- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Should Disc Medicine’s (IRON) FDA Priority Voucher for Bitopertin Prompt a Rethink of Its Investment Case?

Reviewed by Sasha Jovanovic

- Disc Medicine recently announced significant updates to its pipeline, highlighting accelerated commercial plans for bitopertin following receipt of the FDA Commissioner's National Priority Voucher, and preparation for new clinical trials of DISC-3405 targeting sickle cell disease and polycythemia vera.

- An interesting aspect is Disc Medicine's pursuit of multiple development programs across rare hematologic diseases, with regulatory recognition positioning bitopertin for expedited review and potential to address critical unmet patient needs.

- We'll now look at how Disc Medicine's regulatory achievements, especially the FDA priority voucher for bitopertin, could reshape its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Disc Medicine's Investment Narrative?

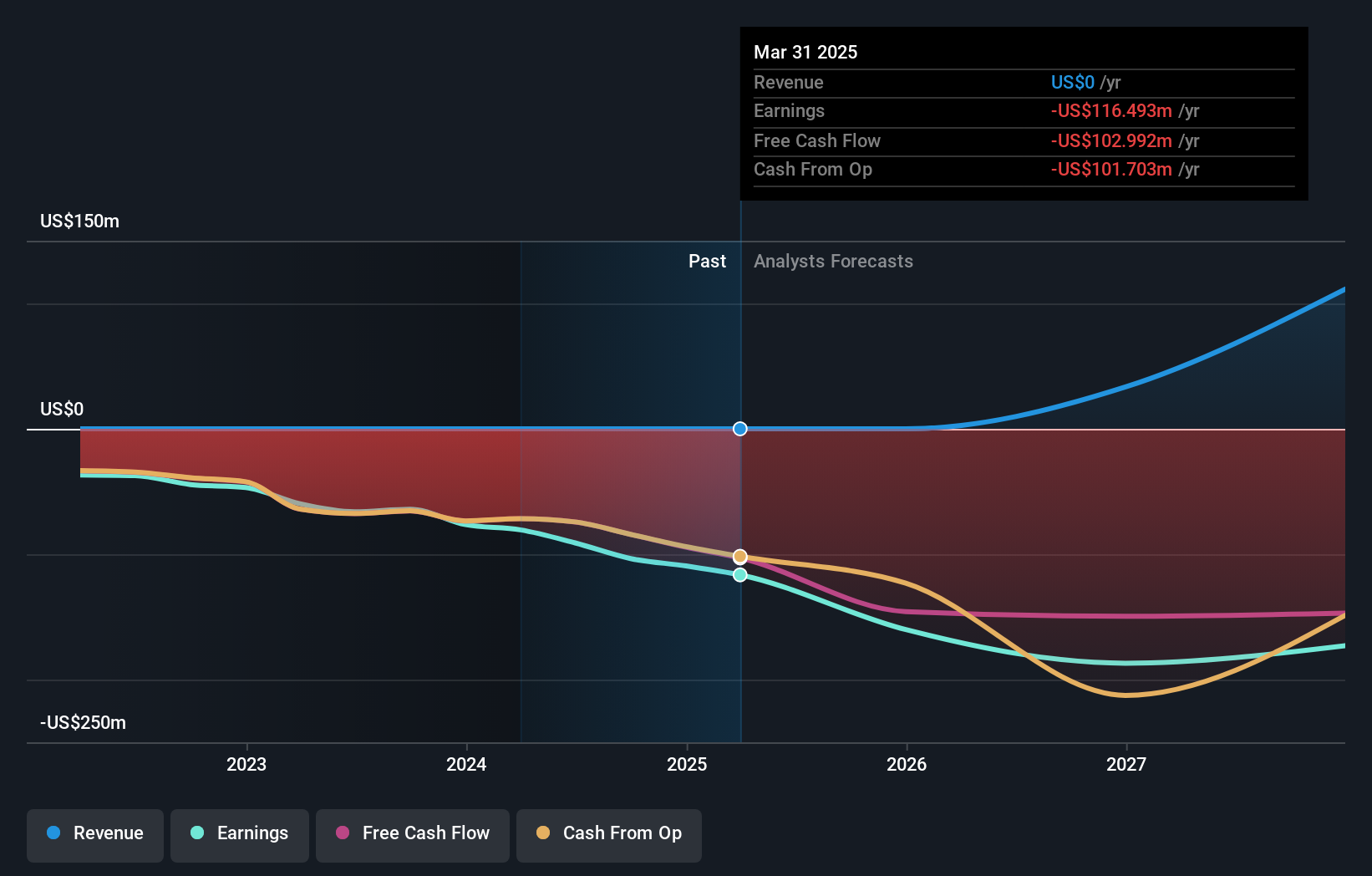

To believe in Disc Medicine as a shareholder, it's essential to have conviction in the company’s focused push into rare hematologic diseases, with bitopertin at the center. The recent news, FDA awarding the National Priority Voucher for bitopertin and accelerated commercial plans, adds real weight to short-term catalysts as it enables a much faster review process and direct regulatory engagement. In parallel, Disc Medicine’s rapid movement to advance DISC-3405 into clinical trials for sickle cell disease and polycythemia vera not only adds pipeline breadth but underlines management’s intent to quickly translate science into potential commercial therapies. These developments may reduce some near-term clinical and regulatory risk, but don't eliminate the key challenges: the company remains pre-revenue with growing losses ($55.25 million last quarter), and the scale of recent equity offerings points to ongoing dilution risk. Investors will also need to keep a watchful eye on lock-up expirations and untested late-stage regulatory hurdles, as either could shift sentiment or capital requirements. Yet, a sudden lock-up expiry could bring added volatility that investors should be aware of.

Despite retreating, Disc Medicine's shares might still be trading 30% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth as much as 27% more than the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives