- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

Shareholders in CytomX Therapeutics (NASDAQ:CTMX) have lost 87%, as stock drops 10% this past week

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Imagine if you held CytomX Therapeutics, Inc. (NASDAQ:CTMX) for half a decade as the share price tanked 87%. And some of the more recent buyers are probably worried, too, with the stock falling 75% in the last year. The falls have accelerated recently, with the share price down 49% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for CytomX Therapeutics

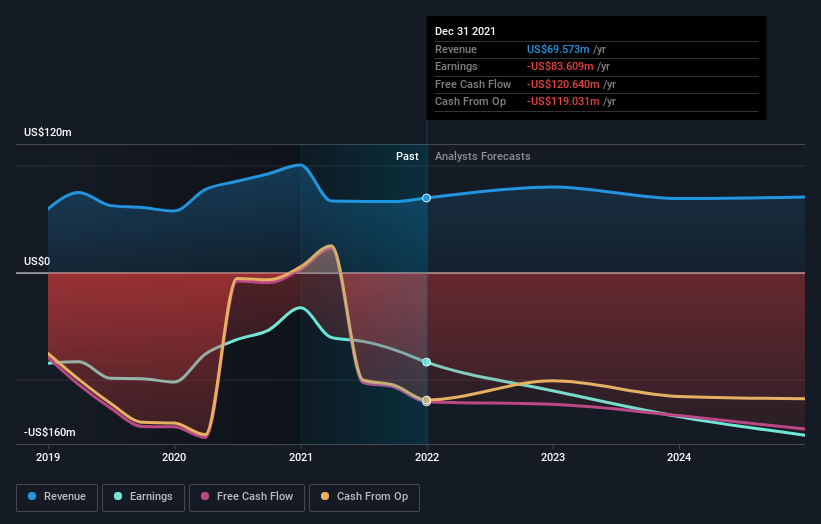

Given that CytomX Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, CytomX Therapeutics saw its revenue increase by 13% per year. That's a fairly respectable growth rate. So the stock price fall of 13% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 0.5% in the last year, CytomX Therapeutics shareholders lost 75%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand CytomX Therapeutics better, we need to consider many other factors. For example, we've discovered 3 warning signs for CytomX Therapeutics (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTMX

CytomX Therapeutics

An oncology-focused biopharmaceutical company, focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Slight and fair value.