- United States

- /

- Biotech

- /

- NasdaqCM:CLDX

What Celldex Therapeutics (CLDX)'s Strong Barzolvolimab Data and Commercial Focus Mean for Shareholders

Reviewed by Sasha Jovanovic

- Celldex Therapeutics recently reported robust positive Phase 2 data for barzolvolimab in chronic spontaneous urticaria, cold urticaria, and symptomatic dermatographism, highlighting rapid and sustained disease control and a favorable safety profile even after treatment ended.

- The company also appointed Teri Lawver, an experienced leader in biologic launches and immunology, as Chief Commercial Officer, reflecting a sharpened focus on commercial strategy as late-stage trials advance.

- We'll explore how the strong barzolvolimab results and experienced commercial leadership could shape Celldex Therapeutics' investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Celldex Therapeutics' Investment Narrative?

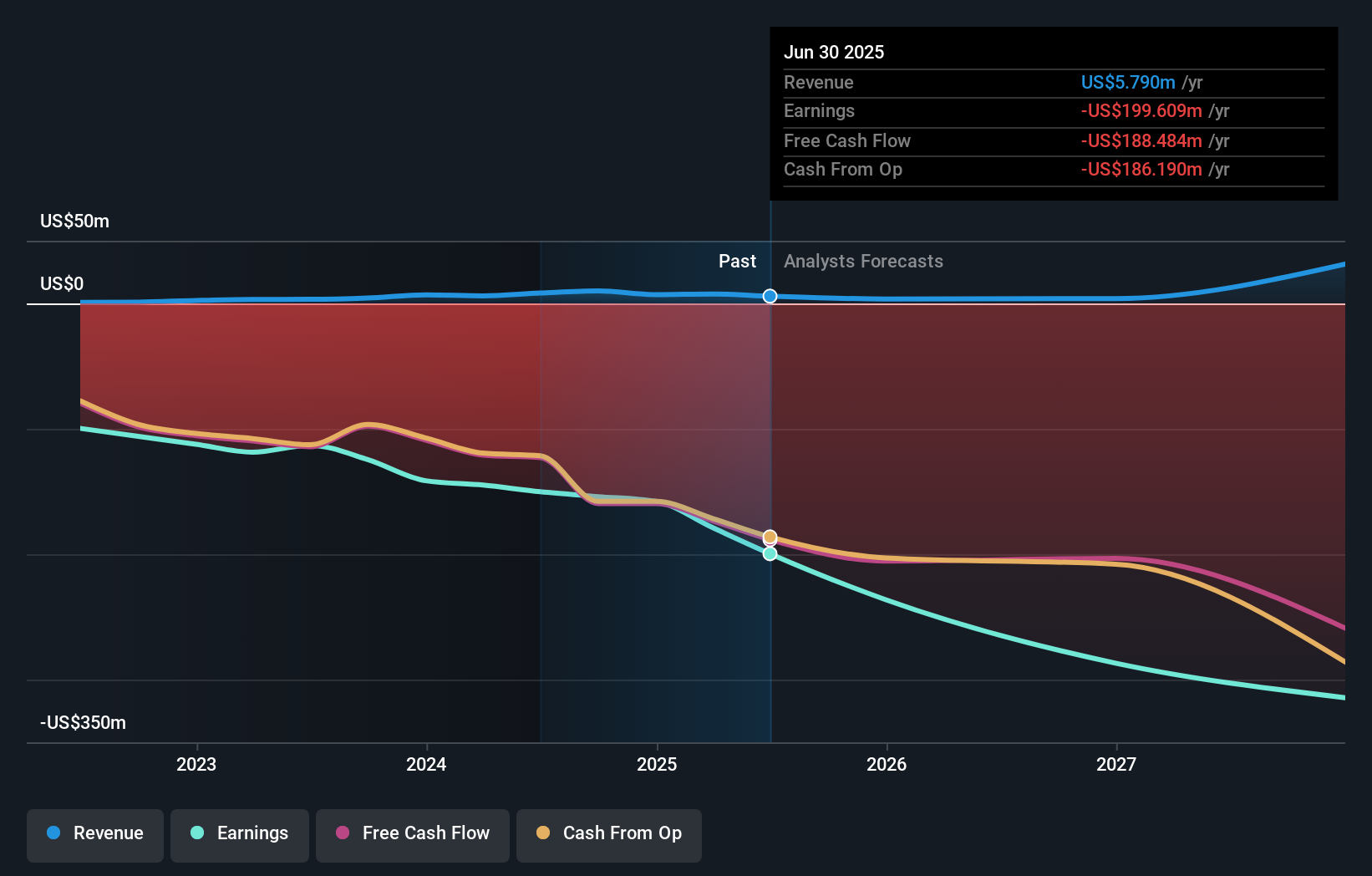

Being a Celldex Therapeutics shareholder means believing that recent clinical advances, particularly the robust Phase 2 results for barzolvolimab in multiple forms of urticaria, can translate into successful Phase 3 outcomes and future commercial potential. The addition of Teri Lawver as Chief Commercial Officer signals a readiness to turn pipeline progress into a commercially focused story. However, the company remains unprofitable, with net losses widening and revenue declining sharply year over year, a reminder that execution risks are high until late-stage readouts or partnerships emerge. The recent positive data and commercial leadership could increase confidence in upcoming catalysts, but do not instantly change Celldex's biggest challenge: moving from promising science to meaningful, recurring revenue. Investors may see optimism for future growth, but should keep a close eye on trial progress and cash utilization.

But the strength of recent data doesn't erase the underlying financial risks investors should monitor. Upon reviewing our latest valuation report, Celldex Therapeutics' share price might be too optimistic.Exploring Other Perspectives

Explore another fair value estimate on Celldex Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Celldex Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celldex Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Celldex Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celldex Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLDX

Celldex Therapeutics

A biopharmaceutical company, engages in developing therapeutic antibodies for patients with severe inflammatory, allergic, autoimmune, and other diseases.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives