- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Disc Medicine (IRON) Surges 19.4% on FDA Priority Voucher for Bitopertin – Has the Rare Disease Thesis Evolved?

Reviewed by Sasha Jovanovic

- Disc Medicine announced it has received the FDA’s Commissioner’s National Priority Voucher for its investigational therapy bitopertin, expediting regulatory review for erythropoietic protoporphyria and X-linked protoporphyria, following the recent submission of its New Drug Application under the accelerated approval pathway.

- This designation offers unprecedented accelerated review timelines and enhanced regulatory engagement, underscoring the significance of bitopertin’s potential as a first-in-class treatment for a rare, serious disorder with substantial unmet medical need.

- We'll explore how this expedited FDA review opportunity elevates Disc Medicine's investment narrative amid its progress in rare disease therapeutics.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Disc Medicine's Investment Narrative?

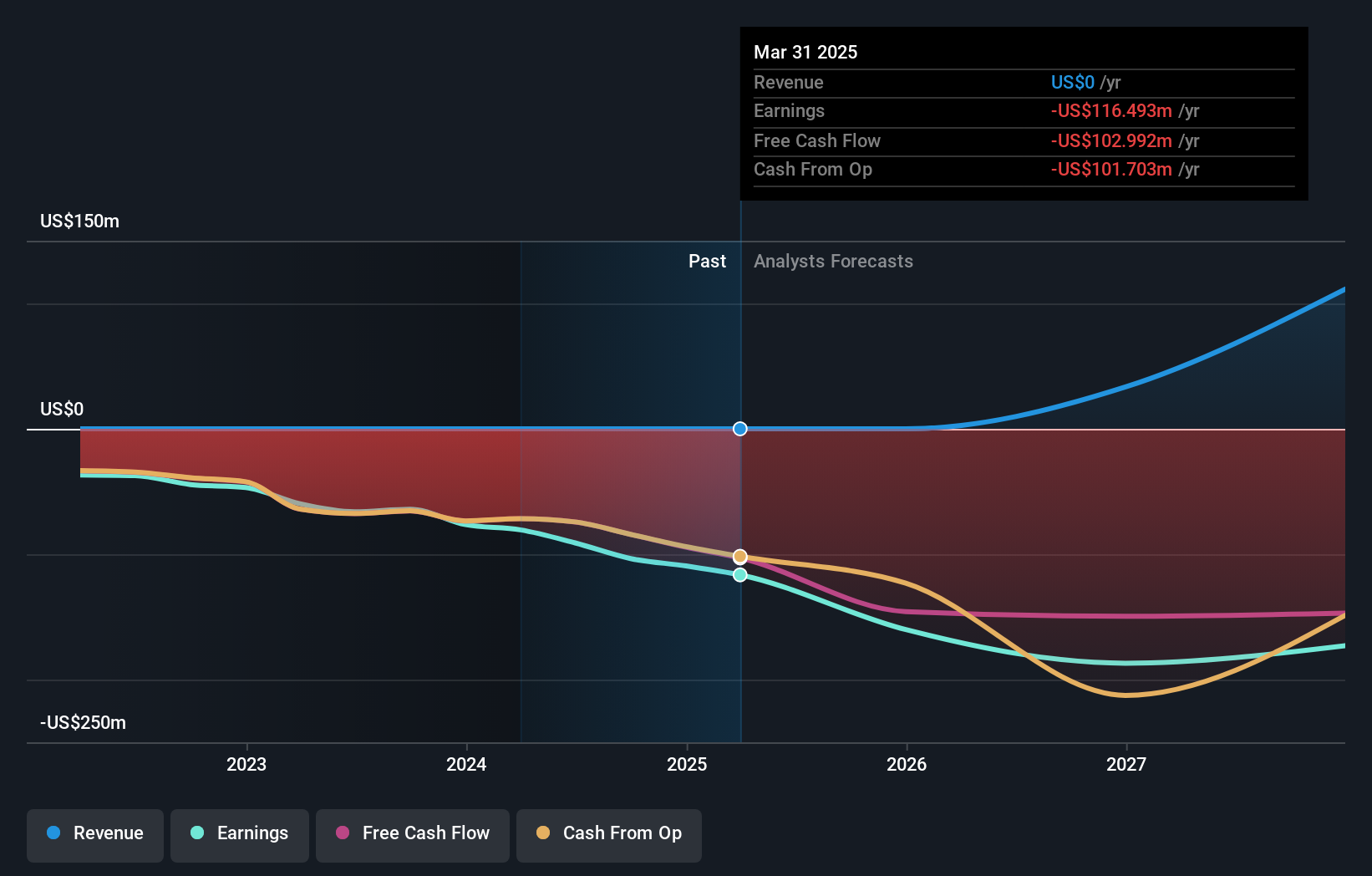

For shareholders in Disc Medicine, the investment case comes down to faith in the company’s ability to translate its clinical pipeline, especially bitopertin, into regulatory approvals and future revenues. The recent receipt of the FDA’s Commissioner’s National Priority Voucher meaningfully shifts the short-term outlook. This move fast-tracks bitopertin’s review process for erythropoietic protoporphyria and X-linked protoporphyria, reducing time to a potential FDA decision to as little as one to two months. That accelerates key catalysts and could create earlier-than-expected commercialization opportunities, adding to investor enthusiasm already evident from the sharp jump in the share price. However, the company remains unprofitable, with growing net losses and no product revenue to offset rising research and development costs. While the expedited review reduces some regulatory risk around bitopertin, the primary risk now centers on ultimate FDA approval outcomes and execution of a successful launch, plus future dilution from ongoing capital raises. Investors should weigh this new momentum against persistent uncertainty in clinical-stage biotech.

But against that optimism, present and future funding needs are a key concern for investors. Disc Medicine's shares have been on the rise but are still potentially undervalued by 9%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth less than half the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives