- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

CAR-T Durability And Off-the-Shelf Progress Could Be A Game Changer For Legend Biotech (LEGN)

Reviewed by Sasha Jovanovic

- Legend Biotech recently reported long-term clinical results showing a median progression-free survival of 50.4 months for CARVYKTI in heavily pretreated multiple myeloma patients, alongside early Phase 1 data for its allogeneic CAR-T candidate LUCAR-G39D that delivered a 75% overall response rate with manageable safety in relapsed or refractory B-cell non-Hodgkin lymphoma.

- These past data releases highlight how earlier use of CARVYKTI and progress in off-the-shelf CAR-T technology could broaden Legend’s treatment reach and reinforce the durability of its cell therapy portfolio.

- We’ll now examine how CARVYKTI’s extended progression-free survival profile could influence Legend Biotech’s investment narrative and long-term growth assumptions.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Legend Biotech Investment Narrative Recap

To own Legend Biotech, you need to believe CARVYKTI can sustain strong clinical relevance while the broader cell therapy pipeline matures into additional revenue streams. The new 50.4‑month PFS data and early LUCAR‑G39D results support that medical story, but do not materially change the near term dependence on CARVYKTI or the key risk that any clinical, manufacturing, or competitive setback in this single product could weigh heavily on the business.

Among recent developments, Legend’s Q3 2025 results, with revenue of US$272.33 million and a reduced quarterly net loss of US$39.69 million, are the most relevant in this context. They show how CARVYKTI uptake is already translating into stronger top line performance, while the company remains loss making as it funds R&D, manufacturing expansion, and new facilities that are intended to support future products beyond CARVYKTI.

Yet investors should also be aware that CARVYKTI’s central role leaves Legend exposed if...

Read the full narrative on Legend Biotech (it's free!)

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and about a $958 million earnings increase from $-325.3 million today.

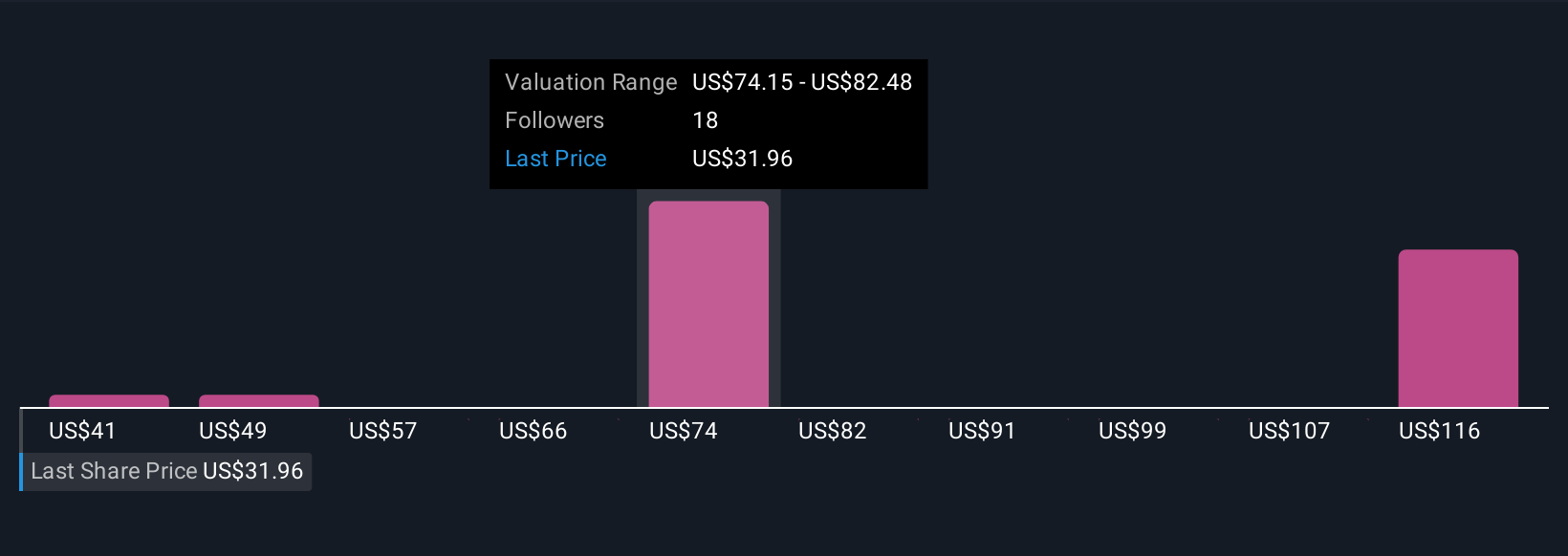

Uncover how Legend Biotech's forecasts yield a $74.91 fair value, a 166% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$40.82 to US$177.52 per share, reflecting very different return expectations. Against this, the company’s reliance on CARVYKTI as a single commercial pillar raises important questions about how resilient those views are if competitive or clinical risks materialize, so it pays to compare several perspectives before forming your own.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth just $40.82!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026