- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Does Disc Medicine's (IRON) Rising R&D Spend Signal Stronger Pipeline Potential or Heightened Risk?

Reviewed by Simply Wall St

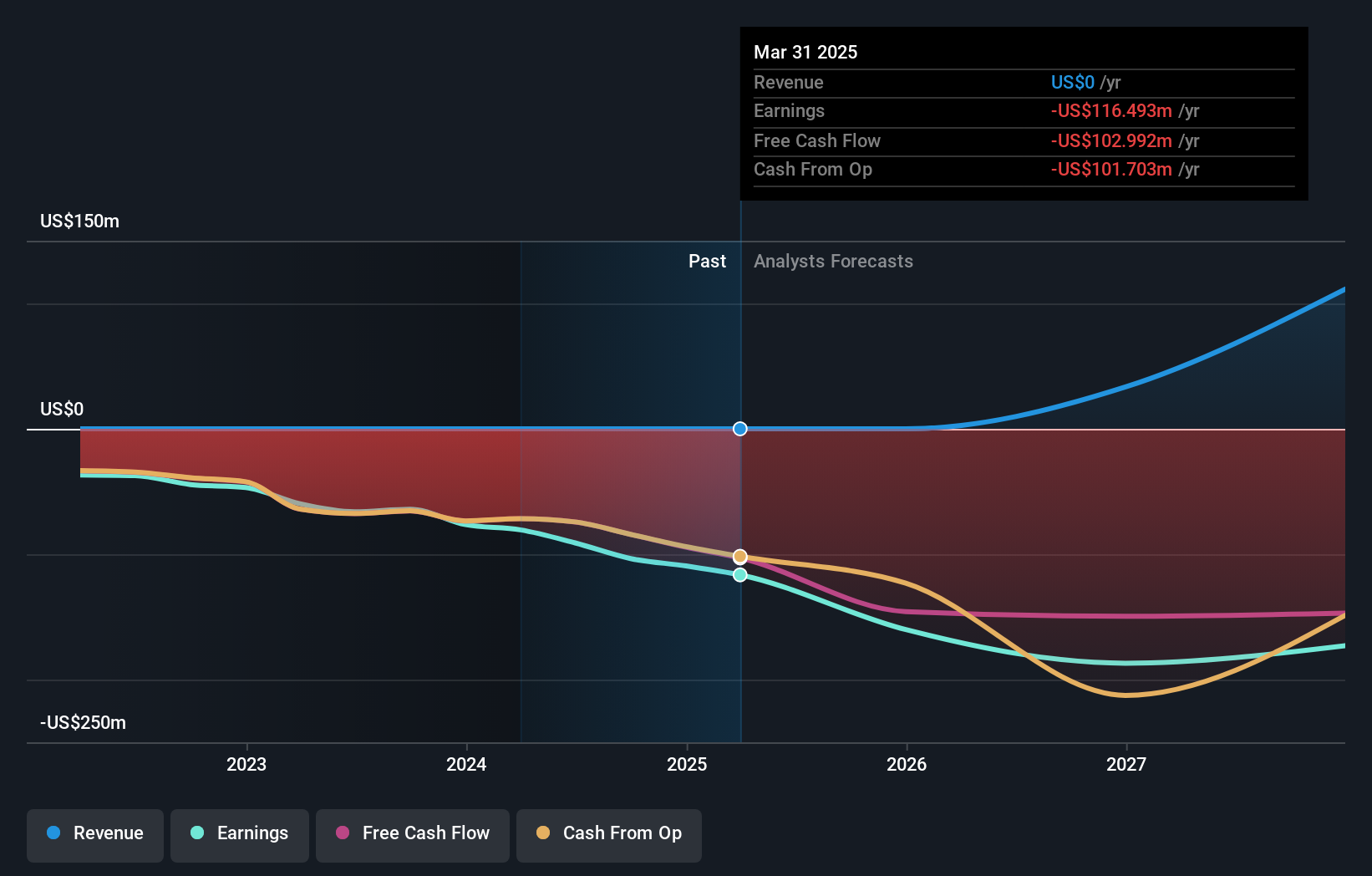

- Disc Medicine reported a wider net loss for the second quarter of 2025, with the loss rising to US$55.25 million due to increased research spending and milestone payments, but maintained a robust cash balance of US$650 million supporting operations into 2028.

- The company is moving forward with plans to submit a New Drug Application for bitopertin in erythropoietic protoporphyria by October 2025, following a positive pre-NDA meeting with the FDA and continued optimism from analysts regarding its clinical pipeline.

- We’ll explore how Disc Medicine’s progress toward regulatory milestones for bitopertin shapes its broader investment narrative amid expanded R&D efforts.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Disc Medicine's Investment Narrative?

For shareholders of Disc Medicine, the investment story still centers on belief in its clinical milestones, especially the upcoming New Drug Application for bitopertin in erythropoietic protoporphyria. The latest quarterly update brought a deeper net loss, primarily driven by rising R&D expenses and milestone payouts, yet the US$650 million cash position provides reassurance about operational funding into 2028. Despite the wider loss, analysts and investors remain focused on whether positive regulatory feedback, confirmed with a successful pre-NDA meeting, can translate to approval and future revenues. The main short-term catalyst remains the NDA filing, targeted for October 2025. However, the swelling losses and lack of revenue reinforce questions about sustainability if key programs face setbacks. The recent update does little to alter this near-term narrative: the risk and opportunity both sit squarely with bitopertin’s FDA outcome. On the flip side, Disc has no revenue to fall back on if clinical trials disappoint.

Despite retreating, Disc Medicine's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth less than half the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives