- United States

- /

- Pharma

- /

- NasdaqGS:COLL

Collegium Pharmaceutical (COLL): Assessing Valuation After Earnings Beats, Strong Zacks Rating and Value Investor Interest

Reviewed by Simply Wall St

Collegium Pharmaceutical (COLL) has jumped onto investors radars after a streak of earnings beats and a top research rating, with that momentum helping push the stock to a fresh 52 week high.

See our latest analysis for Collegium Pharmaceutical.

That surge to around $47.91 has come on the back of a powerful 33.6 percent 1 month share price return and a 67.3 percent year to date share price return, with the 5 year total shareholder return of 156.8 percent showing momentum has been building rather than fading.

If Collegium’s run has you rethinking where the next opportunity in healthcare might come from, it could be worth exploring other specialist names via healthcare stocks.

Yet with Collegium now trading just above its average analyst price target but still flashing strong value signals, investors face a key question: is this a genuine overlooked bargain, or has the market already priced in the next leg of growth?

Most Popular Narrative: 2.4% Overvalued

With Collegium Pharmaceutical closing at $47.91 against a most popular narrative fair value of $46.80, expectations for richer margins are doing the heavy lifting.

The company's differentiated pain portfolio, notably with products featuring proprietary abuse deterrent and extended release technologies (e.g., Xtampza ER's DETERx platform), is supported by industry and regulatory trends that increasingly favor safer opioid options, likely enhancing market share, pricing power, and sustaining net margins as regulatory emphasis on abuse deterrence grows. This underappreciated expansion directly supports revenue and total earnings growth.

Curious how shrinking top line expectations can still sit beside sharply higher profit forecasts and a lower future earnings multiple than the wider sector? The most popular narrative connects these moving parts into one valuation story that hinges on rising margins, disciplined buybacks, and a very specific view of what investors will be willing to pay for earnings a few years from now. Want to see exactly how those assumptions combine to justify the current fair value?

Result: Fair Value of $46.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny of opioids and looming patent expirations for key pain products could compress margins and undermine the margin-driven valuation story.

Find out about the key risks to this Collegium Pharmaceutical narrative.

Another Angle on Value

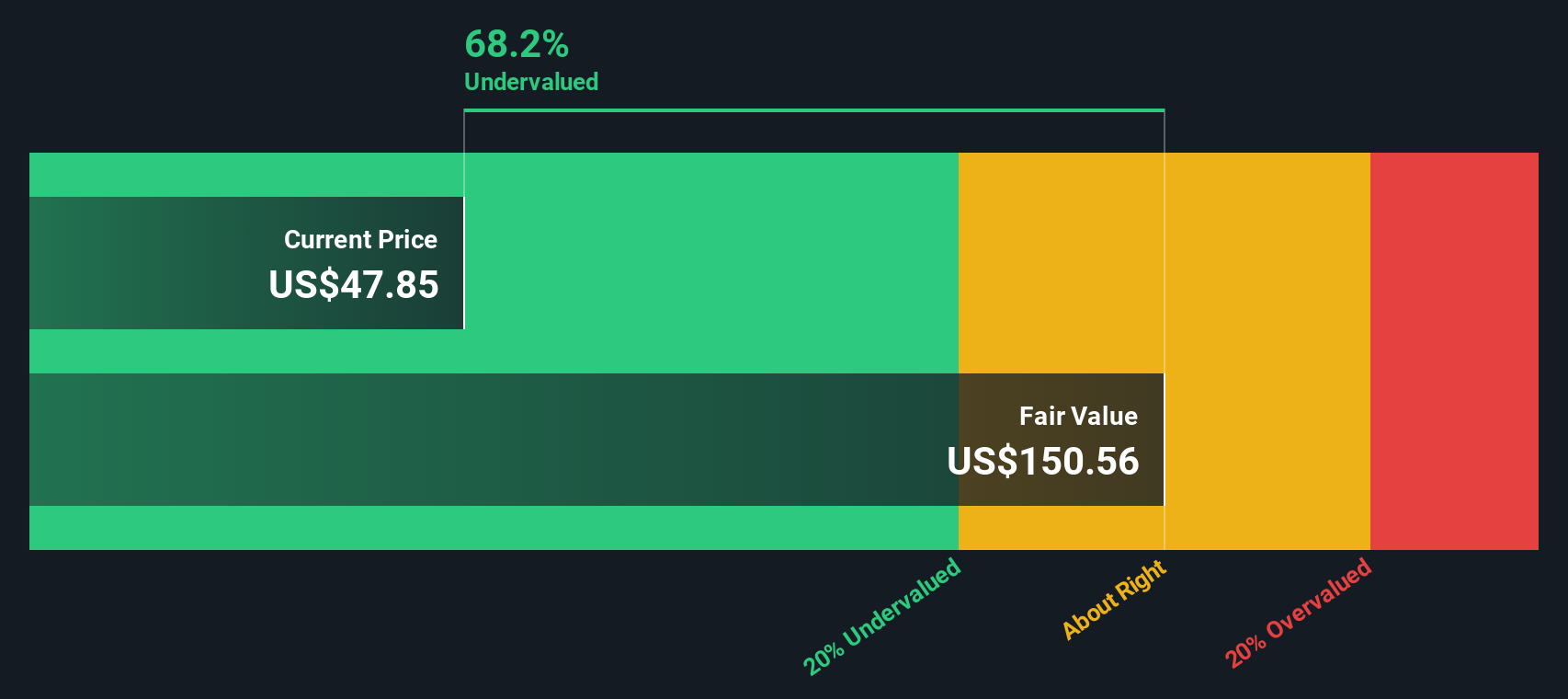

While the most popular narrative calls Collegium slightly overvalued at $46.80, our DCF model sees far more upside, putting fair value closer to $150.56. That huge gap highlights real disagreement about how durable those future cash flows will be, and which view would you lean toward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Collegium Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Collegium Pharmaceutical Narrative

If you see the story differently or would rather rely on your own work, you can build a personalised narrative in just minutes: Do it your way.

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one compelling story. Use the Simply Wall St Screener to uncover fresh opportunities that fit your strategy before the market catches on.

- Explore potential mispriced quality by targeting companies trading below intrinsic value through these 906 undervalued stocks based on cash flows and position yourself ahead of a potential re rating.

- Refine your search for growth by focusing on innovation leaders using these 26 AI penny stocks, where earnings momentum and structural tailwinds may influence returns.

- Strengthen your income focus with resilient payers from these 15 dividend stocks with yields > 3%, concentrating on yields above 3 percent that can support both cash flow and long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026