- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

Did Avadel Pharmaceuticals’ (AVDL) Surprise Profitability Turn Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Avadel Pharmaceuticals plc recently reported earnings for the third quarter and nine months ended September 30, 2025, posting a net income of US$0.02 million and US$4.77 million for these periods respectively, compared to net losses a year ago.

- This marks a turnaround for the company, with basic and diluted earnings per share from continuing operations improving from a US$0.46 loss to a US$0.05 profit year-over-year.

- We'll explore how Avadel's swing to profitability this quarter could impact its investment narrative and market outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Avadel Pharmaceuticals Investment Narrative Recap

To be a shareholder in Avadel Pharmaceuticals, you need conviction in the growth prospects of LUMRYZ as the company’s anchor product, as well as confidence that management can expand its reach or diversify the pipeline. The recent swing to profitability is an encouraging signal, but does not materially lessen Avadel’s concentration risk in the near term, LUMRYZ’s market adoption and competitive threats remain the key short-term catalyst and the primary risk to monitor.

Of the latest announcements, the global litigation settlement with Jazz Pharmaceuticals stands out. By securing a perpetual license and clarity on patent issues, Avadel has lessened legal uncertainties surrounding LUMRYZ and defined a smoother path for future label expansions, directly impacting both the short-term catalyst of market uptake and the long-term outlook for revenue diversification.

Yet, despite these positive shifts, investors should also be aware that if a new competing therapy emerges or reimbursement pressures mount, the reliance on a single revenue stream could become a greater concern…

Read the full narrative on Avadel Pharmaceuticals (it's free!)

Avadel Pharmaceuticals is projected to reach $447.5 million in revenue and $134.9 million in earnings by 2028. This forecast assumes a 26.5% annual revenue growth rate and an earnings increase of $137.8 million from the current earnings of -$2.9 million.

Uncover how Avadel Pharmaceuticals' forecasts yield a $19.12 fair value, in line with its current price.

Exploring Other Perspectives

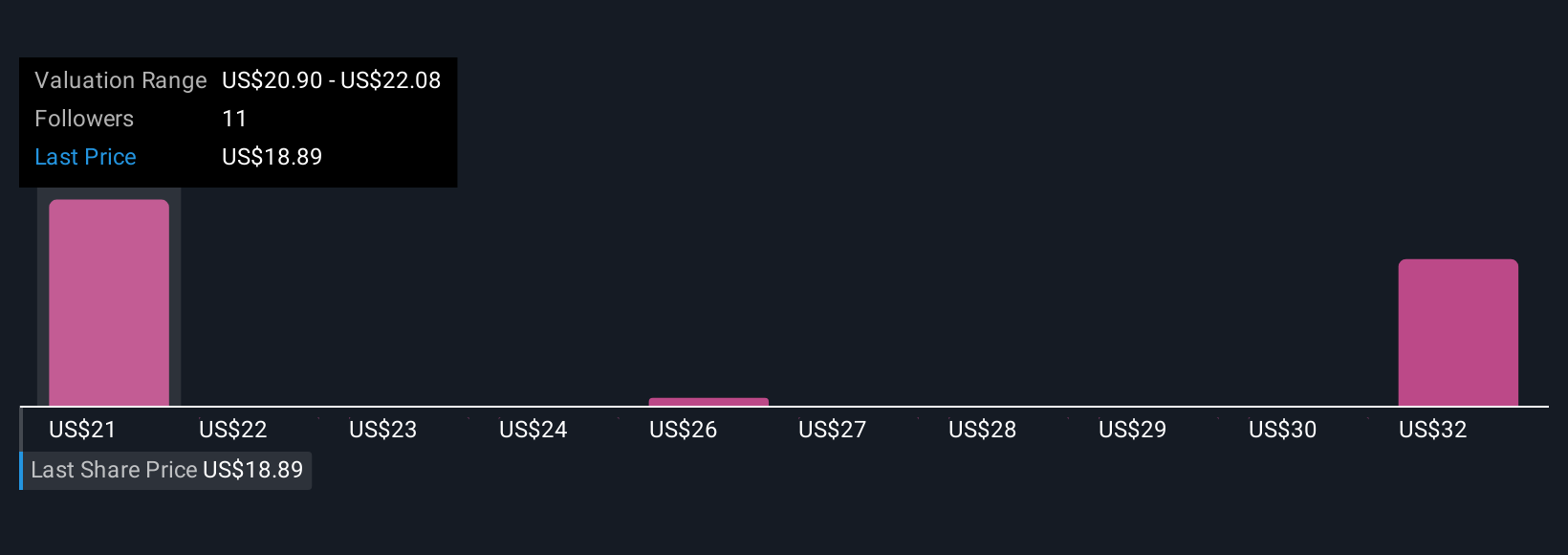

Simply Wall St Community members provided three fair value estimates for Avadel, spanning from US$19.13 to US$32.34 per share. While these varied views highlight differing growth expectations, current results reinforce just how closely LUMRYZ’s adoption and exclusivity will steer the company’s future performance, reminding you to compare multiple approaches before deciding where you stand.

Explore 3 other fair value estimates on Avadel Pharmaceuticals - why the stock might be worth just $19.12!

Build Your Own Avadel Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avadel Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Avadel Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avadel Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives