- United States

- /

- Biotech

- /

- NasdaqGS:BDTX

Can Black Diamond Therapeutics’ (BDTX) Silevertinib CNS Data Redefine Its Precision Oncology Strategy?

Reviewed by Sasha Jovanovic

- Black Diamond Therapeutics recently reported topline Phase 2 data for silevertinib in first-line non-small cell lung cancer patients with non-classical EGFR mutations, and outlined plans to start a randomized Phase 2 trial in newly diagnosed glioblastoma in 2026.

- The early results, including strong central nervous system response rates and a broad range of EGFR alterations targeted, underscore silevertinib’s potential as a brain-penetrant precision therapy across multiple tumor types.

- We’ll now examine how silevertinib’s encouraging CNS activity in hard-to-treat EGFR-mutant cancers may reshape Black Diamond’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Black Diamond Therapeutics' Investment Narrative?

For anyone considering Black Diamond today, the core belief is that silevertinib can become a meaningful precision oncology asset while the company carefully manages cash and dilution. The latest Phase 2 NSCLC data, with strong CNS activity and a broad range of non-classical EGFR mutations treated, directly feeds into that thesis and helps explain why management is now committing to a randomized Phase 2 trial in newly diagnosed glioblastoma. At the same time, the sharp share price drop after the topline release suggests that, at least in the near term, the market is questioning how much value these data add versus expectations. That likely reshapes the main catalysts: updated NSCLC data and partnering progress around silevertinib, set against key risks such as forecast revenue and earnings declines and reliance on external funding, including the US$150,000,000 ATM facility.

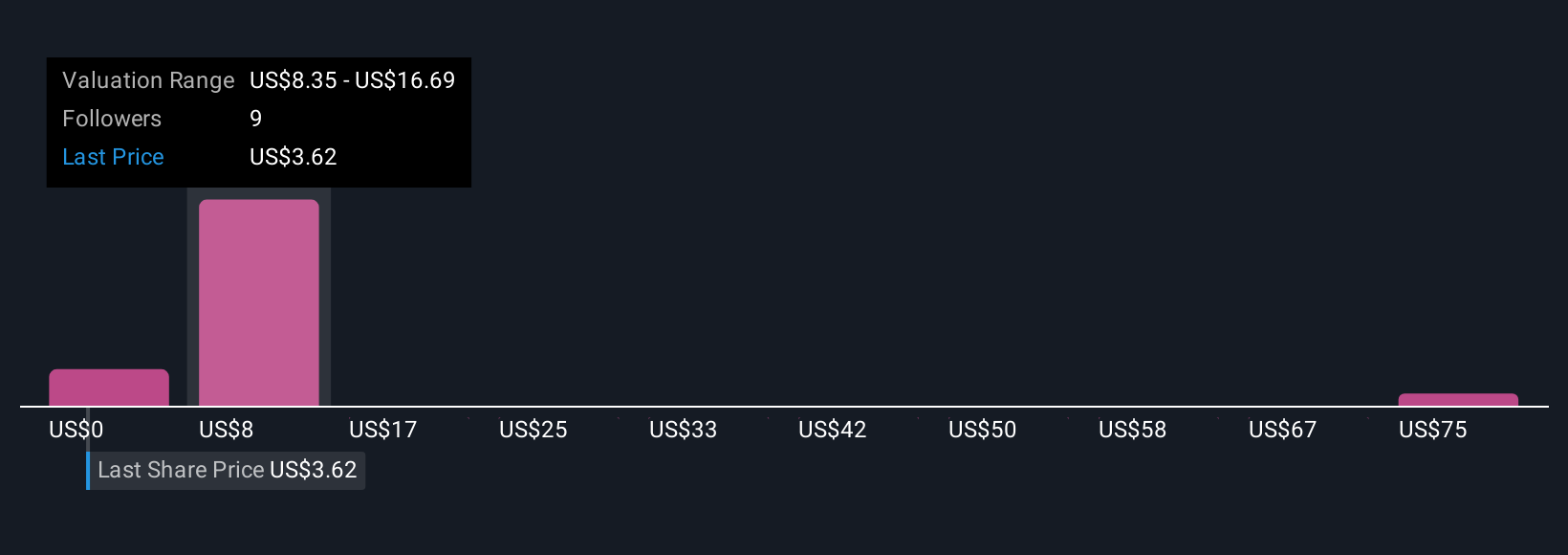

However, one emerging risk around future funding and dilution is easy to overlook right now. Upon reviewing our latest valuation report, Black Diamond Therapeutics' share price might be too pessimistic.Exploring Other Perspectives

Explore 5 other fair value estimates on Black Diamond Therapeutics - why the stock might be worth just $8.34!

Build Your Own Black Diamond Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Diamond Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Diamond Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Diamond Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BDTX

Black Diamond Therapeutics

A clinical-stage oncology company, focuses on the discovery and development of MasterKey therapies for patients with genetically defined tumors.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026