- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Pancreatic Cancer Research Partnership Could Be a Game Changer for Azenta (AZTA)

Reviewed by Sasha Jovanovic

- On November 4, 2025, the PRECEDE Foundation announced a partnership with Azenta, Inc. for secure biorepository storage and improved logistics, supporting research into early detection and survival rates for pancreatic cancer.

- This collaboration enhances Azenta’s profile in providing critical infrastructure for high-impact cancer research, aligning the company with global efforts to advance early cancer diagnostics.

- We'll examine how Azenta’s entry into large-scale cancer research biorepositories could influence its investment case and industry positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Azenta Investment Narrative Recap

To be a shareholder in Azenta, you need to believe in the long-term demand for outsourced biorepository services and life sciences digitization, both of which are fundamental as pharma and research clients seek operational efficiency. While Azenta's partnership with the PRECEDE Foundation enhances its exposure to high-profile cancer research, the collaboration by itself does not materially shift the most important near-term catalyst, growth in recurring, higher-margin service revenues, or address the most pressing risk: ongoing delays in orders and revenue pressure from budget constraints in the pharma and biotech sectors.

Among recent announcements, the upcoming Q4 and full-year 2025 earnings release on November 21 is particularly relevant, as it provides fresh insight into whether recent partnerships and service expansions are translating into sustained revenue growth. Progress here could signal Azenta’s ability to offset softness in capital equipment and sequencing revenues, reinforcing the narrative of service-driven resilience even as project deprioritizations continue in other areas.

But against the promise of new opportunities, investors should also consider the possibility that persistent softness in core product demand could...

Read the full narrative on Azenta (it's free!)

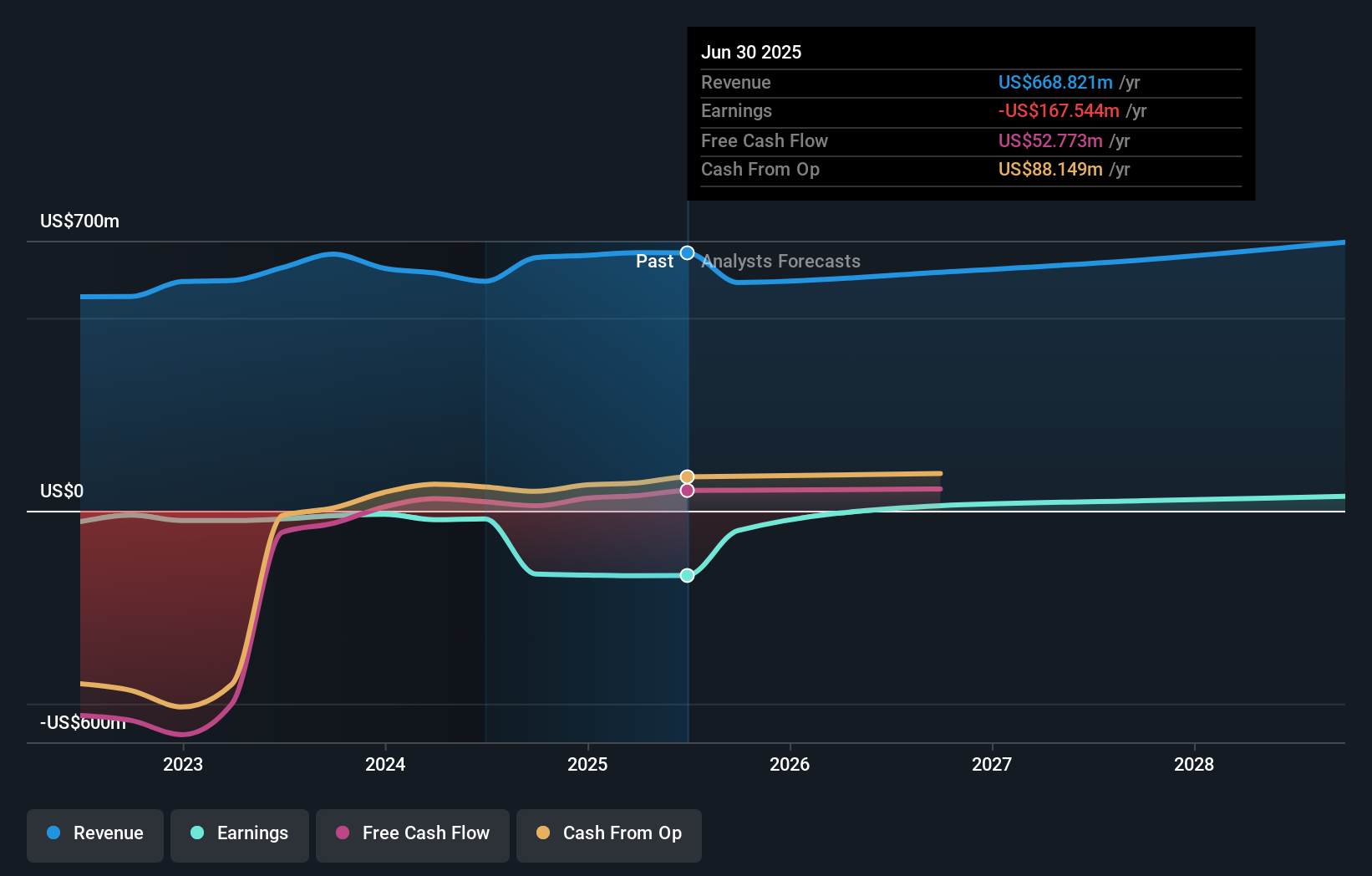

Azenta's story anticipates $684.6 million in revenue and $34.5 million in earnings by 2028. This outlook assumes revenue will decline by 0.8% annually and marks a $202 million increase in earnings from the current -$167.5 million.

Uncover how Azenta's forecasts yield a $35.17 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set Azenta’s fair value between US$32.91 and US$35.17, based on 2 individual analyses. Yet, with order delays and budget constraints still weighing on core revenue, it is important to weigh these opinions against the underlying business challenges and see how your outlook compares.

Explore 2 other fair value estimates on Azenta - why the stock might be worth just $32.91!

Build Your Own Azenta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Azenta research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Azenta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Azenta's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives