- United States

- /

- Pharma

- /

- NasdaqGS:COLL

Collegium Pharmaceutical (COLL): Exploring Valuation Following Zacks Analyst Upgrade and Rising Earnings Estimates

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 22.8% Undervalued

The most widely followed narrative suggests that Collegium Pharmaceutical is trading at a meaningful discount to its fair value, with upside potential based on future earnings strength and expanding profit margins.

Collegium's differentiated pain portfolio, notably with products featuring proprietary abuse-deterrent and extended-release technologies (for example, Xtampza ER's DETERx platform), is supported by industry and regulatory trends that increasingly favor safer opioid options. This is likely to enhance market share, pricing power, and sustain net margins as regulatory emphasis on abuse deterrence grows.

Think the market's already priced in the upside? This bold valuation actually rests on clear assumptions about shrinking risk, improved profitability, and a radical shift in earnings power over the next few years. Curious which key financial forecasts analysts are baking into their fair value, and if they stack up to scrutiny? The mystery lies in future profit margins and a valuation multiple that dares to defy industry norms.

Result: Fair Value of $44.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the exclusivity loss from upcoming patent expirations and unpredictable regulatory shifts could challenge Collegium's bullish outlook and slow growth momentum.

Find out about the key risks to this Collegium Pharmaceutical narrative.Another View: Comparing Valuation Methods

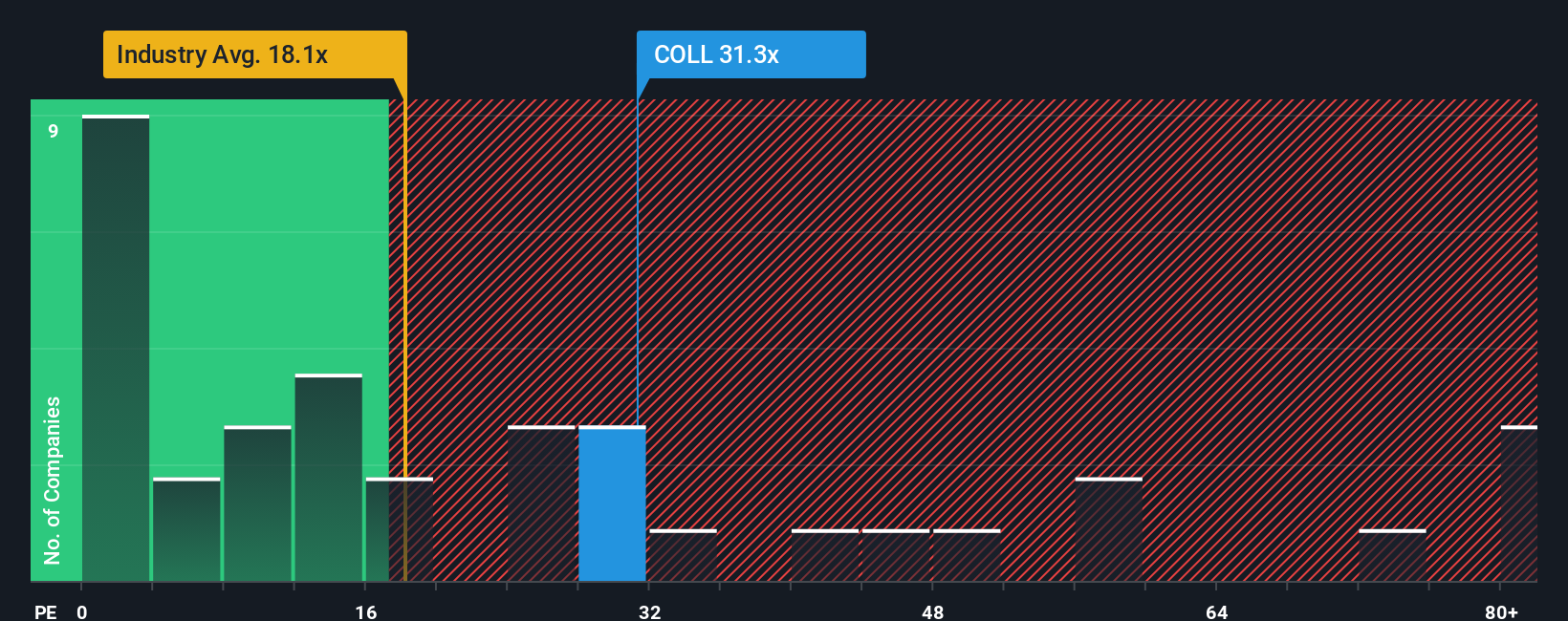

While many investors are drawn to analyst targets or discounted cash flow models, a look at how the company’s earnings multiple compares to the industry tells a different story and hints at potential overvaluation. Which story will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Collegium Pharmaceutical to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Collegium Pharmaceutical Narrative

If you see things differently or want to investigate the numbers on your own terms, you can build your own analysis in just a few minutes. Do it your way

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the winners of tomorrow might be found before everyone else catches on. See what else is catching momentum and don't let standout opportunities slip away.

- Pinpoint undervalued companies ready to surprise Wall Street by checking out our list of undervalued stocks based on cash flows.

- Tap into the booming growth of artificial intelligence by scanning for potential market leaders using AI penny stocks.

- Turn a steady income into your strategy with stocks offering attractive yields in the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives