- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (CORT): Reassessing Valuation After Q3 Earnings Beat, Revenue Miss, and Planned CEO Share Sale

Reviewed by Simply Wall St

Corcept Therapeutics (CORT) just posted third quarter earnings that topped profit expectations even as revenue missed forecasts, and the update landed alongside a pre planned 40,000 share sale by CEO Joseph Belanoff.

See our latest analysis for Corcept Therapeutics.

The stock has been climbing steadily, with a 72.31% year to date share price return and a 302.74% three year total shareholder return suggesting momentum is still firmly building behind the story.

If Corcept’s run has you rethinking your healthcare exposure, this could be a good moment to explore other potential leaders across healthcare stocks.

With earnings outpacing forecasts, revenue growth still robust, and the stock trading at a steep discount to analyst targets, is Corcept genuinely undervalued today or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 36.0% Undervalued

Compared with Corcept Therapeutics' last close at $86.11, the most followed narrative points to a meaningfully higher fair value anchored in aggressive growth expectations.

The publication of the CATALYST study and the resulting increased awareness and screening for hypercortisolism among physicians are expanding the potential addressable patient pool, which is expected to drive significant acceleration in revenue growth over the next several years.

Anticipated regulatory approvals for relacorilant in both hypercortisolism (end of this year) and platinum-resistant ovarian cancer (next year), supported by clinically differentiated safety and efficacy data, create major new revenue and margin expansion opportunities as the company moves past single-product dependence.

Curious how fast revenue, margins, and earnings must scale to back up that upside view? The narrative leans on ambitious growth, richer profitability, and a future valuation multiple that rivals sector leaders. Want to see how those moving parts fit together and what they imply for 2028 earnings power and fair value today?

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering Korlym dependence and unresolved Teva litigation mean that faster-than-expected generic pressure could derail those optimistic growth and valuation assumptions.

Find out about the key risks to this Corcept Therapeutics narrative.

Another View: Valuation Through Earnings

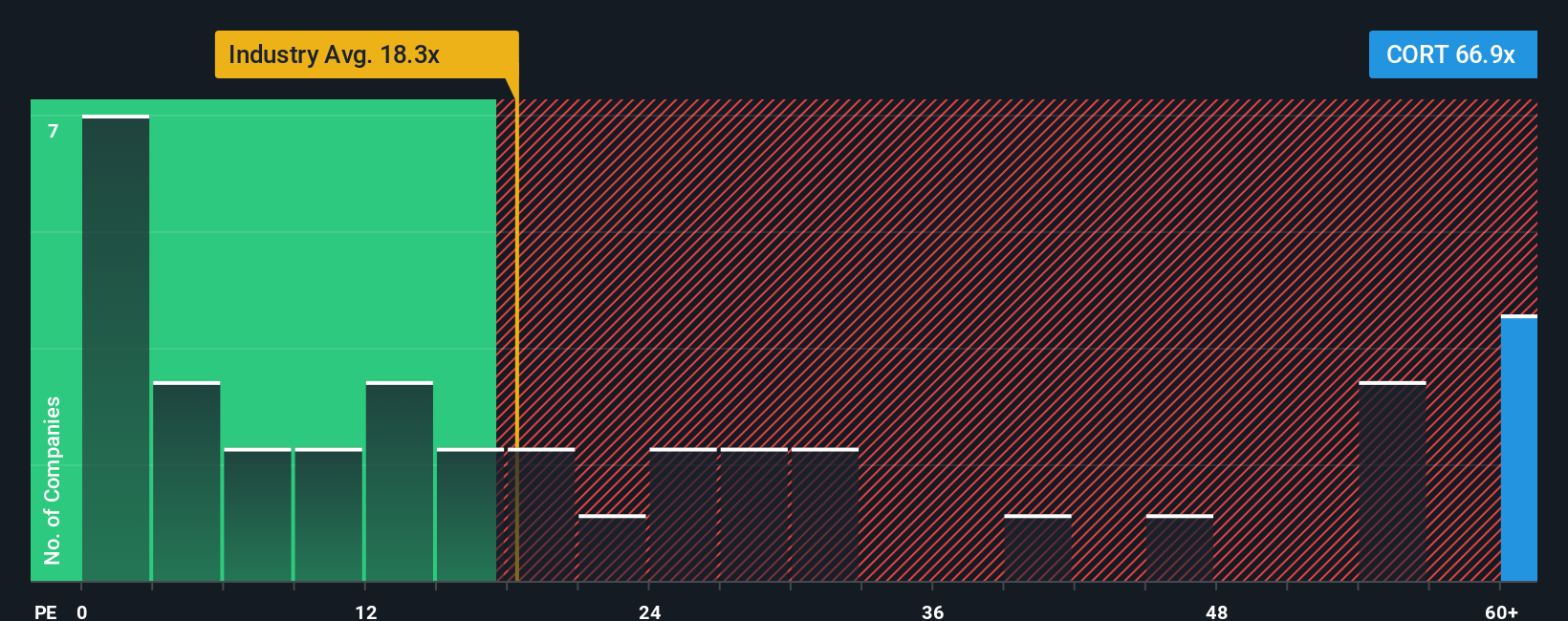

While the narrative and fair value point to upside, the current price to earnings ratio of 86.5 times paints a more demanding picture. That is far richer than the US pharmaceuticals average of 19.7 times, peers at 36.2 times, and even its 44.6 times fair ratio, leaving less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fresh perspective in just a few minutes. Do it your way.

A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Skip the guesswork and put your capital to work with targeted ideas on Simply Wall St's screener, before others crowd into the same opportunities.

- Capture mispriced potential by targeting businesses trading below intrinsic value with these 906 undervalued stocks based on cash flows before the market catches up.

- Ride the next wave of innovation by focusing on transformational companies at the intersection of medicine and algorithms through these 30 healthcare AI stocks.

- Position yourself early in the digital finance shift by zeroing in on market leaders and emerging platforms via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026