- United States

- /

- Biotech

- /

- NasdaqGS:GILD

How Will the Trump HIV Partnership Impact Gilead Sciences Valuation in 2025?

Reviewed by Bailey Pemberton

If you are standing at the crossroads, trying to decide what to do with Gilead Sciences stock, you are in good company. This biotech giant has made impressive moves that have grabbed investors’ attention. Its shares are up 23.6% year-to-date and 38.5% over the past year, with a striking 114.2% gain across the last five years. Even just this past week, Gilead built on its momentum with a modest 0.9% uptick, suggesting ongoing optimism that is tough to ignore.

What is fueling all this interest? In part, it is the company’s deep involvement in HIV prevention. Recent headlines hint at bigger things ahead. Gilead is joining forces with the Trump administration and global partners to distribute its HIV prevention drug more widely, while industry watchers speculate about new government support that could maximize sales for Yeztugo, their latest HIV PrEP therapy. At the same time, there are hurdles, like CVS Health’s decision to keep this breakthrough off its drug coverage lists for now. These twists shape the evolving narrative around Gilead's growth prospects and risk perceptions, with many investors now eyeing the share price and potential catalysts.

But let’s talk numbers. By our analysis, Gilead earns a valuation score of 4 out of 6, signaling that it is undervalued on most of the key checks we watch. That makes it especially interesting for value-focused investors. In the next section, we will break down the specific valuation methods that led to this score. If you are looking for an even sharper way to measure Gilead’s value, stay tuned for our favorite next-level approach at the end of the article.

Approach 1: Gilead Sciences Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach aims to provide investors with a sense of what a business is truly worth, based on its potential to generate cash going forward.

For Gilead Sciences, the current Free Cash Flow stands at $9.3 billion. That figure is expected to grow steadily, with analyst estimates for annual FCF reaching $15.4 billion by 2029. After five years, projections are extended using established growth rates. Simply Wall St analysts estimate Free Cash Flow rising to $19.2 billion by 2035. These projections combine data from multiple analysts and carefully chosen modeling assumptions to reflect both near-term expectations and long-term potential.

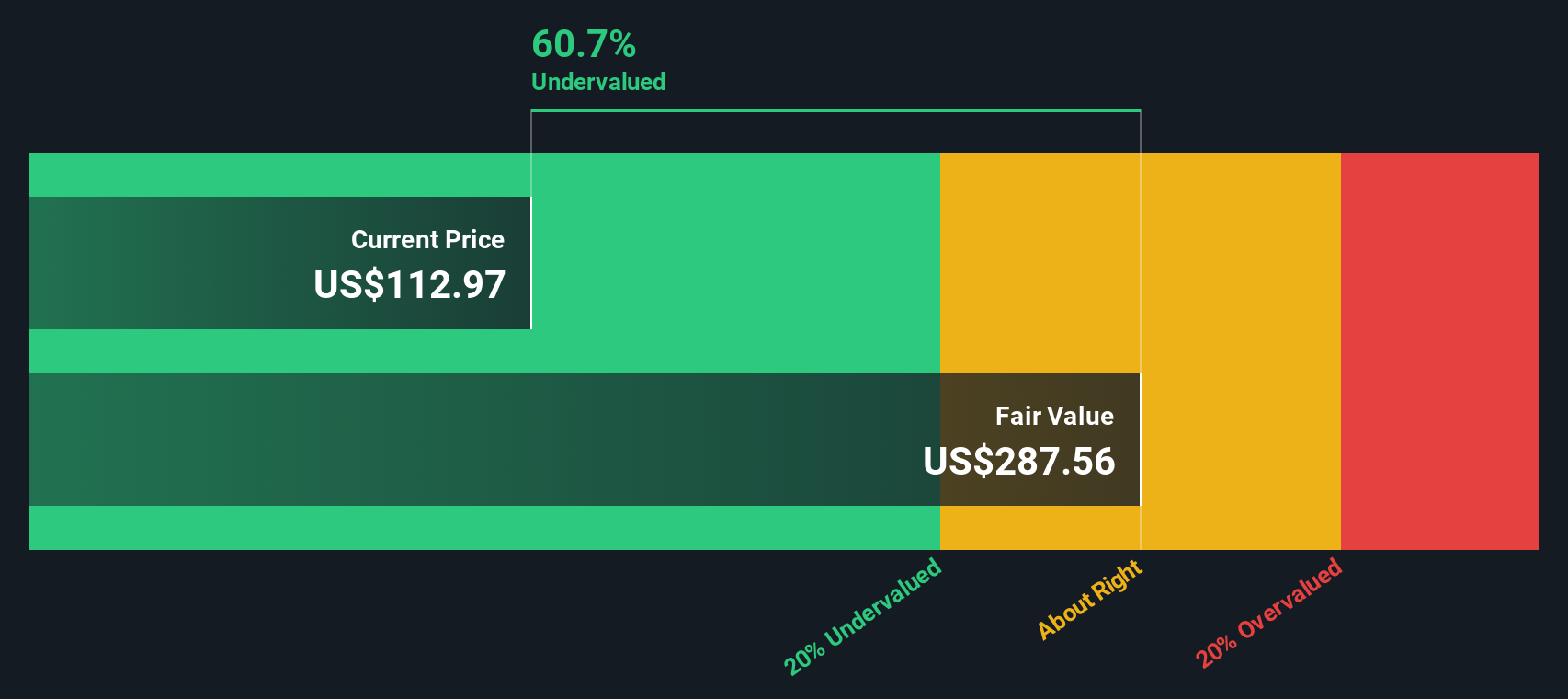

Based on these projections and the DCF methodology, Gilead’s estimated intrinsic value is $290.71 per share. With the DCF analysis implying the stock is trading at a 60.9% discount to this value, Gilead Sciences is considered dramatically undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gilead Sciences is undervalued by 60.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Gilead Sciences Price vs Earnings

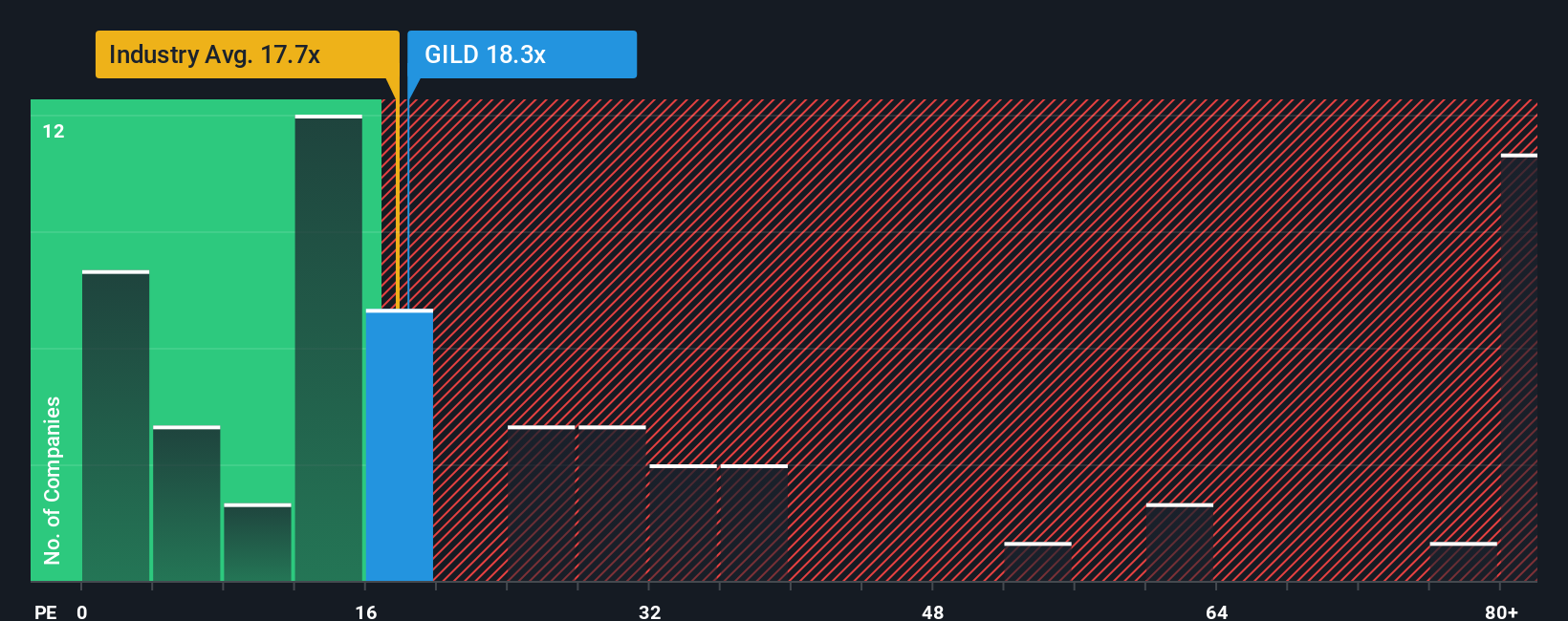

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Gilead Sciences because it relates the market price directly to the company’s bottom line. For investors, the PE ratio provides a simple snapshot of how much you are paying for each dollar of earnings, making it especially useful when analyzing companies with consistent profits.

Interpreting the PE ratio requires context. Growth expectations, risk profile, and broader market conditions all shape what a “normal” or “fair” PE should look like. High-growth companies often command higher PE ratios, while companies facing headwinds or greater risks tend to trade at lower multiples.

Gilead Sciences currently trades at a PE ratio of 22.3x. This sits well above the biotech industry average of 16.5x, but notably below the average PE of direct peers at 43.8x. To go beyond those simple comparisons, Simply Wall St’s proprietary “Fair Ratio” takes a tailored approach for Gilead, the Fair Ratio is 26.0x. This custom benchmark reflects the company’s unique mix of earnings growth, risk, profit margins, market cap, and sector-specific dynamics.

Comparing Gilead’s actual PE ratio of 22.3x to its Fair Ratio of 26.0x suggests the stock is modestly undervalued based on its current earnings power and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gilead Sciences Narrative

Earlier, we mentioned there is an even better way to understand a company's value. Let’s introduce Narratives, a smarter and more dynamic approach that goes far beyond traditional valuation metrics like DCF or PE ratios.

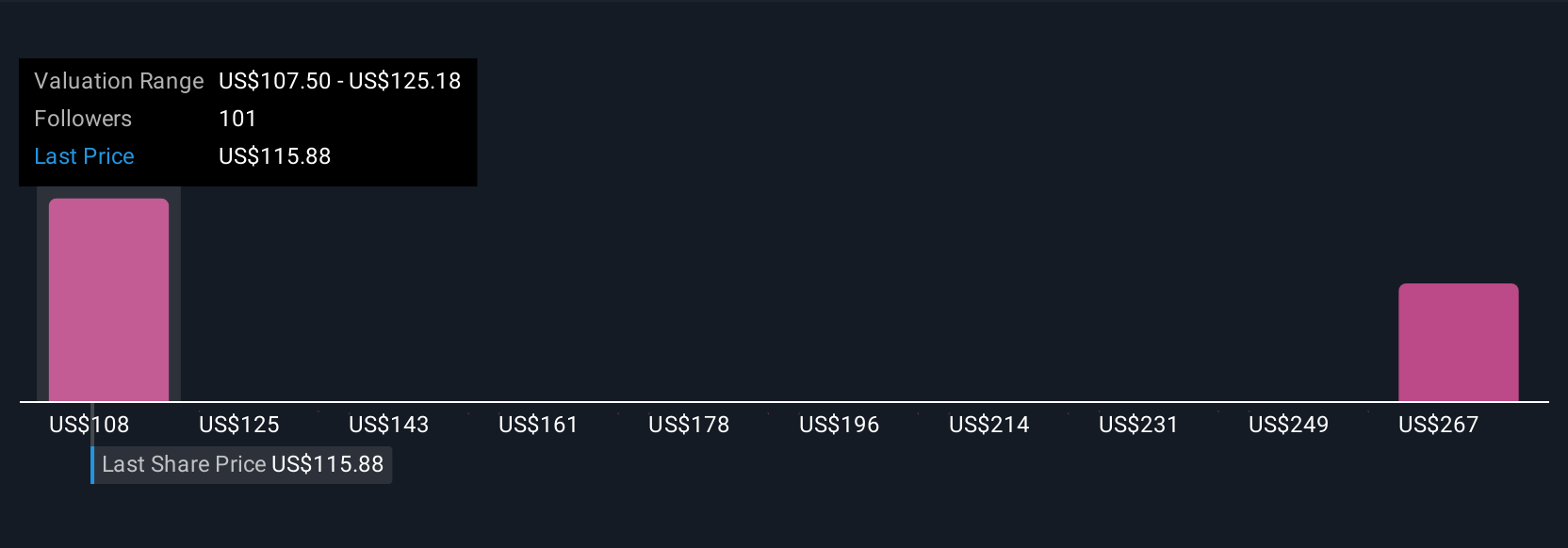

A Narrative is simply your story about a company, connecting your perspective on its future, your estimates of growth, margins, risk, and fair value, to a clear, data-driven forecast. Narratives link what you believe about Gilead Sciences’ business prospects to financial forecasts and then to a specific fair value, so you can see the real-world impact of your expectations.

On Simply Wall St’s Community page, millions of investors can easily create or adopt Narratives. This intuitive tool helps you make buy or sell decisions by instantly comparing your Narrative’s Fair Value to Gilead’s current share price. Best of all, Narratives update automatically whenever significant news or earnings releases shift the fundamentals, keeping your viewpoint fresh without extra effort.

For example, the most optimistic investors see Gilead’s fair value as high as $140 per share, based on strong product launches and expanding markets. The most cautious estimate is just $91, accounting for pricing pressures and competitive risks. Narratives let you choose the story that matches your convictions and see how that story stacks up against market reality.

Do you think there's more to the story for Gilead Sciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives