- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Illumina (ILMN): Reassessing Valuation After Recent Share Price Momentum From a Low Base

Reviewed by Simply Wall St

Illumina (ILMN) shares have quietly shifted higher over the past month, and that small move sits against a much tougher backdrop when you zoom out to the past year and beyond.

See our latest analysis for Illumina.

That recent 30 day share price return of 5.33 percent, and a strong 90 day share price return of 30.35 percent, stands in contrast to a still negative 1 year total shareholder return of 8.6 percent. This suggests momentum is rebuilding from a low base.

If Illumina has put your radar back on healthcare innovation, it could be worth scanning other potential winners with healthcare stocks.

With Illumina still trading below some intrinsic value estimates but also sitting under Wall Street’s price targets, are investors getting an undervalued genomics leader here, or is the market already factoring in the next leg of growth?

Most Popular Narrative: 7.6% Overvalued

With Illumina closing at $128.96 against a narrative fair value of $119.84, the story leans toward a premium that hinges on execution and earnings resilience.

Operational efficiencies, disciplined cost controls, and targeted share repurchases have already resulted in notable operating margin and EPS improvements. Further scaling, along with tax headwinds turning into tailwinds, sets the stage for continued net margin and earnings growth over the next several years.

Curious how modest revenue growth, shifting margins and a richer future earnings multiple can still support this higher fair value? The underlying forecasts may surprise you.

Result: Fair Value of $119.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained China uncertainty and intensifying competition in next generation sequencing could pressure Illumina’s growth assumptions and undermine this premium narrative.

Find out about the key risks to this Illumina narrative.

Another View: Earnings Multiple Signals Caution

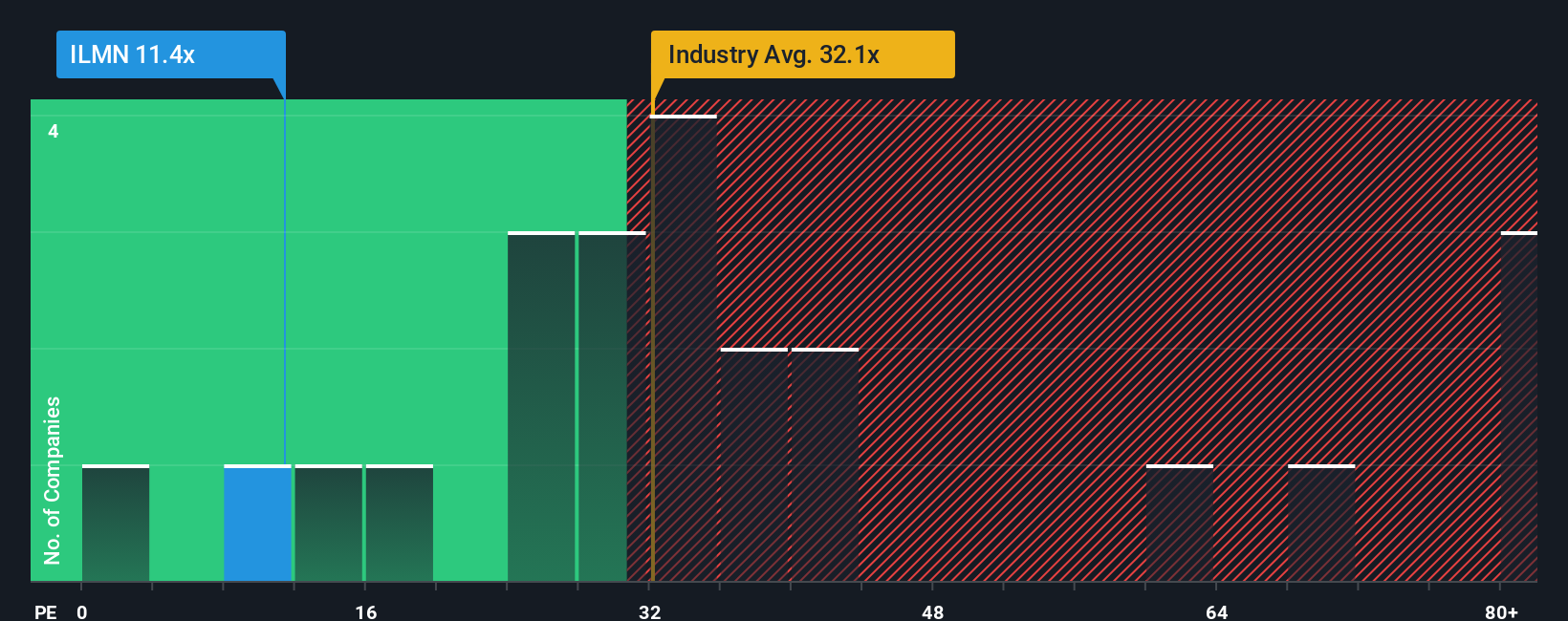

While the narrative fair value points to a modest premium, Illumina’s 28x price to earnings ratio looks more stretched when set against its own fair ratio of 23.9x, even if it still trades cheaper than peers at 33.9x. Is this a quality discount, or optimism that has run ahead of realistic growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Illumina Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Illumina.

Ready For Your Next Move?

If you stop at Illumina, you could miss stronger momentum, sharper value, and bigger themes. Push your edge further with these focused stock ideas.

- Capture potential mispricings by targeting quality businesses trading below their cash flow value through these 906 undervalued stocks based on cash flows, before the crowd catches on.

- Tap into the next wave of automation and data-driven growth by zeroing in on innovation leaders using these 26 AI penny stocks while they are still early.

- Strengthen your income stream by pinpointing reliable payouts with these 15 dividend stocks with yields > 3% and avoid scrambling for yield after the best opportunities are gone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026