- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Can Denali Therapeutics (DNLI)’s New Leadership Steady the Narrative Amid Mounting Losses?

Reviewed by Sasha Jovanovic

- Denali Therapeutics recently announced significant leadership changes, with Chief Medical Officer Carole Ho departing for Eli Lilly, Peter Chin appointed as Acting Chief Medical Officer, and seasoned executive Tim Van Hauwermeiren joining the Board of Directors.

- These executive transitions come as the company reported higher net losses for both the third quarter and nine months ended September 30, 2025, increasing market attention on Denali’s future direction and stability.

- We’ll explore how the addition of Tim Van Hauwermeiren to the board shapes Denali’s investment narrative during this pivotal period of transition.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Denali Therapeutics' Investment Narrative?

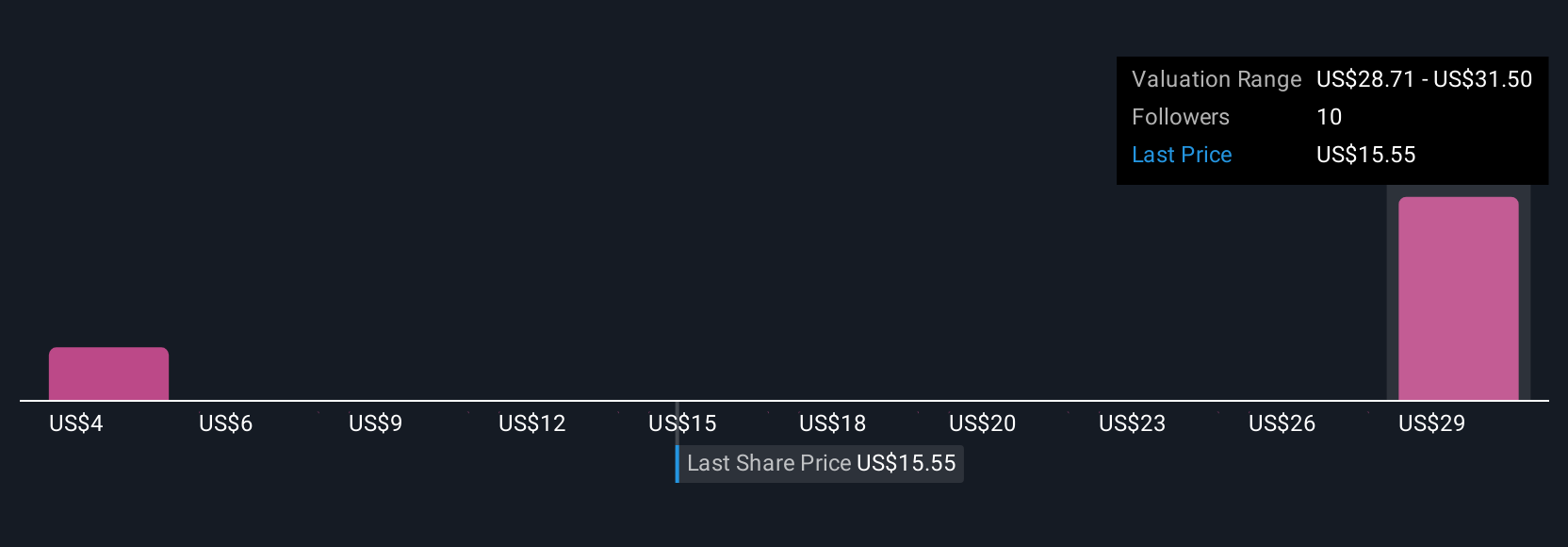

To be a shareholder in Denali Therapeutics, you need conviction in its mission to develop transformative treatments for neurodegenerative and genetic disorders, despite ongoing operating losses and a lack of revenue. The company’s near-term catalysts are largely tied to FDA decisions on its lead candidate, tividenofusp alfa, for MPS II, a timeline now pushed back to April 2026 following the FDA’s recent extension. Leadership transitions, particularly the departure of longtime CMO Carole Ho and the arrival of Peter Chin as Acting CMO, introduce uncertainty for clinical execution and regulatory interactions at a critical moment. However, the addition of Tim Van Hauwermeiren, an executive with deep industry experience, may bring fresh perspective and operational expertise to the board. While these changes raise questions about stability and continuity, recent share price moves suggest the immediate impact is not seen as material. Still, risk remains elevated given no profitability in sight and a history of widening losses.

But investor attention should be on whether the new leadership can keep clinical milestones on track. Our comprehensive valuation report raises the possibility that Denali Therapeutics is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives