- United States

- /

- Biotech

- /

- NasdaqGS:COGT

Cogent Biosciences (COGT) Is Up 13.8% After Positive SUMMIT Trial Results for Bezuclastinib

Reviewed by Simply Wall St

- Earlier this month, Cogent Biosciences reported positive top-line results from Part 2 of its SUMMIT clinical trial, showing that bezuclastinib met all primary and key secondary endpoints in non-advanced systemic mastocytosis with clinically meaningful and statistically significant improvements.

- These findings highlight a potential shift in treatment options for this condition, with bezuclastinib showing a strong efficacy and safety profile and paving the way for an anticipated new drug application submission to the FDA by the end of 2025.

- We'll take a closer look at how the SUMMIT trial results position bezuclastinib as a focal point in Cogent Biosciences' investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Cogent Biosciences' Investment Narrative?

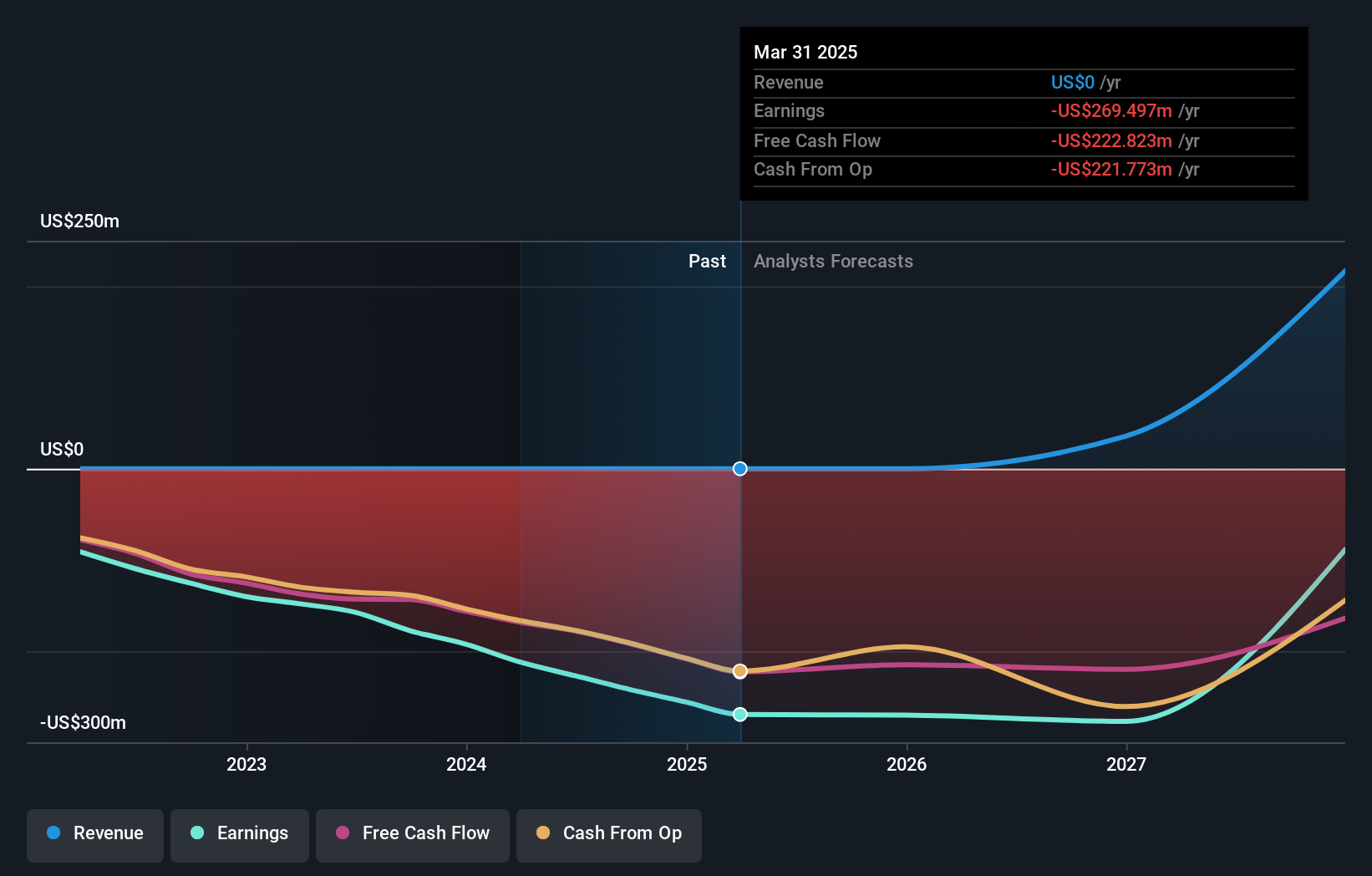

For anyone considering Cogent Biosciences as an investment, the story now centers squarely on the future of bezuclastinib as a potential new standard for non-advanced systemic mastocytosis. The recent release of strong SUMMIT trial data, and Cogent’s follow-on equity offering, both bring the company’s most important catalyst, the path to a new drug application in 2025, into sharper focus. This good news temporarily lifts near-term regulatory and clinical risk, and market reaction suggests optimism, yet it also shifts attention to financial sustainability and the risk of further shareholder dilution. Cogent is still running at a steep annual loss of over US$255 million, and remains unprofitable with significant cash burn. Short-term catalysts now hinge on regulatory progress and new trial results, while ongoing dilution and the timeline to revenue remain big questions for investors.

Yet, with the promise come real risks tied to funding needs and limited current revenue. Our valuation report unveils the possibility Cogent Biosciences' shares may be trading at a premium.Exploring Other Perspectives

Build Your Own Cogent Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Biosciences research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cogent Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Biosciences' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COGT

Cogent Biosciences

A biotechnology company, focuses on developing precision therapies for genetically defined diseases.

Flawless balance sheet slight.

Market Insights

Community Narratives