- United States

- /

- Pharma

- /

- NasdaqCM:CORT

The Bull Case For Corcept Therapeutics (CORT) Could Change Following Positive ROSELLA Phase 3 Ovarian Cancer Data

Reviewed by Sasha Jovanovic

- Corcept Therapeutics recently announced new late-breaking data from its pivotal Phase 3 ROSELLA trial at the ESMO 2025 Annual Meeting, revealing that relacorilant plus nab-paclitaxel provided a progression-free survival benefit in patients with platinum-resistant ovarian cancer who had progressed after PARP inhibitor treatment.

- An important insight from the data is that relacorilant consistently improved outcomes across PARP inhibitor subgroups, showing efficacy in populations with particularly poor prognosis and maintaining its established safety profile.

- We'll explore how the ROSELLA trial's positive results for relacorilant in hard-to-treat ovarian cancer impact Corcept's broader investment outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Corcept Therapeutics Investment Narrative Recap

To be a shareholder in Corcept Therapeutics, you need confidence in the company’s ability to pivot beyond Korlym and create new revenue streams through pipeline approvals, especially for relacorilant. While the latest ROSELLA Phase 3 trial data for relacorilant in platinum-resistant ovarian cancer strengthens the short-term outlook for regulatory success and wider adoption, the most important near-term catalyst remains timely FDA approval, however, the recent update does not materially change the significant risk that Korlym revenues may decline before relacorilant can offset potential losses.

One recent corporate move directly tied to these clinical milestones is Corcept’s submission of a Marketing Authorization Application (MAA) to the European Medicines Agency for relacorilant in platinum-resistant ovarian cancer. This step complements the ROSELLA trial's results, as regulatory progress in major markets like the EU will be key to supplementing and eventually replacing reliance on Korlym as the main revenue driver.

In contrast, investors should also be aware of what happens if Korlym revenues fall faster than relacorilant’s ramp-up allows...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' outlook anticipates $2.0 billion in revenue and $743.0 million in earnings by 2028. This requires 40.7% annual revenue growth and a $611.0 million increase in earnings from the current $132.0 million.

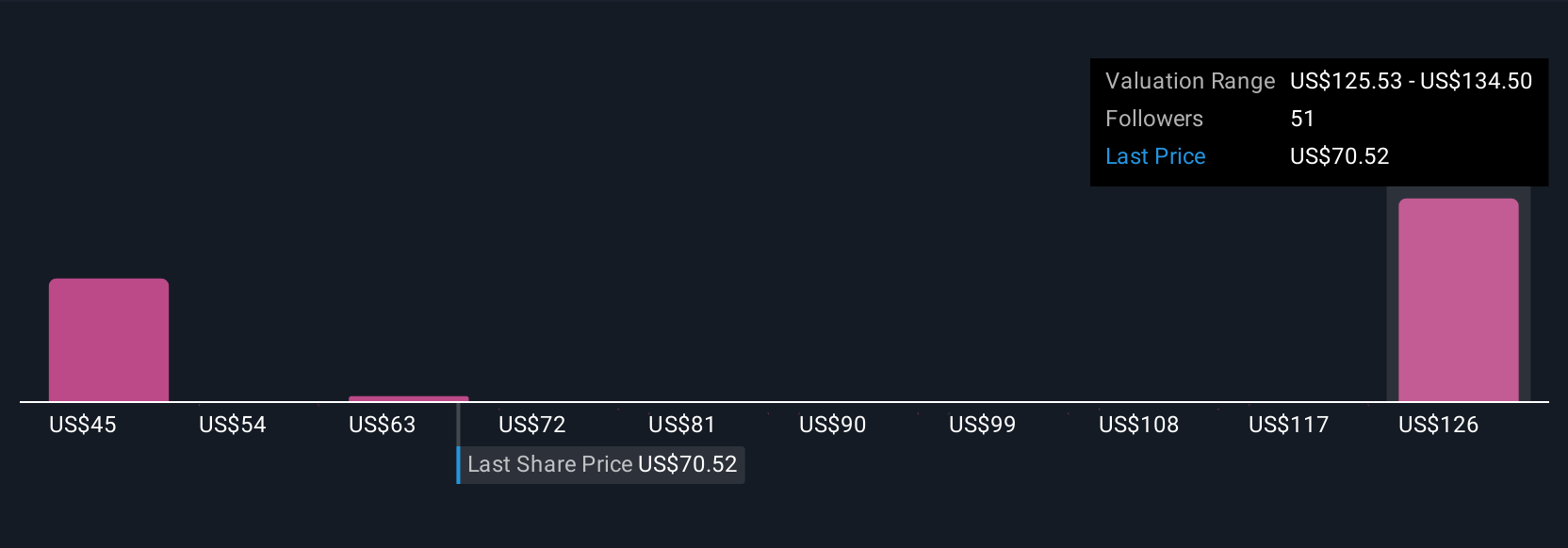

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 86% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 11 Simply Wall St Community members range from US$44.83 to US$193.61 per share. While these views vary widely, Korlym’s shrinking margins and potential for accelerated generic pressure remain critical to understanding different outlooks on Corcept’s future.

Explore 11 other fair value estimates on Corcept Therapeutics - why the stock might be worth 38% less than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives