- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Madrigal Pharmaceuticals, Inc.'s (NASDAQ:MDGL) 26% Price Boost Is Out Of Tune With Revenues

Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 60%.

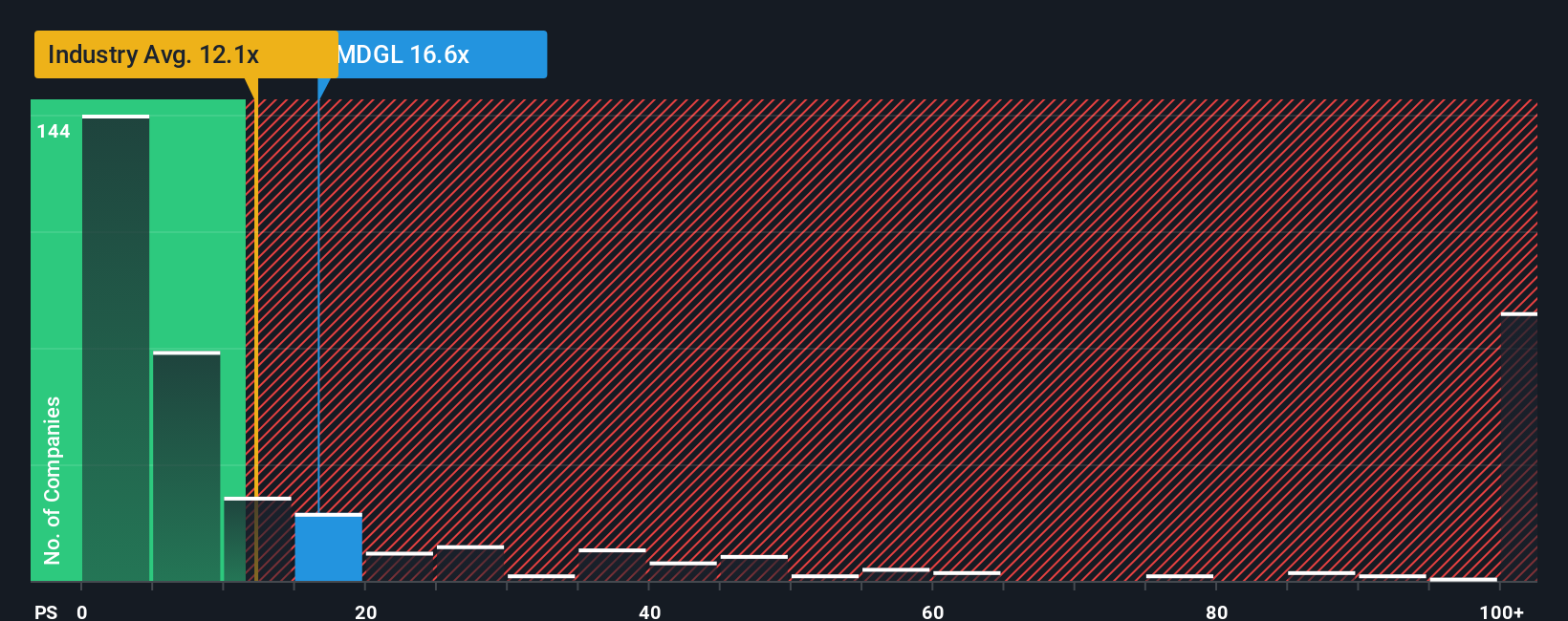

Following the firm bounce in price, Madrigal Pharmaceuticals may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 16.6x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 12.1x and even P/S lower than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Madrigal Pharmaceuticals

What Does Madrigal Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Madrigal Pharmaceuticals has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Madrigal Pharmaceuticals will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Madrigal Pharmaceuticals?

Madrigal Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 54% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 129% per year growth forecast for the broader industry.

In light of this, it's alarming that Madrigal Pharmaceuticals' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Madrigal Pharmaceuticals shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Madrigal Pharmaceuticals, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Madrigal Pharmaceuticals that you should be aware of.

If you're unsure about the strength of Madrigal Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives