- United States

- /

- Pharma

- /

- NasdaqGM:EYPT

EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) May Have Run Too Fast Too Soon With Recent 30% Price Plummet

EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

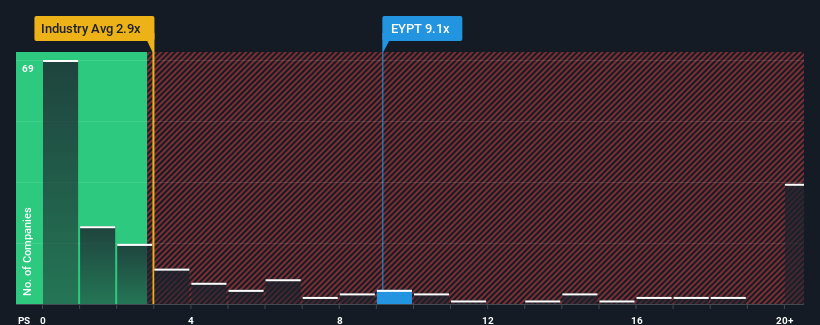

In spite of the heavy fall in price, when almost half of the companies in the United States' Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider EyePoint Pharmaceuticals as a stock not worth researching with its 9.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for EyePoint Pharmaceuticals

What Does EyePoint Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, EyePoint Pharmaceuticals has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EyePoint Pharmaceuticals.How Is EyePoint Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, EyePoint Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.5% last year. The latest three year period has also seen an excellent 41% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 0.5% per annum during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 24% each year, which paints a poor picture.

With this information, we find it concerning that EyePoint Pharmaceuticals is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From EyePoint Pharmaceuticals' P/S?

Even after such a strong price drop, EyePoint Pharmaceuticals' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of EyePoint Pharmaceuticals' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for EyePoint Pharmaceuticals (1 doesn't sit too well with us!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if EyePoint Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EYPT

EyePoint Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives