- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

What ICON (ICLR)'s Trial Site Bottleneck Survey Reveals About Its Evolving CRO Partnership Strategy

Reviewed by Sasha Jovanovic

- In December 2025, ICON plc released results from a June 2025 survey of just over 100 principal investigators and senior clinical trial site staff, highlighting widespread startup bottlenecks, with over half of respondents reporting more than five months from site selection to full activation.

- The survey’s finding that 92% of sites view contract and budget support as the top area for sponsor and CRO improvement underscores a growing push for more site-centric, collaborative trial models that could reshape operating practices across the industry.

- We’ll now examine how ICON’s spotlight on contract, budget, and communication challenges at trial sites could influence its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ICON Investment Narrative Recap

To own ICON, you need to believe that contract research organizations can still grow by helping pharma and biotech run more efficient, faster trials, even as funding and demand remain uneven. The new survey on site startup bottlenecks reinforces ICON’s focus on operational friction, but does not materially change the near term picture, where trial cancellations and delays remain the key catalyst and the most immediate risk.

The December survey also connects directly to ICON’s January 2025 launch of AI tools for study startup, contract drafting, and resource forecasting, which are aimed at exactly the pain points sites highlighted. How well these tools translate into fewer cancellations, stronger win rates, and more resilient revenue is likely to matter more than the survey headlines themselves.

Yet while these tools may help, investors should be aware that rising trial cancellations and funding driven delays could still...

Read the full narrative on ICON (it's free!)

ICON's narrative projects $8.8 billion revenue and $1.0 billion earnings by 2028. This requires 2.9% yearly revenue growth and around a $205.8 million earnings increase from $794.2 million today.

Uncover how ICON's forecasts yield a $206.19 fair value, a 10% upside to its current price.

Exploring Other Perspectives

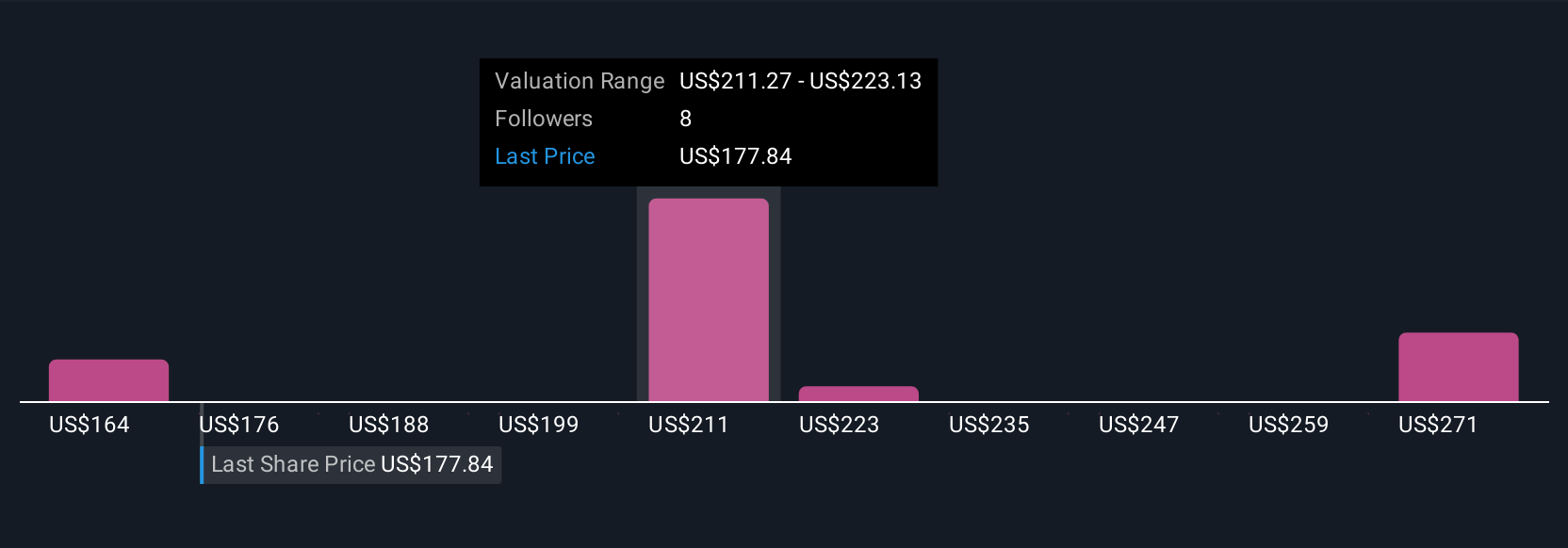

Five members of the Simply Wall St Community currently place ICON’s fair value between US$163.85 and US$242.24, highlighting how far apart individual assessments can be. You should weigh those views against ICON’s ongoing exposure to trial cancellations and delays, which remain central to how its future performance could evolve.

Explore 5 other fair value estimates on ICON - why the stock might be worth 13% less than the current price!

Build Your Own ICON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICON research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICON's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026