- United States

- /

- Biotech

- /

- NasdaqGS:CABA

Assessing Cabaletta Bio (CABA) Valuation as ESGCT Data Drives New Attention to Rese-cel Clinical Progress

Reviewed by Kshitija Bhandaru

Recent data presented at the ESGCT Congress put the spotlight on Cabaletta Bio (CABA), as its investigational CAR T therapy, rese-cel, showed strong B cell depletion and positive early clinical responses in pemphigus vulgaris patients, even without preconditioning.

See our latest analysis for Cabaletta Bio.

Following the news from the ESGCT Congress, Cabaletta Bio's share price jumped more than 26% over the past month, as investors responded enthusiastically to initial RESET-PV trial data and renewed pipeline momentum. Despite the strong recent move, the 1-year total shareholder return is still down nearly 45%, reminding us that while optimism is returning, the long game will be shaped by regulatory milestones and further clinical progress.

If novel immunotherapies like this have you intrigued, it is a promising moment to explore the latest breakthroughs with our See the full list for free.

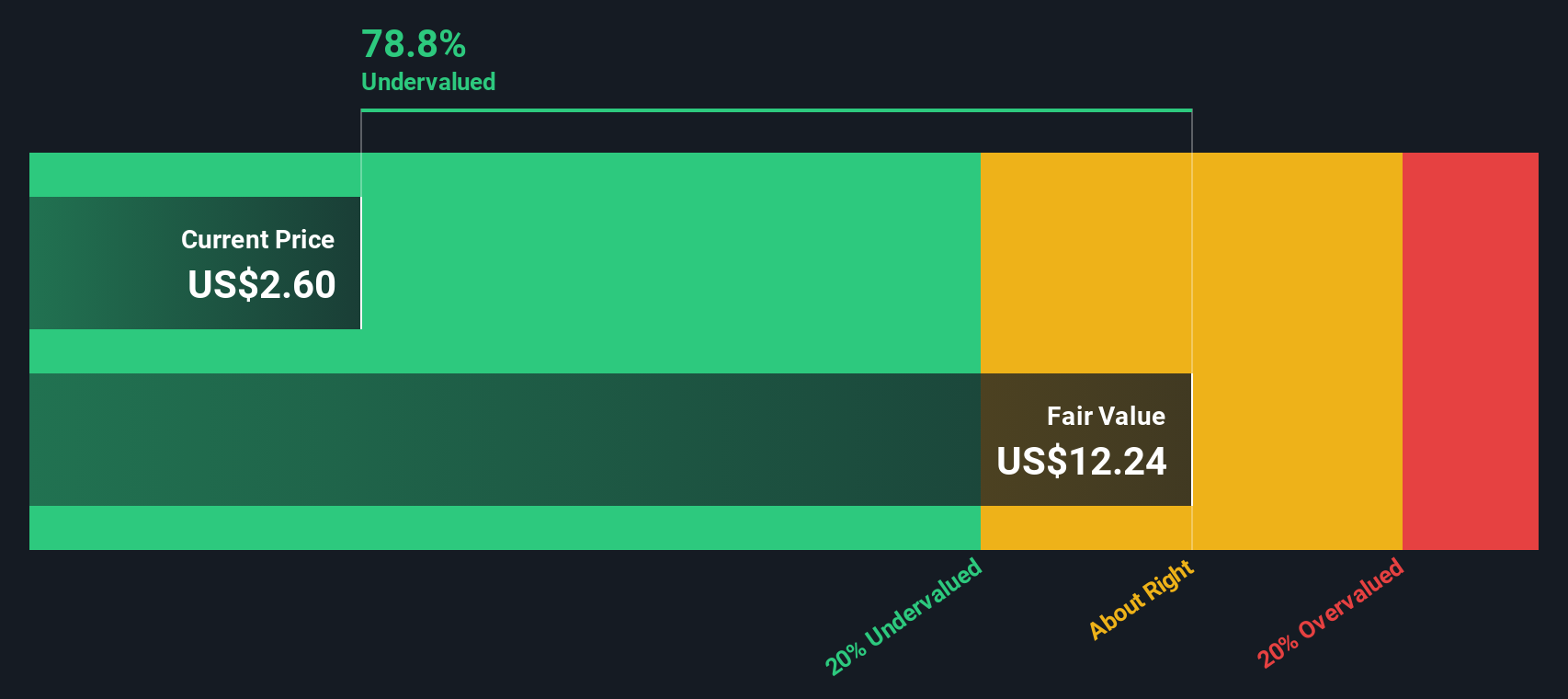

With the recent surge in share price and a price target far above current levels, the real question is whether Cabaletta Bio remains a hidden value play or if the market is already factoring in future success.

Price-to-Book Ratio of 1.2x: Is it justified?

Trading at a price-to-book ratio of 1.2x, Cabaletta Bio stands out as notably cheaper than both its US Biotechs peers and the broader market, with a last close of $2.32.

The price-to-book ratio compares a company's market value to its book value, giving investors insight into how much they are paying for each dollar of net assets. In high-growth biotech, low ratios reflect uncertainty about near-term profitability but can also highlight unloved pipeline potential.

Cabaletta’s 1.2x ratio is meaningfully more attractive than the US Biotechs industry average of 2.5x and the peer group average of 30.9x. Such a deep discount signals that the market is either overlooking future prospects or remains unconvinced by the clinical pipeline. However, recent trial developments may start changing sentiment.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 1.2x (UNDERVALUED)

However, disappointing future trial data or regulatory setbacks could quickly reverse recent gains and change investor expectations for Cabaletta Bio's outlook.

Find out about the key risks to this Cabaletta Bio narrative.

Another View: Discounted Cash Flow Says Deep Value

Looking through a different lens, the SWS DCF model estimates Cabaletta Bio’s fair value at $35.13, which is dramatically higher than the current price of $2.32. This suggests the market might be missing significant upside. However, how reliable are such projections for early-stage biotech stocks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cabaletta Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cabaletta Bio Narrative

If you want to dig deeper, the data is yours to explore and your own perspective might reveal something new. Why not shape your own narrative in a matter of minutes? Do it your way

A great starting point for your Cabaletta Bio research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead of the crowd. Simply Wall Street’s powerful screeners are some of the fastest ways to find your next breakthrough stock idea.

- Boost your potential returns when you target income by accessing these 19 dividend stocks with yields > 3% with yields above 3% and proven financial strength.

- Tap into tomorrow’s transformative trends by tracking these 24 AI penny stocks at the forefront of artificial intelligence innovation.

- Find exceptional value opportunities hiding in plain sight through our list of these 892 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CABA

Cabaletta Bio

A clinical-stage biotechnology company, focuses on the discovery and development of engineered T cell therapies for patients with autoimmune diseases.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.