- United States

- /

- Biotech

- /

- NasdaqGS:CNTA

Centessa Pharmaceuticals (CNTA): Rapid 74.3% Revenue Growth Challenges Profitability Concerns

Reviewed by Simply Wall St

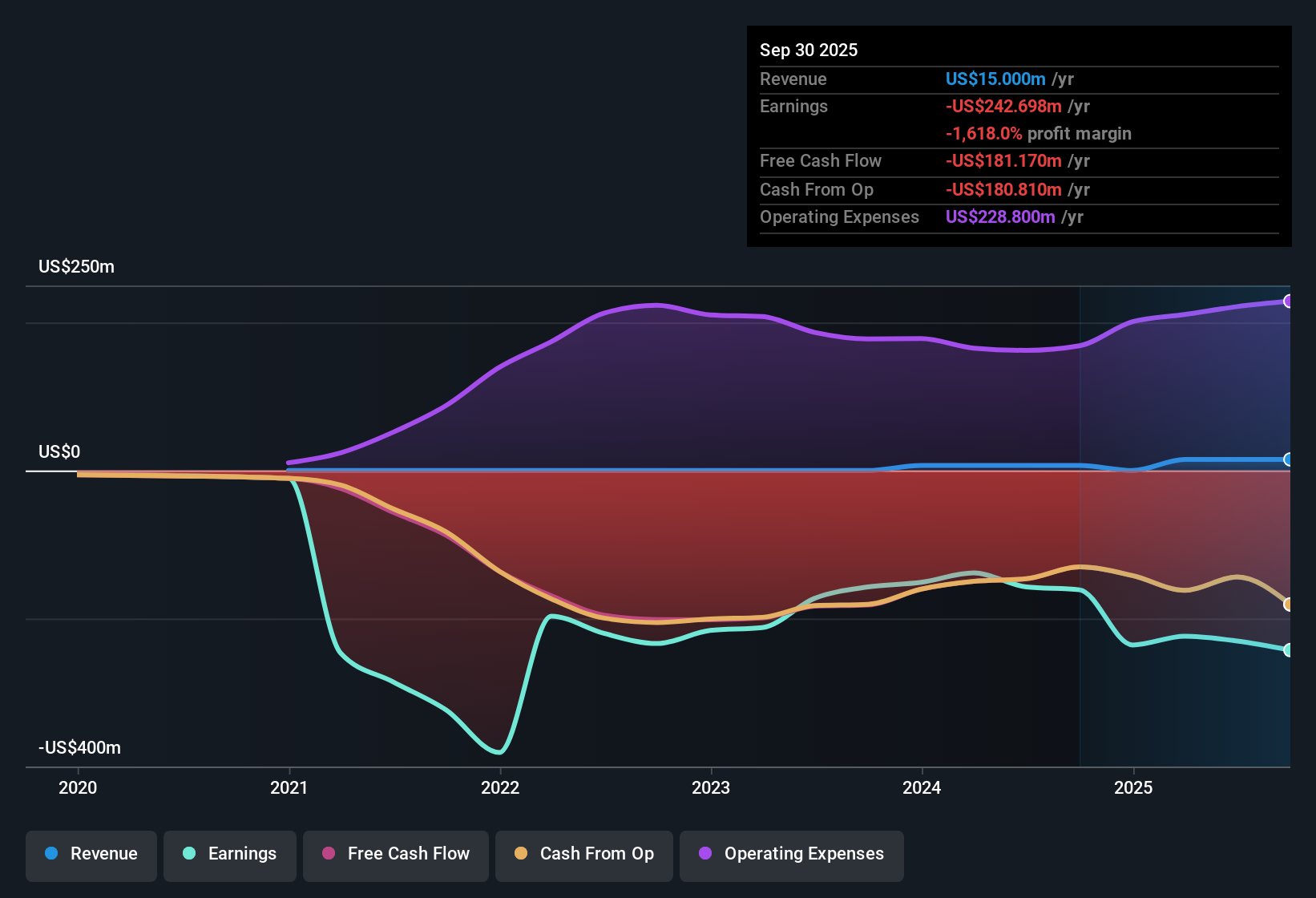

Centessa Pharmaceuticals (CNTA) is forecast to deliver stellar annual revenue growth of 74.3%, far surpassing the broader US market’s 10.5% pace. Despite the robust top-line outlook, the company remains unprofitable and is expected to continue operating at a loss over the next three years. While losses have narrowed at an average rate of 4.3% per year over the past five years, there are no signs of an imminent shift toward profitability. This raises the stakes for investors weighing rapid growth against persistent negative margins.

See our full analysis for Centessa Pharmaceuticals.Next, we will see how these headline figures stack up against the prevailing narratives shaping sentiment around Centessa and whether the numbers challenge or confirm the market’s expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Book Ratio Sits Well Below Peers, Still Above Industry

- Centessa’s price-to-book ratio stands at 8.8x, which is lower than peer companies averaging 13x but remains significantly higher than the US biotech industry average of 2.4x.

- What is surprising is how the prevailing market view sees this as a potential middle ground for investors:

- Trading below the peer group average suggests Centessa may not be facing the strongest speculative overvaluation. This could present a possible relative discount for buyers focused on the sector.

- However, a premium against the broader US biotech space might give value investors pause, especially amid continuing losses and a long path to breakeven.

Profitability Remains Elusive as Losses Persist

- Despite solid revenue growth, Centessa has not yet turned a profit and is forecast to continue operating at a loss over the next three years, with no near-term positive shift in net margins cited.

- Prevailing market view sees ongoing losses as the central risk narrative:

- Rapid top-line growth has not yet led to improving net margin trends. This keeps the focus on execution risks and sustainability.

- Loss reduction averaging 4.3% each year over the past five years provides some encouragement but the absence of targeted profitability figures means the risk case stays prominent for now.

Analyst Price Target Suggests Room for Upside

- With shares trading at $22.52 and analyst price targets sitting at $33.23, Centessa is currently priced below where analysts expect it could go, even as uncertainty around profits continues.

- The prevailing market view highlights this upside:

- Bulls may see the gap to analyst targets as a sign the market has not yet fully rewarded rapid growth. This could potentially hint at future upside if expectations are met.

- Cautious investors could counter that a discount to target is justified by ongoing losses and higher-than-average valuation ratios relative to the industry.

To understand how analysts’ narratives could shift as Centessa approaches profitability or re-rates on valuation, read the full consensus perspective for more context. 📊 Read the full Centessa Pharmaceuticals Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Centessa Pharmaceuticals's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Centessa’s rapid revenue growth stands out, the persistent losses and lack of a clear path to profitability highlight the risks that come with inconsistent financial performance.

If you’re looking for companies with proven records of steady revenue and profit growth, consider using stable growth stocks screener (2074 results) to focus on those delivering reliable results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNTA

Centessa Pharmaceuticals

A clinical-stage pharmaceutical company, discovers, develops, and delivers medicines.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives