- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

Why Avadel Pharmaceuticals (AVDL) Is Up 6.6 Percent After Joining the S&P Pharma Select Index

Reviewed by Simply Wall St

- Avadel Pharmaceuticals plc (NasdaqGM: AVDL) was recently added to the S&P Pharmaceuticals Select Industry Index, a move reflecting its growing prominence within the sector.

- This inclusion may attract increased attention from institutional investors and index funds, given that membership in such indices often leads to higher visibility and broader market participation.

- We'll explore how Avadel's addition to a major industry index could reinforce perceptions of long-term stability and sector relevance within its investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Avadel Pharmaceuticals Investment Narrative Recap

For investors considering Avadel Pharmaceuticals, confidence in the long-term potential of LUMRYZ, the company's primary commercial product, remains central. While inclusion in the S&P Pharmaceuticals Select Industry Index may bring greater market attention and help boost liquidity, it does not directly address Avadel’s dependence on LUMRYZ as its main growth catalyst or its concentration risk, which remains the most immediate challenge. Among recent developments, the sustained momentum and clinical data supporting LUMRYZ’s efficacy in narcolepsy care stand out, particularly as new real-world evidence and expanded FDA approvals have supported broader adoption. Such progress is essential as Avadel seeks to solidify its position ahead of pending Phase 3 results for LUMRYZ’s potential label expansion, a near-term opportunity watched closely by the market. In contrast, investors should also remain aware of unresolved legal and royalty risks that could impact future profitability and...

Read the full narrative on Avadel Pharmaceuticals (it's free!)

Avadel Pharmaceuticals' outlook anticipates $447.5 million in revenue and $134.9 million in earnings by 2028. This projection relies on a 26.5% annual revenue growth rate and marks a $137.8 million increase in earnings from current levels of -$2.9 million.

Uncover how Avadel Pharmaceuticals' forecasts yield a $20.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

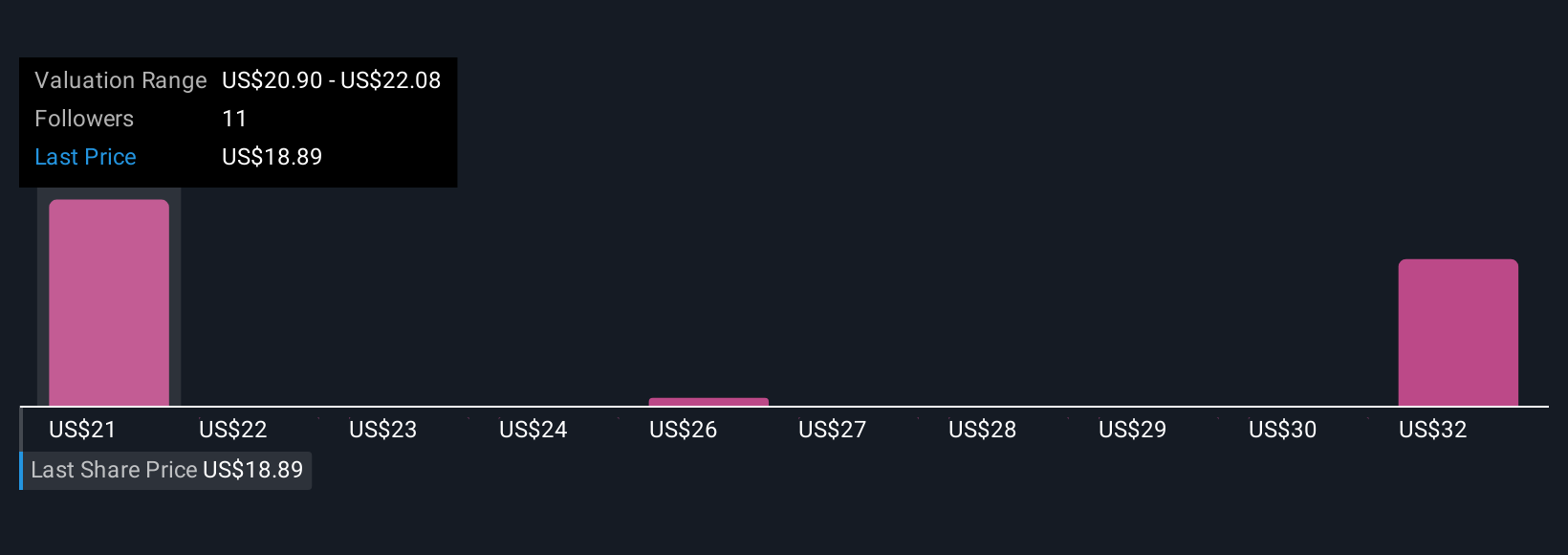

Simply Wall St Community members offered three unique fair value estimates for Avadel Pharmaceuticals ranging from US$20.20 to US$32.79 per share. With LUMRYZ driving the story, many are watching for progress on label expansion and its impact on long-term revenue growth.

Explore 3 other fair value estimates on Avadel Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Avadel Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avadel Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Avadel Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avadel Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives