- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Incyte (INCY) Valuation: Assessing Shares After Strong Earnings, Oncology Pipeline Progress, and Investor Optimism

Reviewed by Simply Wall St

Incyte (INCY) recently reported impressive third quarter results, with strong revenue growth that surpassed expectations. The earnings release drew a positive reaction from investors as excitement builds around the company's expanding oncology pipeline and upcoming milestones.

See our latest analysis for Incyte.

Momentum has clearly accelerated for Incyte, with a 30-day share price return of 18.15% and a total return of 49.79% year-to-date. This underscores how strong earnings and promising oncology developments have shifted sentiment despite some recent insider selling and elevated short interest. Long-term holders have also seen solid rewards, with a 37.27% total shareholder return over the past year.

If Incyte’s pipeline progress has you thinking bigger, this could be the right moment to discover See the full list for free.

With the stock rallying sharply this year and analysts divided on its future prospects, investors now face an important question: Is Incyte’s strong growth already reflected in its share price, or is there still an attractive buying opportunity ahead?

Most Popular Narrative: 11% Overvalued

Compared to Incyte’s last closing price of $104.15, the most popular narrative estimates a fair value at $93.82, indicating analysts currently see the shares as trading above where they believe the fundamentals justify. This sets the stage for a close look at the drivers and uncertainties shaping that view.

The company’s more disciplined capital allocation strategy, prioritizing internal late-stage pipeline assets, operating expense control, and targeted business development, suggests increasing operating leverage and net margin expansion, as evidenced by guidance for operating expenses to grow more slowly than revenues. Strengthened and diversified product portfolio momentum (with Jakafi, Opzelura, Niktimvo, Monjuvi, and Zynyz all delivering robust growth) alongside an active business development pipeline increases resilience against biosimilar/generic threats and potentially derisks near- or mid-term revenue, suggesting the current valuation does not fully reflect future earnings stability or potential upside from new product successes.

Want to know what’s really fueling Incyte’s valuation debate? The cash flow story, margin ambitions, and bullish assumptions that pull the numbers together—one bold projection links them all. Which high-stakes growth forecasts tip the scales in this calculation? The surprising foundation of this fair value might test your expectations.

Result: Fair Value of $93.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on Jakafi and the potential for pipeline setbacks could quickly challenge the upbeat outlook that is reflected in today's valuation.

Find out about the key risks to this Incyte narrative.

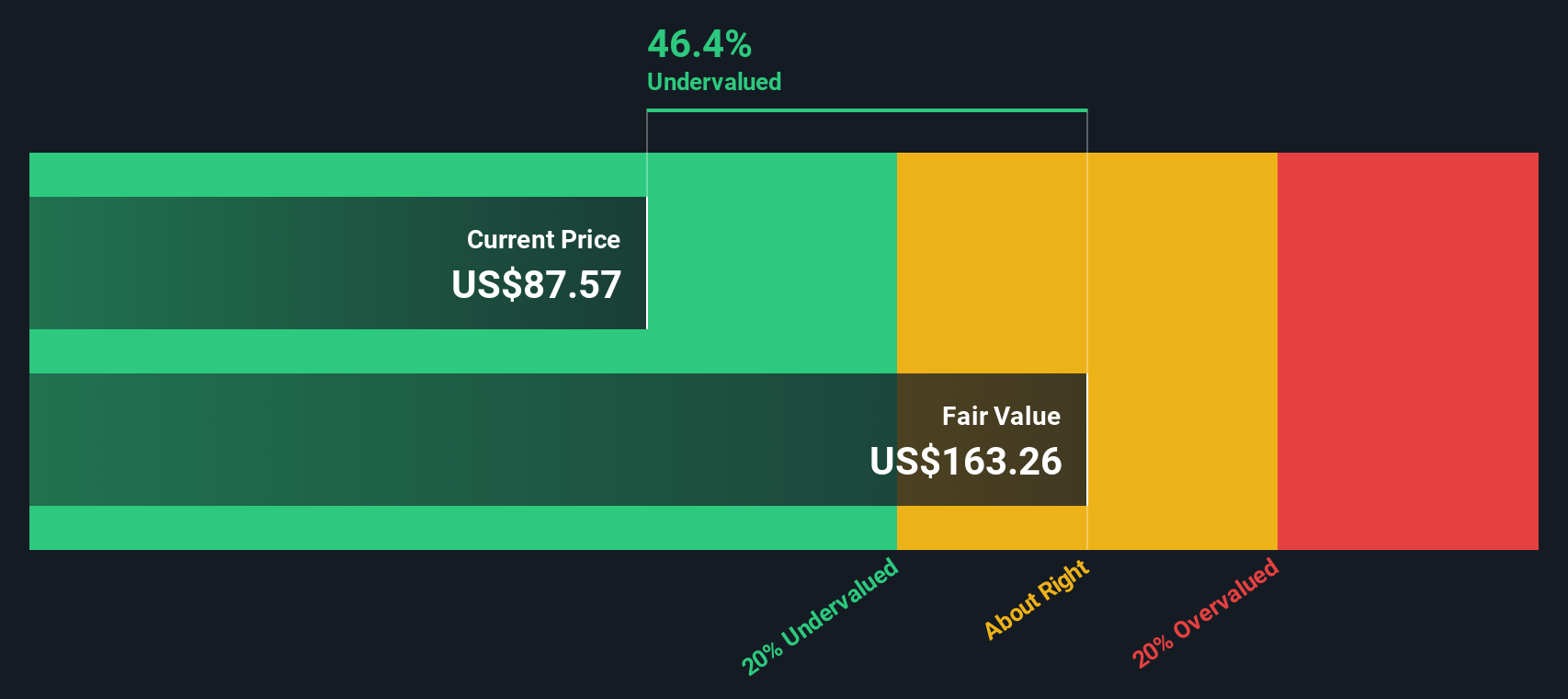

Another View: Our DCF Model Signals Undervaluation

While many analysts see Incyte as overvalued based on traditional market ratios, our SWS DCF model tells a different story. According to our estimate, the shares are trading about 36% below their fair value. This suggests there could be significant upside that the market is currently missing. Could a focus on long-term cash flows signal a real opportunity, or is the market cautious for a good reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Incyte Narrative

If you want a deeper dive or would rather form your own conclusions, you can build a custom narrative in just a few minutes. Do it your way

A great starting point for your Incyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by searching beyond Incyte. The market is brimming with overlooked opportunities just waiting to be found. Start now and don’t let the best ideas pass you by.

- Spot the next wave of returns by scanning for these 877 undervalued stocks based on cash flows that the market is still overlooking but have strong cash flow potential.

- Target reliable income streams by exploring these 16 dividend stocks with yields > 3% offering above-average yields and steady performance for long-term confidence.

- Ride the digital finance surge and uncover growth frontiers with these 82 cryptocurrency and blockchain stocks at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives