- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) Stock Catapults 33% Though Its Price And Business Still Lag The Industry

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 116% in the last year.

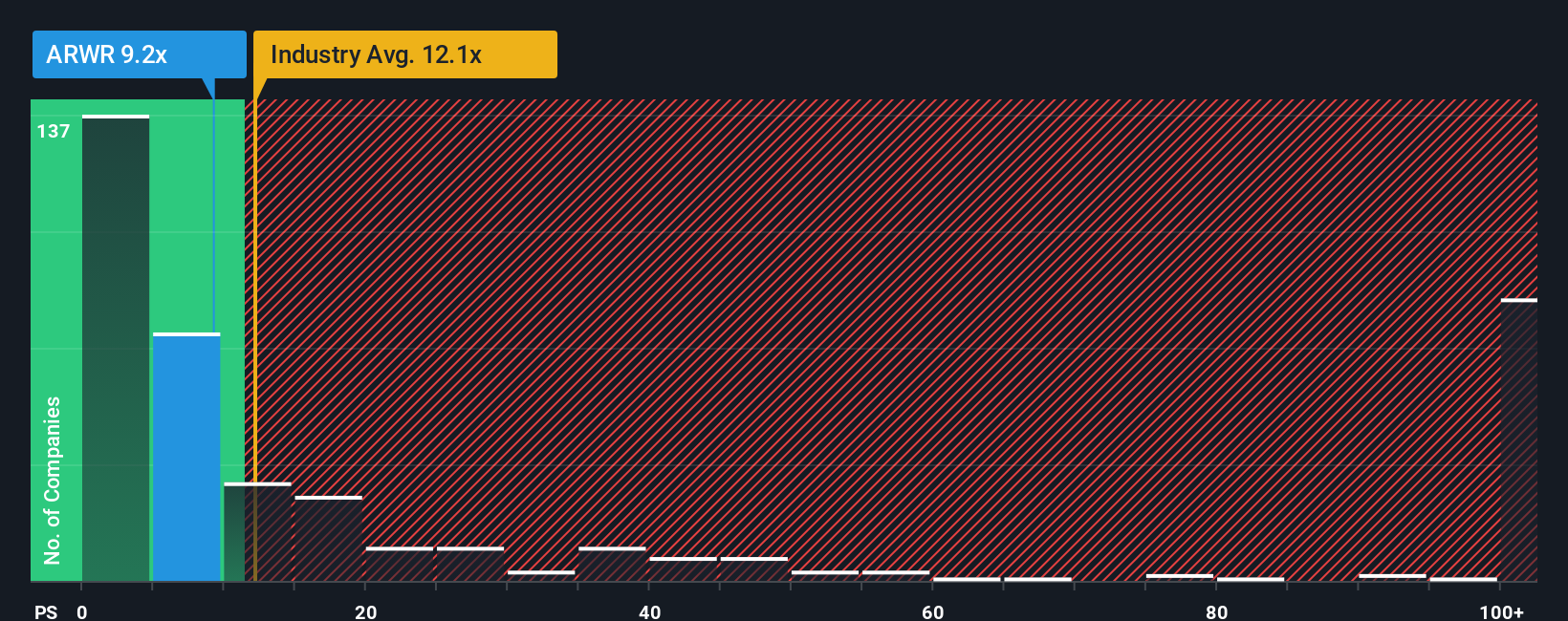

In spite of the firm bounce in price, Arrowhead Pharmaceuticals may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 9.2x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.1x and even P/S higher than 101x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Arrowhead Pharmaceuticals

What Does Arrowhead Pharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Arrowhead Pharmaceuticals has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Arrowhead Pharmaceuticals will help you uncover what's on the horizon.How Is Arrowhead Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Arrowhead Pharmaceuticals would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an excellent 241% overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 14% per year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 128% each year, which paints a poor picture.

With this in consideration, we find it intriguing that Arrowhead Pharmaceuticals' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Arrowhead Pharmaceuticals' P/S

Arrowhead Pharmaceuticals' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Arrowhead Pharmaceuticals' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Arrowhead Pharmaceuticals that you should be aware of.

If these risks are making you reconsider your opinion on Arrowhead Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026