- United States

- /

- Pharma

- /

- NasdaqGM:HROW

Should Vevye’s CVS Formulary Win Prompt a Closer Look from Harrow (HROW) Investors?

Reviewed by Sasha Jovanovic

- Harrow, Inc. recently presented at major industry events and secured a key win as its dry eye therapy Vevye replaced Xiidra on the CVS Tier 1 formulary.

- This change gives Vevye first-line access at the largest pharmacy benefit manager in the US, which could significantly broaden adoption of Harrow’s flagship product.

- We’ll explore how Vevye’s elevated CVS formulary status may influence Harrow’s growth profile and long-term investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Harrow Investment Narrative Recap

To believe in Harrow, Inc. as a shareholder, one must have confidence in the company’s ability to capture significant share in the ophthalmic drug market, led by products like Vevye. The replacement of Xiidra with Vevye on the CVS Tier 1 formulary stands out as a near-term catalyst that may accelerate patient access and adoption. However, the biggest risk remains Harrow’s dependence on just a handful of flagship therapies, making the business vulnerable if competitors gain market share or exclusivity weakens.

Among recent company announcements, the launch of the Harrow Access for All (HAFA) program in September 2025 aligns closely with Vevye’s inclusion on CVS’s top formulary. This initiative could improve accessibility and reimbursement for Harrow’s branded drugs, supporting the company’s efforts to grow prescription volumes and sustain revenue momentum as insurance coverage broadens, an important factor connected to formulary wins like this one.

In contrast, investors should be mindful of the risk that sharp increases in flagship product adoption, while impressive, may be difficult to sustain if organic demand growth normalizes or if...

Read the full narrative on Harrow (it's free!)

Harrow's narrative projects $586.7 million in revenue and $209.0 million in earnings by 2028. This requires a 37.1% yearly revenue growth rate and a $219.2 million increase in earnings from the current level of -$10.2 million.

Uncover how Harrow's forecasts yield a $70.62 fair value, a 78% upside to its current price.

Exploring Other Perspectives

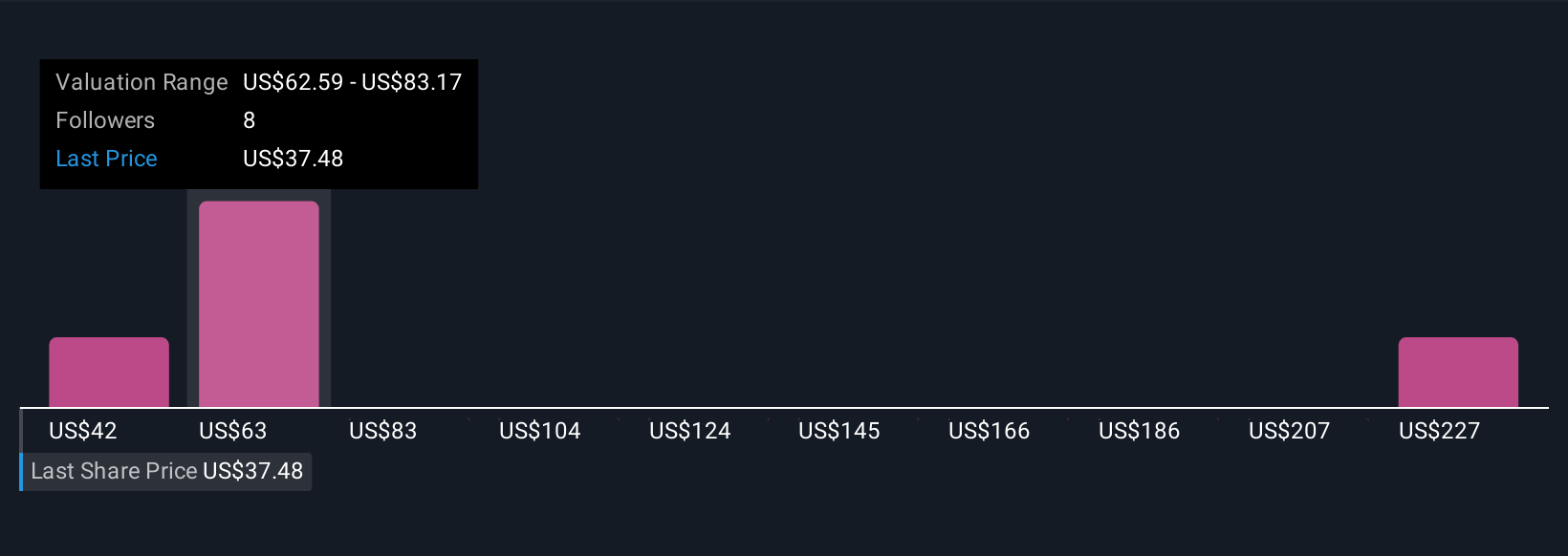

Simply Wall St Community members assigned fair values for Harrow ranging from US$42 to US$272, with five distinct viewpoints reflected. As investor opinions often diverge widely, remember that future growth may depend on Harrow’s continued ability to expand patient access and prescription coverage.

Explore 5 other fair value estimates on Harrow - why the stock might be worth just $42.00!

Build Your Own Harrow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harrow research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Harrow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harrow's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026