- United States

- /

- Pharma

- /

- NasdaqGM:ETON

Further weakness as Eton Pharmaceuticals (NASDAQ:ETON) drops 14% this week, taking three-year losses to 52%

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Eton Pharmaceuticals, Inc. (NASDAQ:ETON) shareholders. So they might be feeling emotional about the 52% share price collapse, in that time. Even worse, it's down 16% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

With the stock having lost 14% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Eton Pharmaceuticals

Because Eton Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Eton Pharmaceuticals saw its revenue grow by 44% per year, compound. That's well above most other pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

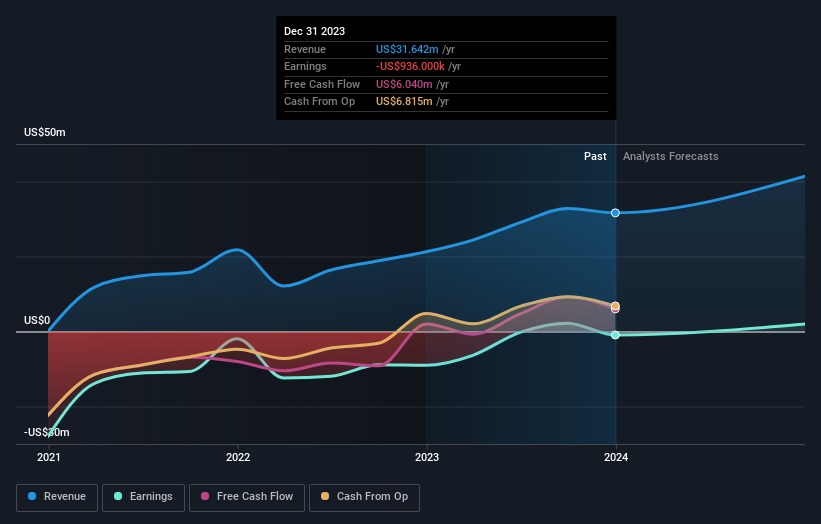

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Eton Pharmaceuticals shareholders are down 1.3% for the year, but the market itself is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 9% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Eton Pharmaceuticals is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eton Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ETON

Eton Pharmaceuticals

A specialty pharmaceutical company, focuses on developing, acquiring, and commercializing pharmaceutical products for rare diseases.

High growth potential with adequate balance sheet.