- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

Insiders Favor These 3 Growth Companies With Strong Ownership

Reviewed by Simply Wall St

As the U.S. market experiences mixed movements with the Dow Jones Industrial Average reaching new heights and the Nasdaq showing slight declines, investors are closely watching developments like the potential end of a lengthy government shutdown. In such an environment, growth companies with substantial insider ownership can be particularly appealing, as this often indicates confidence in their long-term prospects amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51.6% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 59.4% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 81.6% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 27.1% |

| AppLovin (APP) | 27.6% | 26.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

We're going to check out a few of the best picks from our screener tool.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

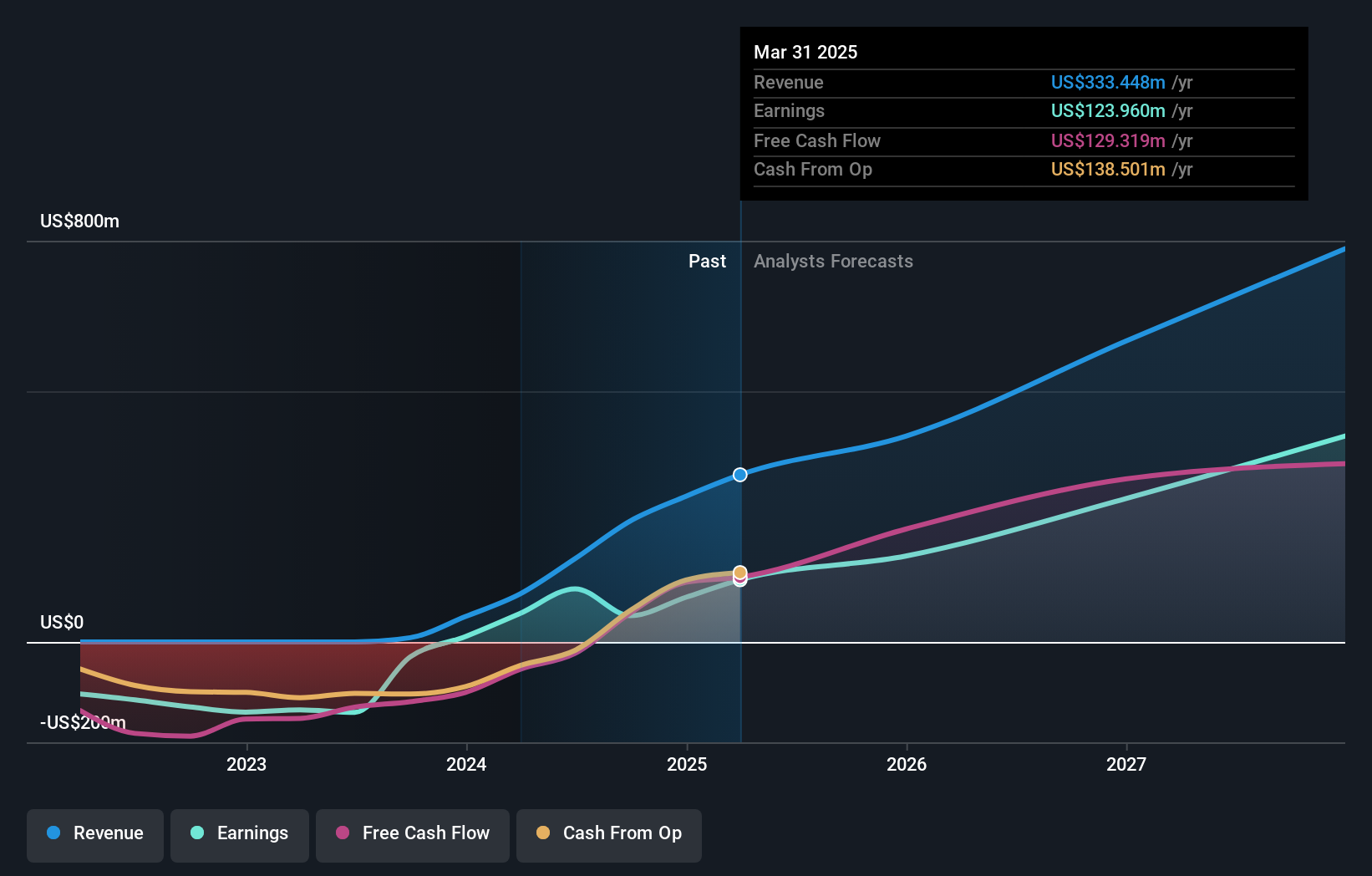

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of approximately $5.89 billion.

Operations: The company's revenue segment consists of $373.16 million from genetic medicines aimed at addressing diseases with significant unmet medical needs in the United States.

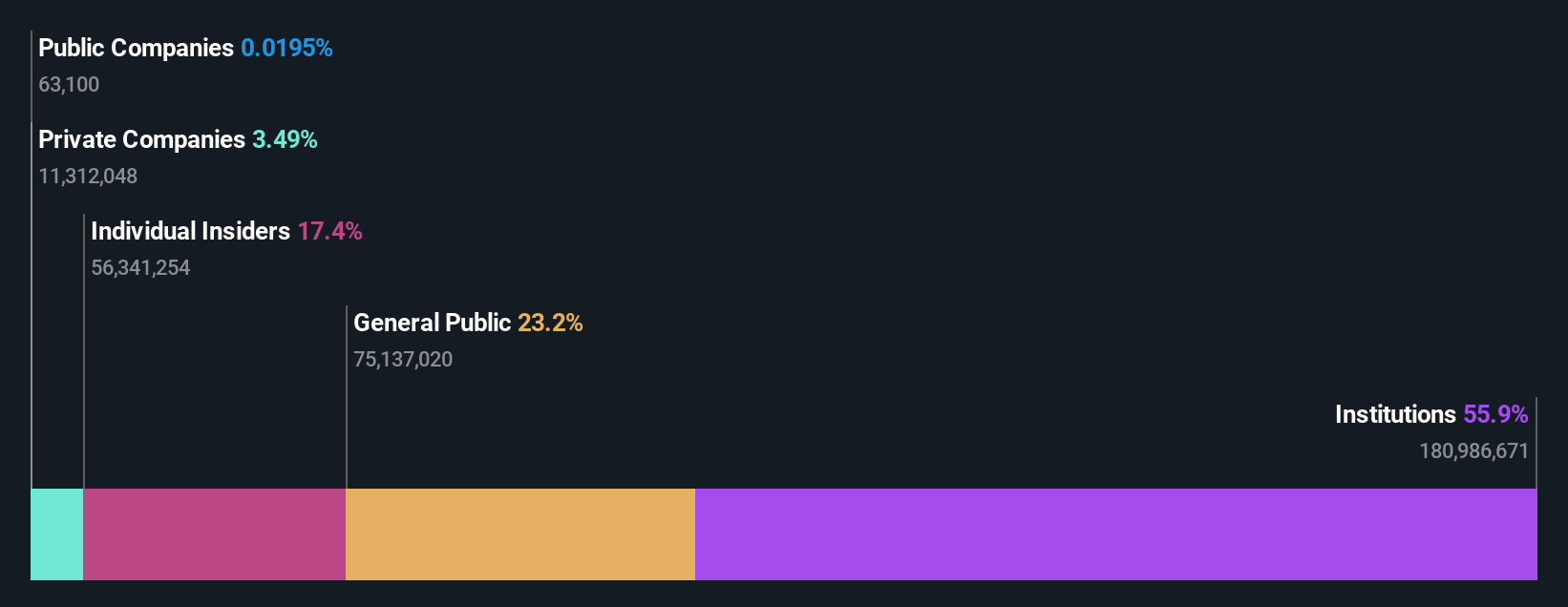

Insider Ownership: 10.4%

Krystal Biotech demonstrates significant growth potential with earnings forecasted to increase by 30.71% annually, outpacing the US market. Recent Q3 results showed a substantial rise in net income to US$79.37 million from US$27.18 million year-over-year, highlighting robust financial performance. The FDA's platform technology designation for KB801 could streamline regulatory processes and enhance drug development efficiency, supporting its innovative pipeline across various therapeutic areas including dermatology and ophthalmology.

- Unlock comprehensive insights into our analysis of Krystal Biotech stock in this growth report.

- According our valuation report, there's an indication that Krystal Biotech's share price might be on the cheaper side.

On Holding (ONON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of approximately $11.49 billion.

Operations: The company's revenue primarily comes from its Athletic Footwear segment, generating CHF 2.72 billion.

Insider Ownership: 26.8%

On Holding shows strong growth potential with a forecasted annual earnings increase of 33%, surpassing the US market. Despite a decline in profit margins from 7.7% to 5%, recent Q3 results highlighted impressive sales growth to CHF 794.4 million and net income rise to CHF 118.9 million year-over-year. The company raised its full-year guidance, expecting net sales of CHF 2.98 billion, reflecting robust business momentum amid high insider ownership levels supporting strategic alignment and long-term vision.

- Click to explore a detailed breakdown of our findings in On Holding's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of On Holding shares in the market.

Roblox (RBLX)

Simply Wall St Growth Rating: ★★★★★☆

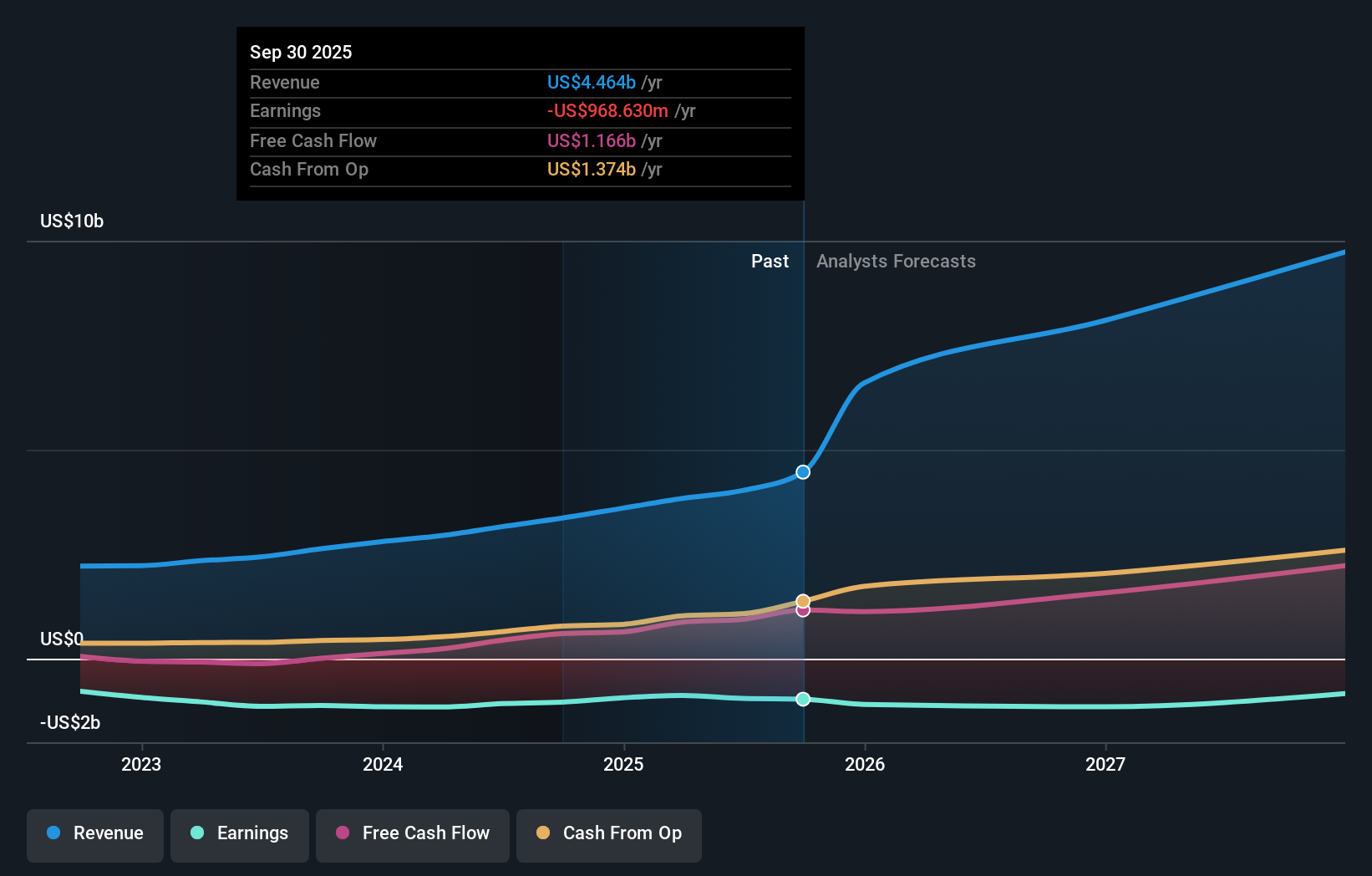

Overview: Roblox Corporation operates an immersive platform for connection and communication both in the United States and internationally, with a market cap of approximately $73.48 billion.

Operations: The company's revenue segment is primarily derived from Internet Information Providers, totaling approximately $4.46 billion.

Insider Ownership: 10.9%

Roblox Corporation's recent Q3 results show significant sales growth to US$1.36 billion, though net losses widened slightly to US$255.63 million. Despite these challenges, the company is expected to become profitable in three years with projected revenue growth of 21.6% annually, outpacing the market average. High insider ownership aligns leadership with long-term strategic goals, while collaborations with Mattel and Lionsgate enhance platform engagement and content diversity amid ongoing legal and safety concerns.

- Take a closer look at Roblox's potential here in our earnings growth report.

- Our valuation report here indicates Roblox may be overvalued.

Seize The Opportunity

- Click here to access our complete index of 190 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives