- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences Holdings (HRMY) Is Up 6.8% After Positive Pitolisant Study Results Are Patent Hopes Justified?

Reviewed by Sasha Jovanovic

- Earlier this week, Harmony Biosciences Holdings announced positive pivotal bioequivalence study results for its new pitolisant gastro-resistant formulation, setting the stage for a planned New Drug Application submission in early 2026.

- With patent applications potentially extending pitolisant exclusivity to 2044, the company is aiming to reinforce its leadership position in sleep disorder therapeutics.

- We'll explore how the bioequivalence study success and anticipated regulatory milestones impact Harmony Biosciences' investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Harmony Biosciences Holdings Investment Narrative Recap

To be a shareholder in Harmony Biosciences, you need to believe in the company's ability to maintain and extend its leadership in sleep disorder therapeutics, especially as it manages dependence on WAKIX and pursues diversification through new formulations and pipeline assets. The recent positive bioequivalence study results for pitolisant GR meaningfully strengthen the upcoming NDA submission, offering a strong near-term catalyst that directly addresses the core risk of product concentration, though regulatory approval and commercial uptake remain key hurdles for the business.

The latest announcement of successful dosing optimization and bioequivalence for pitolisant GR is particularly relevant, as this formulation could help sustain Harmony's market position and extend pitolisant exclusivity to 2044 if approved. With potential patent protection, Harmony is better positioned to manage upcoming competitive pressures and generic threats, which is critical given ongoing pipeline risks and the company’s current revenue concentration in WAKIX.

By contrast, investors should also be aware of the potential for new therapies and generic competition to impact Harmony’s core revenue stream...

Read the full narrative on Harmony Biosciences Holdings (it's free!)

Harmony Biosciences Holdings' narrative projects $1.2 billion in revenue and $333.5 million in earnings by 2028. This requires 17.0% yearly revenue growth and a $152.6 million increase in earnings from the current $180.9 million.

Uncover how Harmony Biosciences Holdings' forecasts yield a $44.55 fair value, a 25% upside to its current price.

Exploring Other Perspectives

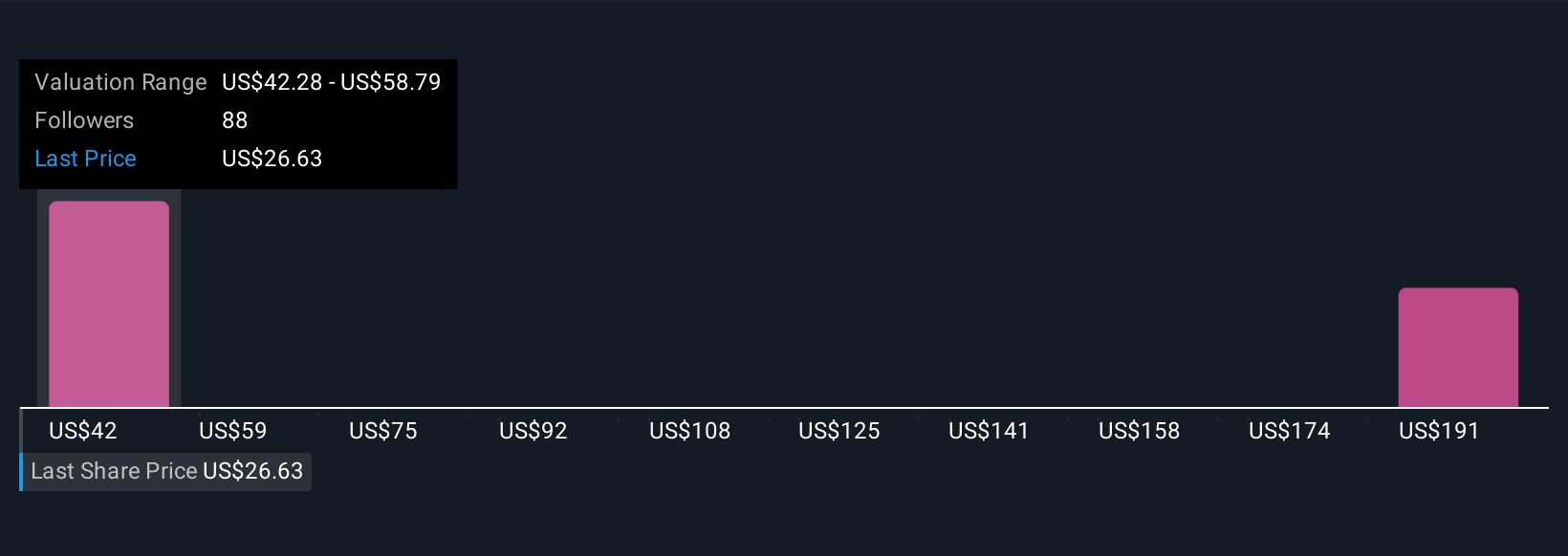

Seven distinct fair value estimates from the Simply Wall St Community range from US$42.28 to US$197.14 per share. With patent exclusivity potentially extending to 2044, there are broad differences in opinion about Harmony’s ability to withstand future competition, explore how your views compare.

Explore 7 other fair value estimates on Harmony Biosciences Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Harmony Biosciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmony Biosciences Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmony Biosciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmony Biosciences Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026