- United States

- /

- Biotech

- /

- NasdaqGS:IMVT

Why Immunovant (IMVT) Is Down 5.4% After Narrowing Its Loss and Highlighting Pipeline Progress

Reviewed by Sasha Jovanovic

- Immunovant reported its second-quarter earnings for the period ended September 30, 2025, revealing a net loss of US$126.5 million and a basic loss per share of US$0.73, which surpassed analyst expectations for loss per share.

- The company also highlighted encouraging updates from its clinical pipeline, including a potentially disease-modifying outcome in its uncontrolled Graves’ disease study and reaffirmed timelines for upcoming Phase 3 trial readouts.

- We’ll examine how Immunovant’s progress in its autoimmune disease pipeline shapes the company’s investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Immunovant's Investment Narrative?

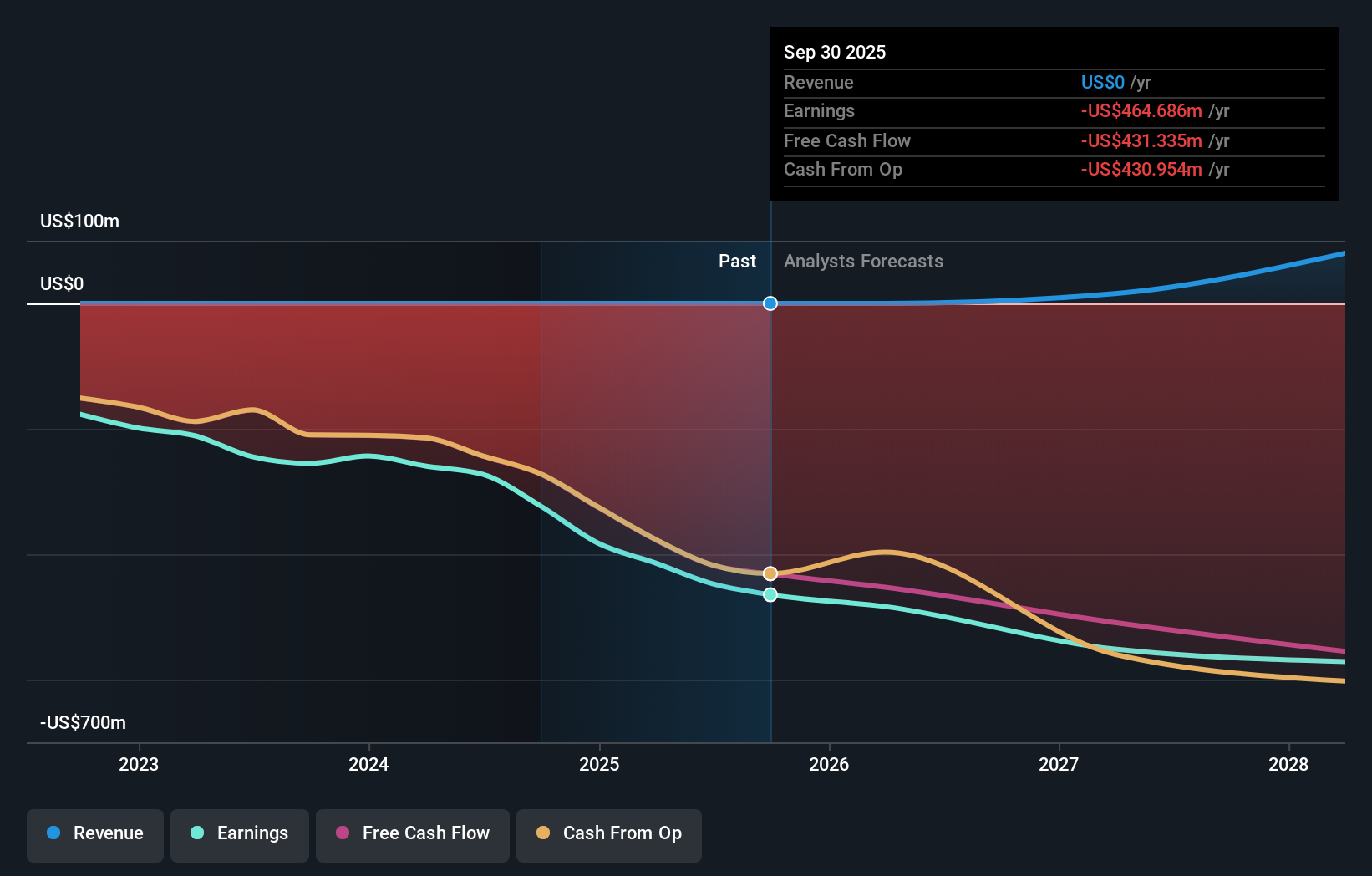

For Immunovant, the central thesis rests on the company’s ability to turn its impressive pipeline in autoimmune diseases into commercial success well ahead of mounting losses. The recent quarterly update reinforced this narrative: encouraging data in Graves’ disease and timelines holding for critical Phase 3 results continue to set up near-term milestones that could reshape sentiment. While the net loss was steep at US$126.5 million for the quarter, the loss per share of US$0.73 was not as severe as analysts feared, offering a modest confidence boost. Importantly, the news maintains the biggest catalyst, upcoming late-stage trial results, while also reminding investors that rising costs and sustained cash burn are not abating. The company’s dependency on positive clinical outcomes and eventual regulatory approvals still outweighs any immediate improvement in sentiment this quarter.

But one risk is still looming: cash burn and ongoing losses remain a crucial issue. Our valuation report unveils the possibility Immunovant's shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Immunovant - why the stock might be worth as much as 68% more than the current price!

Build Your Own Immunovant Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immunovant research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Immunovant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immunovant's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IMVT

Immunovant

A clinical-stage immunology company, develops monoclonal antibodies for the treatment of autoimmune diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives