- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Does the Recent 29% Rally Signal a New Opportunity for Illumina Stock?

Reviewed by Bailey Pemberton

- Ever wondered if Illumina could be a hidden gem, potentially undervalued and offering an opportunity that others might be missing?

- Despite a recent 29.0% surge over the past month, Illumina's stock is still down -8.4% year-to-date and trails its levels from one and five years ago.

- News around the company has been lively, with investors reacting to developments in Illumina's strategy and leadership. Recent headlines have spotlighted board changes and ongoing discussions about its future direction, fueling speculation about where the stock could head next.

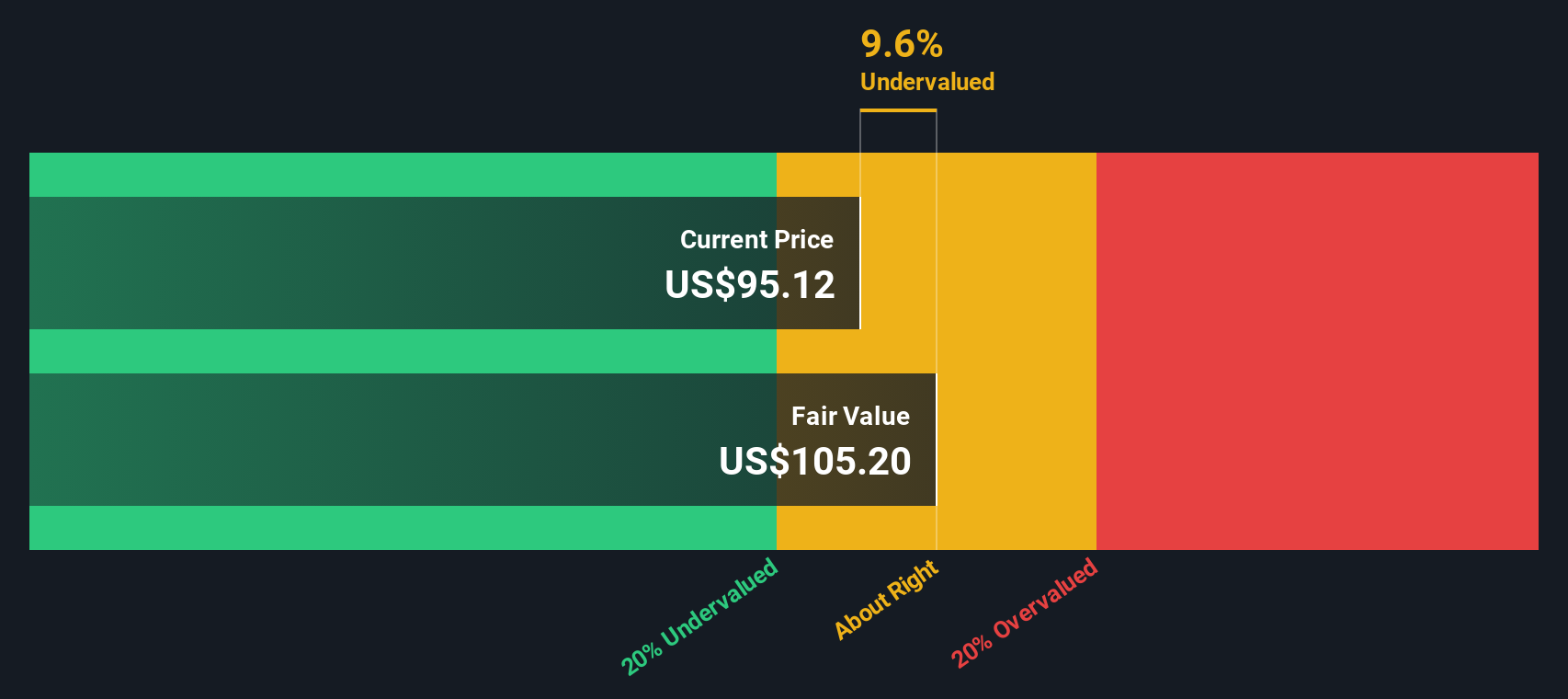

- Digging into valuation, Illumina gets a score of 4 out of 6 on our key checks for undervaluation, but there is more to valuation than numbers alone. Let’s look at the major approaches, and stick around for an even deeper perspective at the end.

Find out why Illumina's -11.2% return over the last year is lagging behind its peers.

Approach 1: Illumina Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company's intrinsic value by projecting its expected future cash flows and then discounting them back to today's value. This approach aims to capture how much future free cash Illumina can generate, adjusted for the time value of money.

For Illumina, the latest reported Free Cash Flow (FCF) comes in at $896 Million. Analyst estimates provide a view for the next five years, while projections beyond that have been extrapolated from observed trends. By 2028, Free Cash Flow is estimated to reach $1.09 Billion, with continued growth anticipated through 2035. Each annual FCF projection is discounted to reflect its value today, factoring in both analyst input and calculated estimates beyond the forecast window.

Based on these cash flow projections using the 2 Stage Free Cash Flow to Equity DCF model, the fair value estimate for Illumina stock is $155.71 per share. With the DCF suggesting the stock is trading at a 23.0% discount to intrinsic value, Illumina currently appears undervalued using this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Illumina is undervalued by 23.0%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Illumina Price vs Earnings

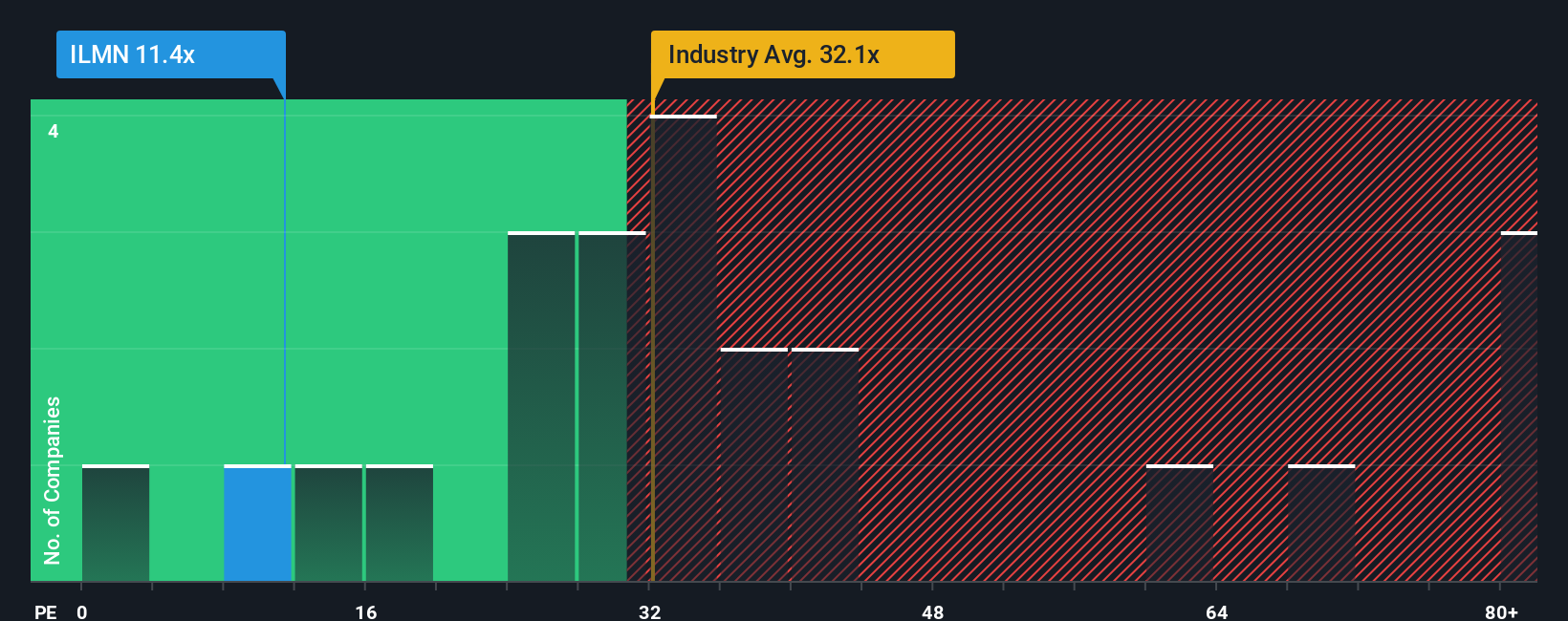

For profitable companies like Illumina, the Price-to-Earnings (PE) ratio is a commonly used valuation metric because it directly compares what investors are willing to pay for each dollar of current earnings. A lower PE ratio can indicate the stock is relatively less expensive, but context matters. Growth potential and the risk profile of a business influence what is considered a "normal" or "fair" PE. Investors are typically willing to pay more for rapidly growing or less risky companies, so their fair PE is often higher.

Illumina currently trades on a PE ratio of 26x. This is below both the industry average of 37x and its peer group average of 32x. Compared to these benchmarks, Illumina appears to be priced at a discount, which may catch the attention of value-focused investors. However, simple comparisons can miss important nuances about a company's growth prospects or risk exposure.

That is why Simply Wall St's proprietary Fair Ratio is useful. The Fair Ratio for Illumina stands at 24.4x, reflecting a blended view of the company’s forecast earnings growth, profit margins, size, and the unique risks and opportunities it faces in the Life Sciences sector. Unlike a flat comparison to peers or industry averages, the Fair Ratio is tailored to the specific context of Illumina and provides a more nuanced sense of what the company should be worth.

Since Illumina’s current PE of 26x is very close to its Fair Ratio of 24.4x, the stock appears to be priced just about right on this key metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

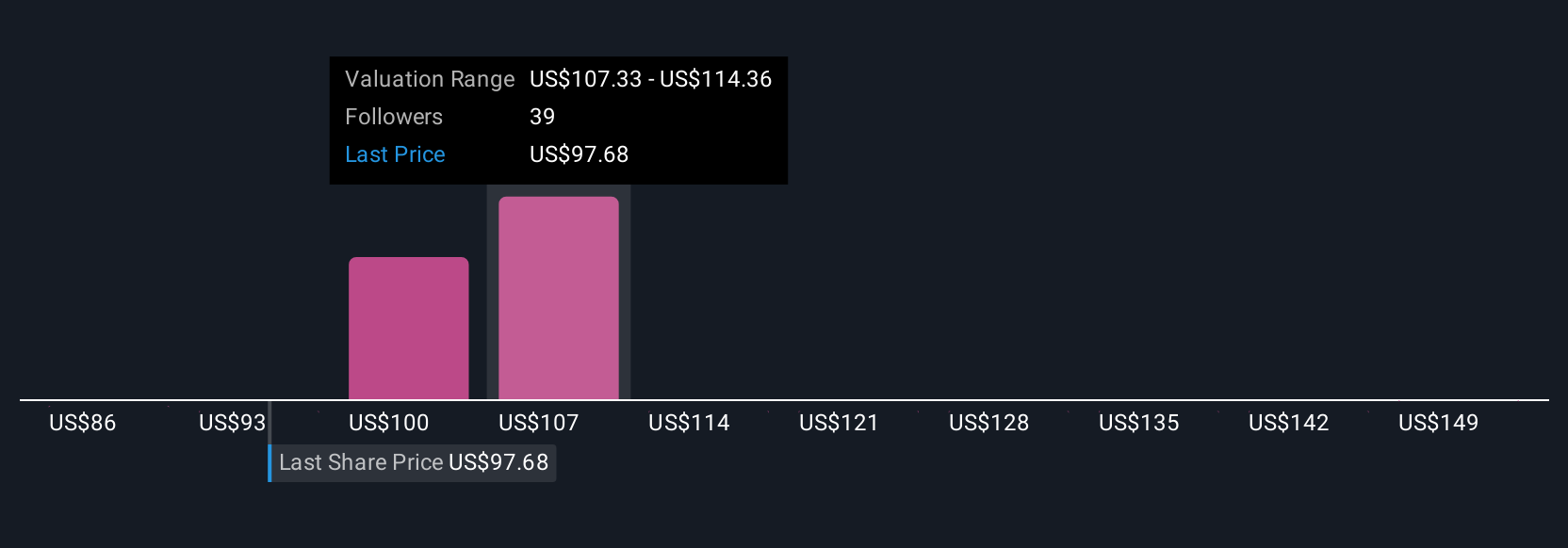

Upgrade Your Decision Making: Choose your Illumina Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story or perspective on a company’s future: it links your beliefs about Illumina’s revenue growth, earnings, and profit margins to a clearly defined financial forecast and fair value. Instead of just looking at numbers, Narratives allow you to explain why you think Illumina is undervalued or overvalued by combining your assumptions about the business, its risks and opportunities, and the drivers you believe matter most.

Narratives are available, free and easy to use for everyone on Simply Wall St's Community page, which is already used by millions of investors making decisions together. They help you see what other investors believe, update automatically when new news or earnings are released, and allow you to compare your assumptions with consensus views and real-time prices. For example, some investors create a Narrative for Illumina expecting a price target as high as $185 if clinical genomics growth and innovation continue to accelerate, while others are more cautious, projecting as low as $75 if competition intensifies and operational risks in China materialize. Narratives help you visualize these scenarios, decide if now is a good time to buy or sell, and make more confident investment decisions based on your unique perspective.

Do you think there's more to the story for Illumina? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives