- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

The past three years for Illumina (NASDAQ:ILMN) investors has not been profitable

While not a mind-blowing move, it is good to see that the Illumina, Inc. (NASDAQ:ILMN) share price has gained 18% in the last three months. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 69%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Illumina

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Illumina has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

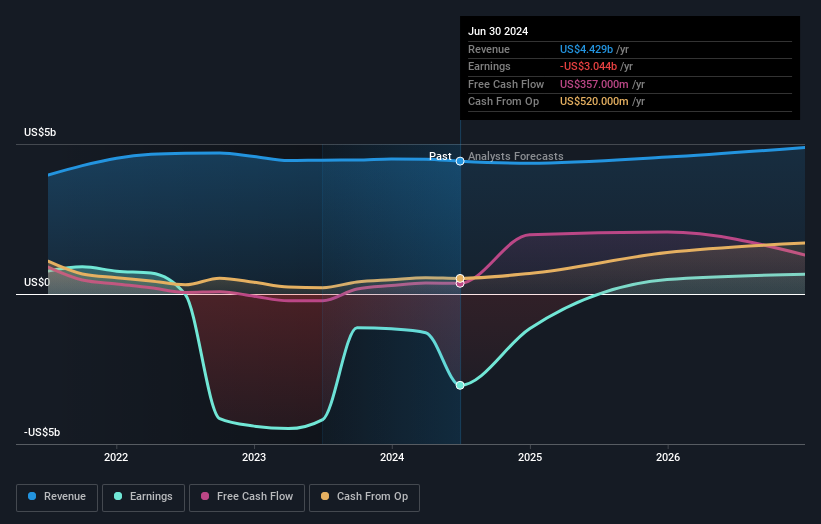

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Illumina will earn in the future (free profit forecasts).

A Different Perspective

Illumina provided a TSR of 1.9% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Illumina is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ILMN

Illumina

Offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.