- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

How Catalyst’s Patent Settlement With Lupin Reshapes FIRDAPSE’s Investment Outlook at CPRX

Reviewed by Simply Wall St

- Earlier this week, Catalyst Pharmaceuticals announced it reached a settlement with Lupin Pharmaceuticals to resolve patent litigation over FIRDAPSE, permitting Lupin to launch a generic version no earlier than February 25, 2035, pending FDA approval.

- This agreement concludes all current patent disputes between Catalyst, SERB S.A., and Lupin in the U.S., following similar deals with Teva and Inventia, and shapes expectations for future competition around FIRDAPSE.

- We will explore how the patent settlement with Lupin may affect Catalyst Pharmaceuticals’ investment outlook, especially regarding FIRDAPSE exclusivity.

Find companies with promising cash flow potential yet trading below their fair value.

Catalyst Pharmaceuticals Investment Narrative Recap

For shareholders of Catalyst Pharmaceuticals, the core belief centers on FIRDAPSE's ongoing exclusivity and its ability to drive robust revenues, supported by diagnostics expansion and new patient identification. The recent Lupin patent settlement reinforces FIRDAPSE’s protection in the U.S. into 2035, removing immediate legal overhang. However, this news is not expected to materially affect the most pressing short-term catalyst: sustained market share gains from improved rare cancer-associated LEMS diagnosis, while significant risks remain centered on revenue concentration and portfolio breadth.

The most pertinent recent announcement was the August 2025 update to NCCN guidelines, formally recognizing FIRDAPSE as a recommended treatment and boosting the credibility of related diagnostic pathways. By increasing physician awareness and paving the way for more timely diagnoses, this change directly targets one of Catalyst’s largest addressable growth drivers, potentially amplifying FIRDAPSE’s market opportunity as the exclusivity period solidifies.

But with FIRDAPSE still making up two thirds of total sales and ongoing litigation with other generic challengers yet unresolved, investors should also be aware that...

Read the full narrative on Catalyst Pharmaceuticals (it's free!)

Catalyst Pharmaceuticals' narrative projects $709.1 million in revenue and $253.5 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $44.8 million earnings increase from $208.7 million today.

Uncover how Catalyst Pharmaceuticals' forecasts yield a $34.29 fair value, a 63% upside to its current price.

Exploring Other Perspectives

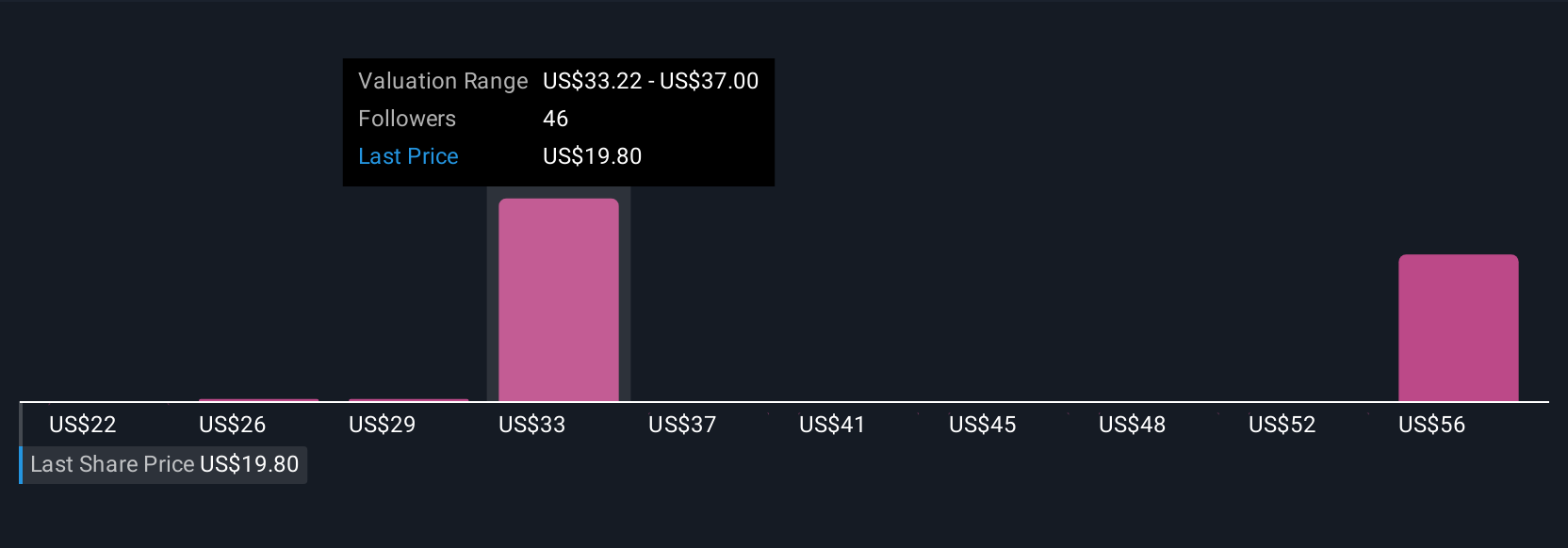

Fair value estimates from 11 Simply Wall St Community participants range from US$21.86 to US$59.71 per share. With FIRDAPSE’s legal horizon extended, the company’s dependence on this single drug remains a key consideration for future performance despite such wide valuation viewpoints.

Explore 11 other fair value estimates on Catalyst Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Catalyst Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catalyst Pharmaceuticals research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Catalyst Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catalyst Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with outstanding track record.

Market Insights

Community Narratives