, a 64% upside to its current price.

Exploring Other Perspectives

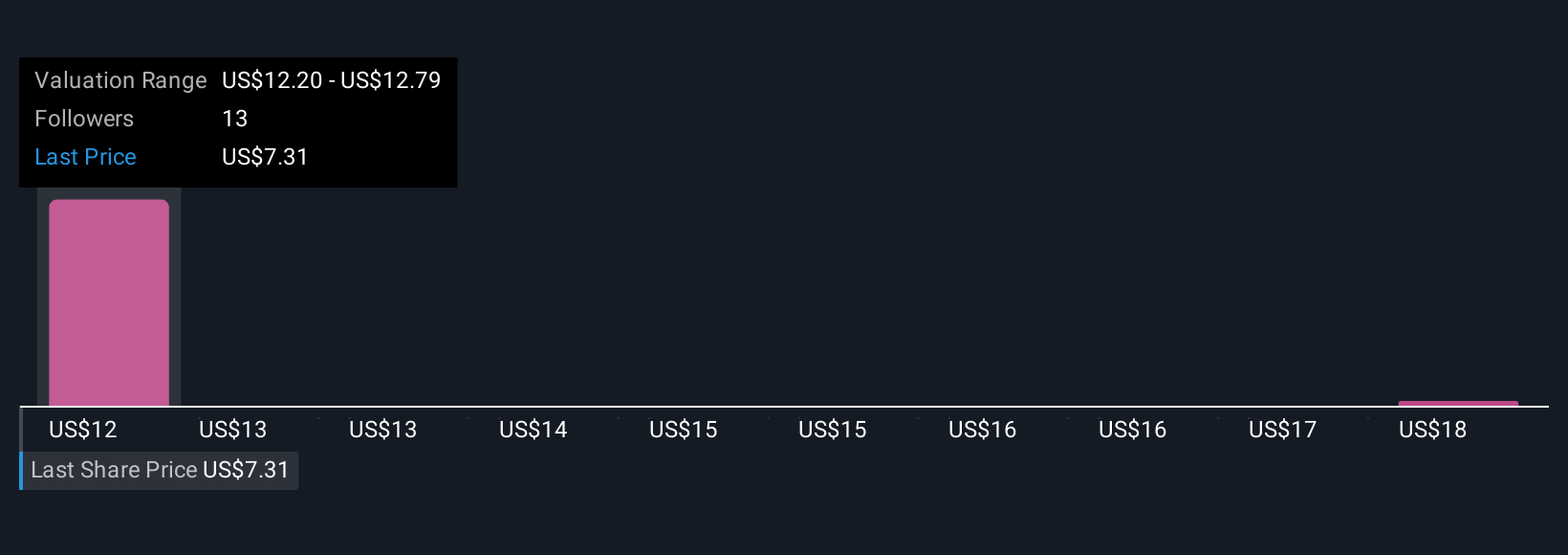

Simply Wall St Community members estimate MiMedx’s fair value between US$12.20 and US$17.71 across two opinions. While product innovation is seen as supportive, the range of investor views shows just how much market participants are weighing the potential impact of regulatory change.

Explore 2 other fair value estimates on MiMedx Group - why the stock might be worth over 2x more than the current price!

Build Your Own MiMedx Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MiMedx Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MiMedx Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MiMedx Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MDXG

MiMedx Group

Develops and distributes placental tissue allografts for various sectors of healthcare.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives