- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Gilead Sciences (GILD): Assessing Valuation After Trodelvy Breast Cancer and Livdelzi PBC Data Updates

Reviewed by Simply Wall St

Gilead Sciences (GILD) is drawing interest following two major clinical updates: mixed results in the Phase 3 ASCENT-07 study of Trodelvy in metastatic breast cancer, and encouraging long-term data for Livdelzi in primary biliary cholangitis.

See our latest analysis for Gilead Sciences.

After a strong run this year, Gilead’s share price has gained 33.4% year-to-date, and the company’s latest news is keeping momentum alive. Recent product updates and raised earnings guidance are clearly resonating with investors. This has driven a sustained 33.8% total shareholder return over the past twelve months and 145% over five years.

If Gilead’s string of clinical milestones has you looking for other compelling names in healthcare, discover more breakout opportunities with our curated See the full list for free.

With shares now just 6% below analyst targets and long-term returns outpacing the sector, the key question is whether Gilead is trading at a bargain given its growth outlook or if future gains are already priced in.

Most Popular Narrative: 5.4% Undervalued

Compared to the latest closing price of $122.56, the most widely followed narrative places Gilead Sciences’ fair value higher, signaling opportunity for those who believe current execution will be rewarded. The conservative gap between the narrative target and the market price sets the stage for a close look at what is driving this assessment.

The launch and scaling of innovative products (Yeztugo, Trodelvy first-line, Livdelzi) position Gilead to deliver a more favorable product mix and premium pricing, driving higher gross margins and improving long-term earnings trajectory as portfolio diversification reduces overexposure to legacy products.

Want to uncover the projections behind this bullish case? Fierce product innovation, margin upgrades, and a bold mix strategy are hiding in plain sight. Don’t miss out. See why analysts are betting on a profitable product transformation and the precise profit multiples behind this valuation spike.

Result: Fair Value of $129.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy uncertainties around drug pricing and looming patent expirations on key HIV drugs could quickly challenge even the most bullish outlook for Gilead.

Find out about the key risks to this Gilead Sciences narrative.

Another View: Multiple-Based Valuation Raises Questions

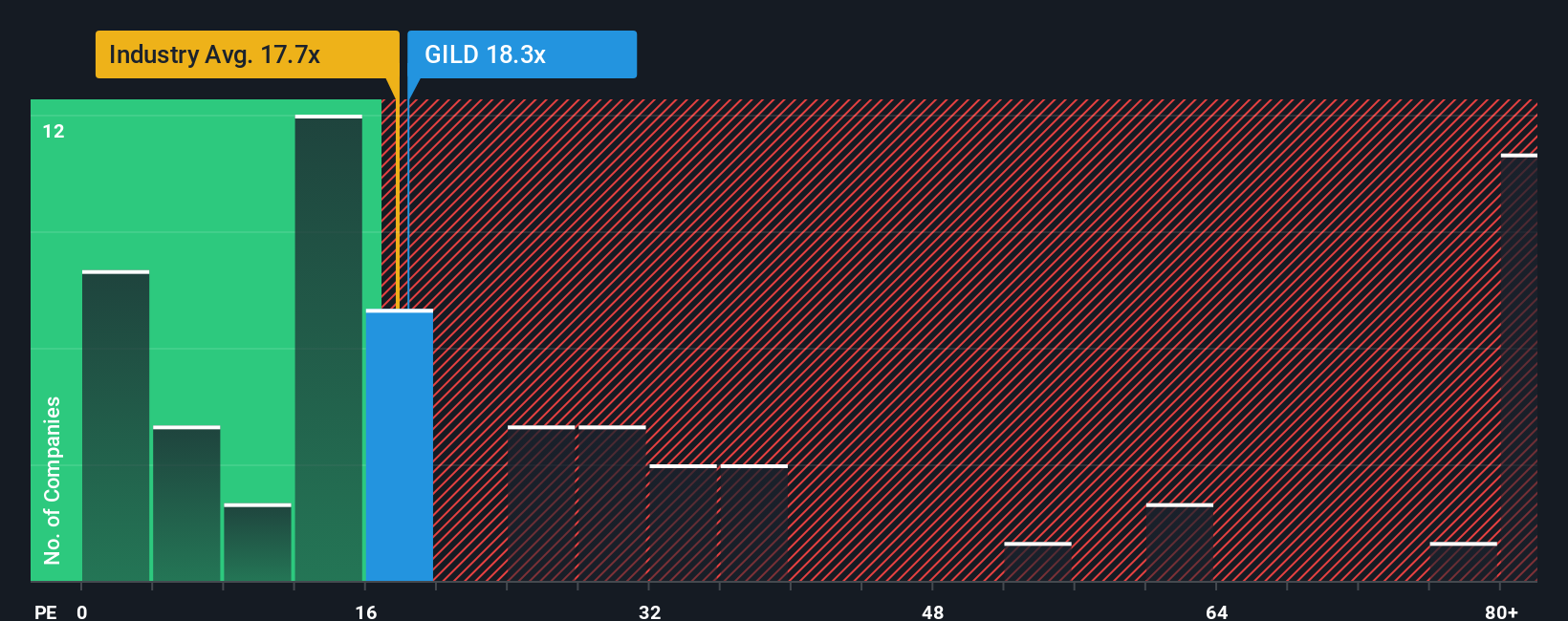

Stepping back from fair value calculations, let’s look at common market metrics. Gilead’s price-to-earnings ratio stands at 18.7x, which is slightly above the US Biotechs industry average of 18x, but dramatically lower than its peers’ 60.1x. Interestingly, this is still well below the market’s fair ratio of 26.7x, suggesting some upside but also warning of possible valuation risks if investor sentiment shifts. Should investors be more concerned about catching up or a potential pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gilead Sciences Narrative

If you have your own take on Gilead or want to challenge the consensus, you can dive into the numbers and build your narrative in just a few minutes. Do it your way

A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of opportunity beyond Gilead Sciences. Unlock your next winning investment with fresh ideas handpicked by the Simply Wall Street Screener. Don’t let the market move without you.

- Start earning with confidence by reviewing these 15 dividend stocks with yields > 3% that offer yields above 3% and can boost your regular returns.

- Capitalize on the surge in machine learning by targeting these 25 AI penny stocks that are reshaping entire industries right now.

- Grow your portfolio’s future by checking out these 27 quantum computing stocks at the forefront of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives