- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Why Corcept Therapeutics (CORT) Is Up 8.4% After Mixed Q3 Results And Insider Share Sale

Reviewed by Sasha Jovanovic

- In the past few days, Corcept Therapeutics reported third-quarter 2025 earnings per share of US$0.16, surpassing analyst expectations even as revenue fell short, and CEO Joseph K. Belanoff sold 40,000 shares under a pre-arranged trading plan.

- Analyst H.C. Wainwright reaffirmed a positive view on Corcept, emphasizing longer-term growth potential despite current commercial headwinds for flagship drug Korlym, which contrasts with the mixed quarterly revenue outcome.

- With earnings beating forecasts but revenue missing expectations, we’ll now consider how this shapes Corcept Therapeutics’ investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Corcept Therapeutics Investment Narrative Recap

An investor in Corcept Therapeutics needs to believe the company can manage Korlym’s maturing franchise while successfully advancing its broader cortisol modulation pipeline. The latest earnings beat, despite softer revenue, does not materially change the near term focus on Korlym commercialization risks and the key catalyst of execution on new therapies and market access.

The recent update to full year 2025 revenue guidance, now at US$800 million to US$850 million after earlier reductions, is particularly relevant here. It reinforces how pharmacy capacity, pricing pressure and Korlym’s authorized generic mix can quickly affect reported growth, making operational follow through just as important as clinical or regulatory milestones for near term outcomes.

But while the topline story looks encouraging today, investors should be aware of the ongoing patent litigation with Teva and how it could...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' narrative projects $2.0 billion revenue and $743.0 million earnings by 2028.

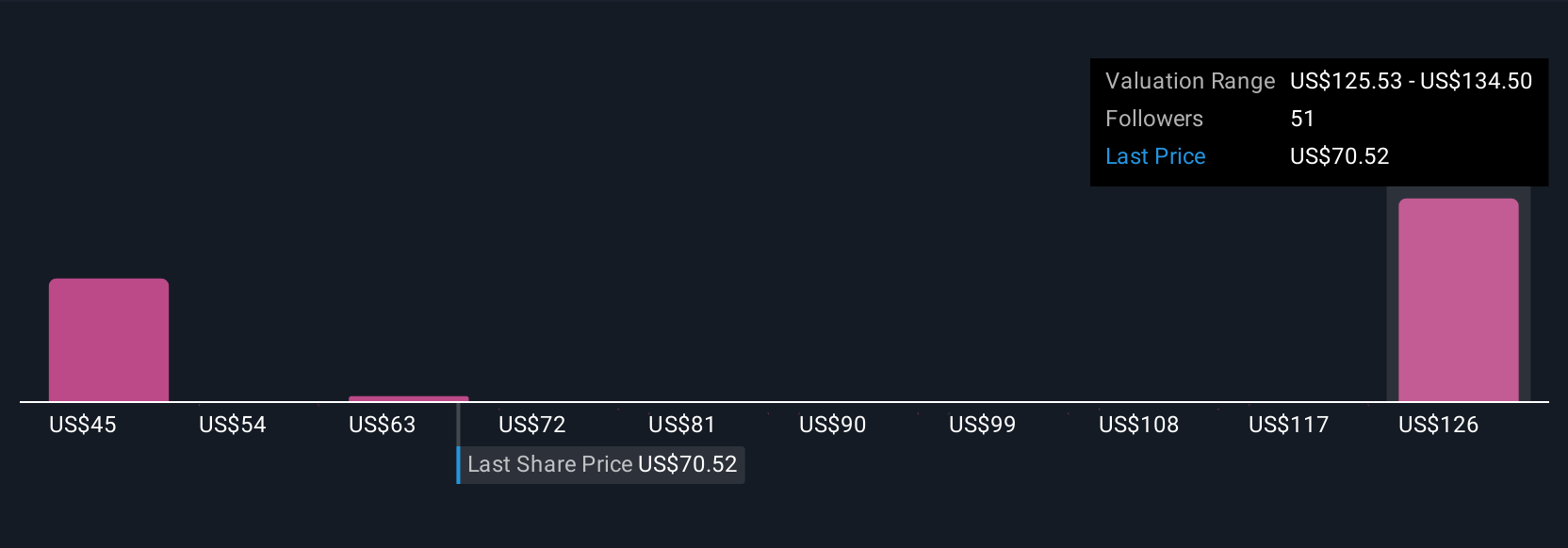

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span roughly US$74 to US$260 per share, showing how far apart individual views can be. When you set those opinions against Corcept’s reliance on Korlym and the risk of faster generic competition, it underlines why many investors look at several perspectives before deciding how comfortable they are with the company’s future performance.

Explore 10 other fair value estimates on Corcept Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026