- United States

- /

- Biotech

- /

- NasdaqGS:HALO

Despite shrinking by US$555m in the past week, Halozyme Therapeutics (NASDAQ:HALO) shareholders are still up 277% over 5 years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Halozyme Therapeutics, Inc. (NASDAQ:HALO) share price has soared 277% in the last half decade. Most would be very happy with that. It's also good to see the share price up 12% over the last quarter.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Halozyme Therapeutics

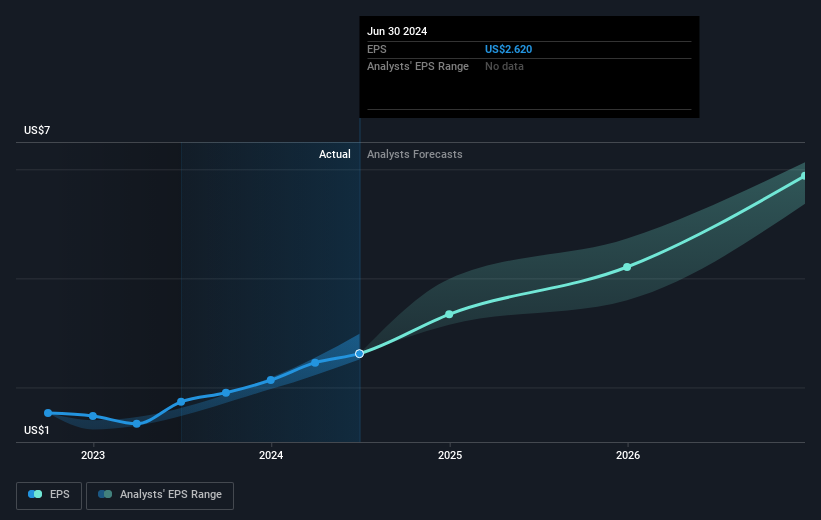

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Halozyme Therapeutics became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Halozyme Therapeutics share price has gained 46% in three years. During the same period, EPS grew by 17% each year. This EPS growth is higher than the 13% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Halozyme Therapeutics has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's nice to see that Halozyme Therapeutics shareholders have received a total shareholder return of 51% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 30% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Halozyme Therapeutics better, we need to consider many other factors. For instance, we've identified 2 warning signs for Halozyme Therapeutics that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharma technology platform company, researches, develops, and commercializes proprietary enzymes and devices in the United States, Switzerland, Belgium, Japan, and internationally.

High growth potential with solid track record.