- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (BBIO): Negative Equity Underscores Balance Sheet Risk Despite Forecasted Profit Growth

Reviewed by Simply Wall St

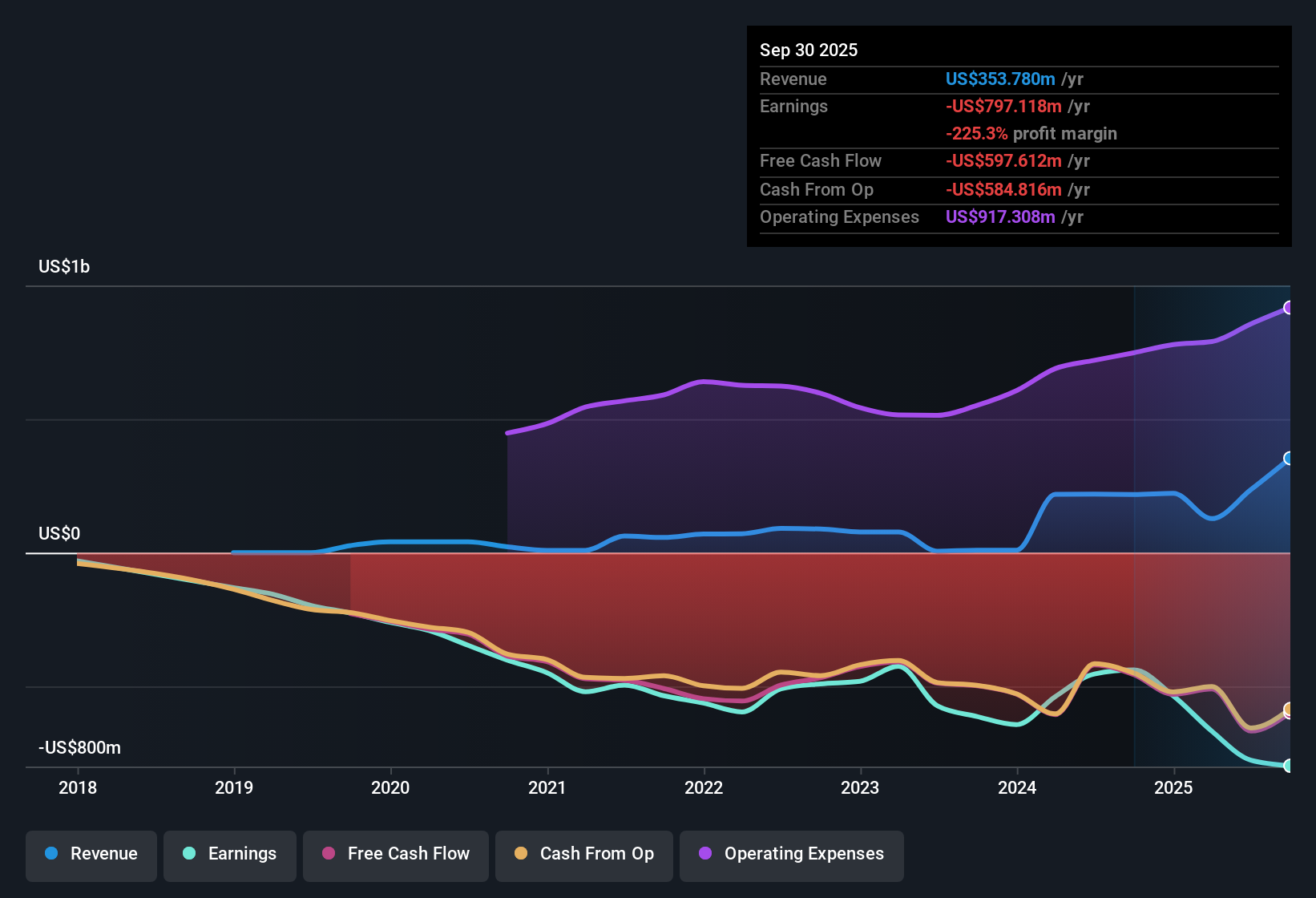

BridgeBio Pharma (BBIO) remains unprofitable, with net losses having grown at an annual rate of 7.3% over the past five years. While the company’s net profit margins have yet to improve, forecasts point to rapid earnings growth ahead as analysts expect earnings to jump 73.17% per year and see BridgeBio turning profitable within three years. Revenue is also projected to accelerate by 42.8% per year, far outpacing the 10.3% growth rate forecast for the broader US market.

See our full analysis for BridgeBio Pharma.The next step is to see how all these figures measure up against the prevailing narratives about BridgeBio. Some expectations may hold up, while others could be up for debate.

See what the community is saying about BridgeBio Pharma

Attruby Drives Pipeline Concentration Risk

- BridgeBio is heavily reliant on Attruby as its core revenue driver, with analysts and the consensus narrative warning that any setback to this single late-stage product could materially affect future growth and profitability.

- Bears argue that pipeline concentration increases the company's vulnerability, especially given the emerging competition from larger pharmaceutical rivals in the ATTR-CM market.

- Competitive threats from established players like Pfizer and Alnylam could erode BridgeBio's market share and compress margins if Attruby loses its differentiation or reimbursement advantages.

- Consensus narrative notes that regulatory or trial setbacks for Attruby's high-risk patient subgroups may directly threaten the company's ability to achieve projected margin expansion and top-line growth.

Operating Expenses Outpace Revenue Gains

- During Q2, operating expenses stood at $244.8 million, more than double the total revenue of $110.6 million. This highlights the ongoing challenge of scaling costs relative to growth.

- Bears caution that high costs may drive persistent net losses even as revenue rises, raising the risk of future dilutive equity financing.

- Consensus narrative points out that escalating late-stage clinical trial costs, growing SG&A, and reliance on milestone payments make the path to sustainable profitability more difficult than top-line projections suggest.

- What is surprising is that despite a forecasted jump in earnings and revenue, BridgeBio's negative equity signals a need for prudent cash management to avoid weakening per-share earnings.

Valuation: Premium Multiples, Deep Discount to DCF

- BridgeBio trades at a price-to-sales ratio of 34.2x, more than triple the US biotech average of 10.8x and nearly seven times industry peers at 4.9x. However, its current share price of $63.31 sits far below the DCF fair value of $338.89.

- According to the analysts' consensus view, the company's growth potential and position below DCF fair value make a compelling case for upside, yet its valuation multiples price in significant future success.

- Consensus narrative notes three pending Phase III clinical trial readouts as major catalysts that could justify these premium multiples, but achievement is far from assured.

- Bulls point to robust cash reserves and operational leverage as reasons for optimism, but only if the company can deliver on its ambitious pipeline milestones.

Momentum may be building, but can BridgeBio convert pipeline hopes into profits before its premium fades? 📊 Read the full BridgeBio Pharma Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BridgeBio Pharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the figures? Share your view and build your own narrative in just a few minutes: Do it your way

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

BridgeBio’s heavy pipeline concentration, negative equity, and high operating expenses highlight vulnerability to financial shocks and inconsistent earnings.

If you want exposure to companies with resilient financial health and stronger balance sheets, start by screening for solid balance sheet and fundamentals stocks screener (1986 results) built to handle volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives