- United States

- /

- Pharma

- /

- NasdaqGM:EOLS

Analysts Just Slashed Their Evolus, Inc. (NASDAQ:EOLS) EPS Numbers

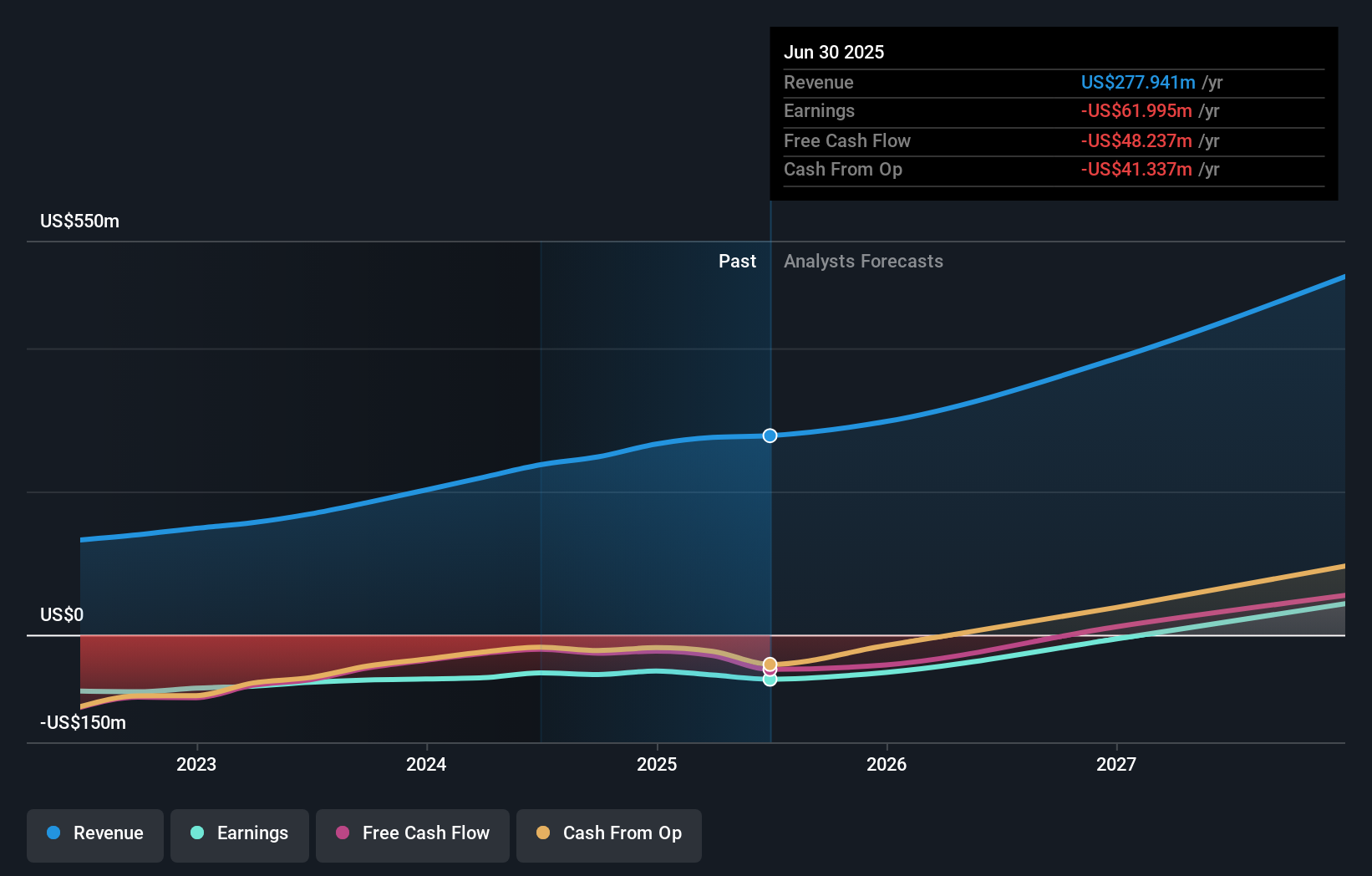

The latest analyst coverage could presage a bad day for Evolus, Inc. (NASDAQ:EOLS), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

Following the downgrade, the latest consensus from Evolus' seven analysts is for revenues of US$298m in 2025, which would reflect an okay 7.1% improvement in sales compared to the last 12 months. Losses are presumed to reduce, shrinking 15% per share from last year to US$0.81. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$348m and losses of US$0.60 per share in 2025. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for Evolus

The consensus price target fell 19% to US$19.00, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Evolus' past performance and to peers in the same industry. We would highlight that Evolus' revenue growth is expected to slow, with the forecast 15% annualised growth rate until the end of 2025 being well below the historical 32% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 7.9% per year. Even after the forecast slowdown in growth, it seems obvious that Evolus is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Evolus. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Evolus.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Evolus' business, like recent substantial insider selling. Learn more, and discover the 1 other concern we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

Valuation is complex, but we're here to simplify it.

Discover if Evolus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EOLS

Evolus

A performance beauty company, delivers products in the cash-pay aesthetic market in the United States, Canada, Europe, and Australia.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success