- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Does Biogen’s Valuation Stack Up After Recent Alzheimer’s Regulatory Updates?

Reviewed by Bailey Pemberton

- Curious if Biogen is a bargain or overpriced in today’s market? You’re not alone. A fresh look at its valuation might challenge what you think you know.

- After climbing 15.2% in the last month and delivering an 18.5% gain year-to-date, Biogen’s stock is once again on investors’ radar. This comes despite being down nearly 39.0% over three years.

- Biogen recently drew attention with regulatory updates surrounding its Alzheimer’s treatments and partnership announcements in the neurology space, both of which have influenced investor sentiment and powered those recent price swings. Ongoing developments in its pipeline continue to feature in headlines, suggesting that expectations around future growth are shifting.

- On our valuation checks, Biogen scores a strong 5 out of 6. However, it’s not just about the high score or traditional metrics. A deeper dive into multiple approaches (and something even better at the end) might give us the full story on whether this stock’s valuation stands out.

Find out why Biogen's 10.5% return over the last year is lagging behind its peers.

Approach 1: Biogen Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. This approach is widely used for its focus on the actual cash a business is expected to generate, rather than just accounting profits.

For Biogen, the current Free Cash Flow stands at $2.18 Billion. Analyst estimates provide projections for the next few years, after which extended forecasts are extrapolated by Simply Wall St. By 2029, Biogen’s Free Cash Flow is expected to reach $2.61 Billion, with similar values forecast in the years beyond. The DCF model used here, based on the 2 Stage Free Cash Flow to Equity method, incorporates these projections to estimate the company's true worth.

According to this analysis, Biogen’s intrinsic value comes to $367.57 per share, representing an implied 51.6% discount compared to today’s market price. This suggests the stock is substantially undervalued by the market if these long-term cash flow projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Biogen is undervalued by 51.6%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

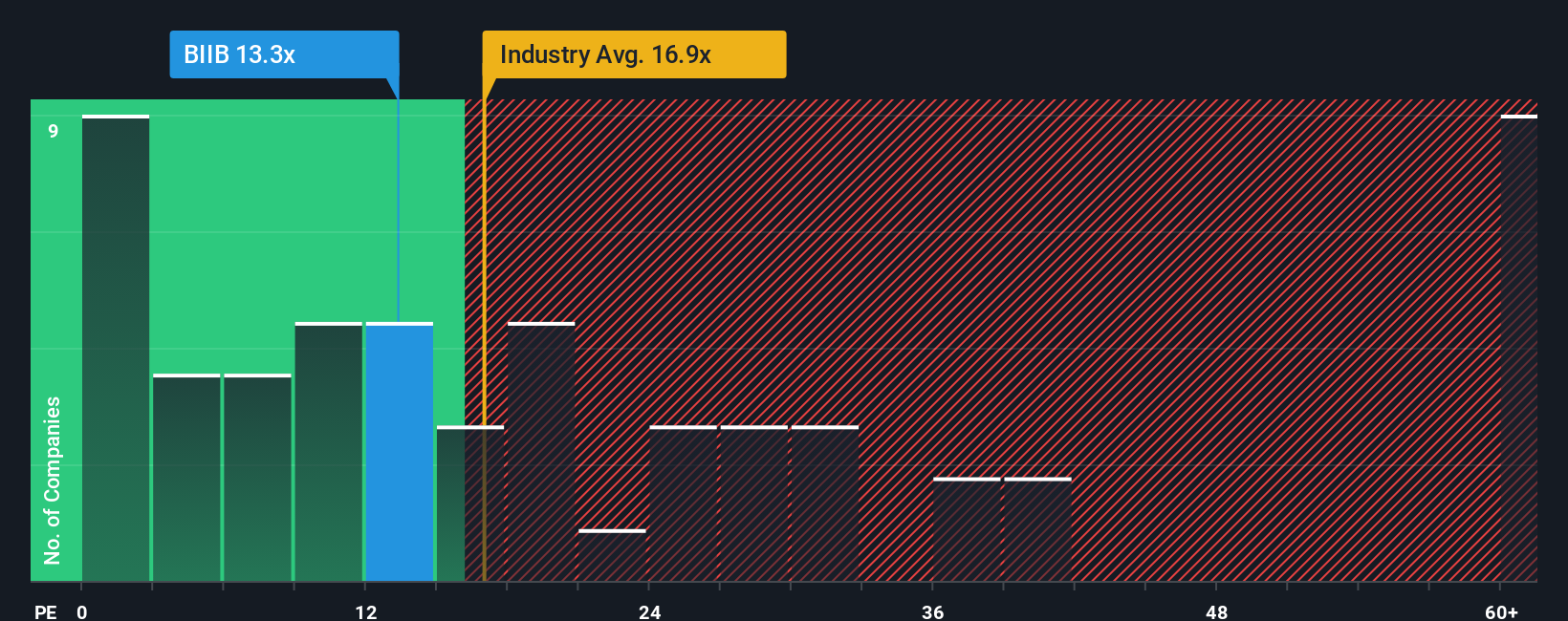

Approach 2: Biogen Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as one of the most insightful valuation metrics for profitable companies like Biogen. It provides a straightforward way to gauge how much investors are willing to pay for each dollar of earnings, making it particularly useful for assessing established firms with consistent profitability.

Determining what constitutes a "normal" or "fair" PE ratio is not just about the number itself. The right PE depends on factors like the company’s expected earnings growth and overall risk profile. Investors typically assign higher PE ratios to companies expected to grow faster or carry less risk, and lower ratios to firms with more uncertain outlooks.

Biogen currently trades at a PE ratio of 16.2x. For perspective, the average PE for its biotech industry peers is 18.7x, and the broader peer group averages 21.4x. These benchmarks suggest Biogen is valued at a discount relative to its sector and the market.

Simply Wall St introduces the concept of a "Fair Ratio," which in Biogen’s case is 23.2x. Unlike comparisons based solely on peers or industry averages, the Fair Ratio accounts for the company’s unique blend of earnings growth, risk factors, profit margins, industry backdrop, and market capitalization. This holistic approach provides a more complete and tailored measure of value, reflecting where Biogen might ideally trade given its specific fundamentals.

Comparing Biogen’s actual PE of 16.2x to its Fair Ratio of 23.2x, the stock appears to be materially undervalued based on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Biogen Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are simply your story behind a stock, not just a number, but your perspective about where the company is headed and why. With Narratives, you connect your view of Biogen’s business drivers and risks to a specific financial forecast, and from there arrive at a fair value you can track against the market price.

This approach makes it easy for anyone, no matter their level of investing experience, to turn their research into actionable insights. On Simply Wall St’s platform, millions of investors build or review Narratives on the Community page, making it a hub for transparent, real-time idea sharing. When new news or earnings are announced, Narratives update automatically, ensuring your view stays relevant with the latest developments.

Narratives give meaning to numbers: if your fair value is above the current price, it could prompt a buy decision; if it’s below, you might decide to sell or hold. For example, among recent Biogen Narratives, bulls project a fair value of $260.00, seeing breakthroughs and global launches driving growth, while bears estimate $128.00, focusing on policy risks and pipeline uncertainties. This highlights how different stories lead to different investment choices.

Do you think there's more to the story for Biogen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026