- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Arrowhead Pharmaceuticals (ARWR) Valuation After FDA Breakthrough Therapy Designation for Plozasiran

Reviewed by Simply Wall St

Arrowhead Pharmaceuticals (ARWR) just got a meaningful regulatory boost, with the FDA granting Breakthrough Therapy designation to its triglyceride lowering drug plozasiran. This move could streamline development timelines and sharpen investor focus.

See our latest analysis for Arrowhead Pharmaceuticals.

The Breakthrough Therapy nod lands on top of a powerful run, with a roughly 71% 1 month share price return and about 189% 1 year total shareholder return. This suggests momentum is still very much building as Arrowhead shifts into a commercial plus late stage story.

If this kind of regulatory driven surge has your attention, it is worth exploring other innovative names in healthcare stocks that could be setting up for their next big catalyst.

Yet with shares now trading above the average analyst target and Arrowhead only just entering its commercial phase, investors face a critical question: is this a fresh entry point, or has the market already banked the next leg of growth?

Most Popular Narrative: 12% Overvalued

Compared with Arrowhead Pharmaceuticals' last close at $64.66, the most popular narrative pegs fair value nearer $57.67, implying the latest rally runs ahead of fundamentals.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $398.8 million, earnings will come to $64.0 million, and it would be trading on a PE ratio of 142.3x, assuming you use a discount rate of 7.0 percent.

Curious what kind of shrinking revenue base, rising margins, and sky high future earnings multiple are baked into that fair value story? The full narrative unpacks every assumption driving this punchy valuation call.

Result: Fair Value of $57.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several moving pieces could still upset that story, especially potential trial setbacks or partner delays, which would quickly challenge such optimistic assumptions.

Find out about the key risks to this Arrowhead Pharmaceuticals narrative.

Another Lens on Valuation

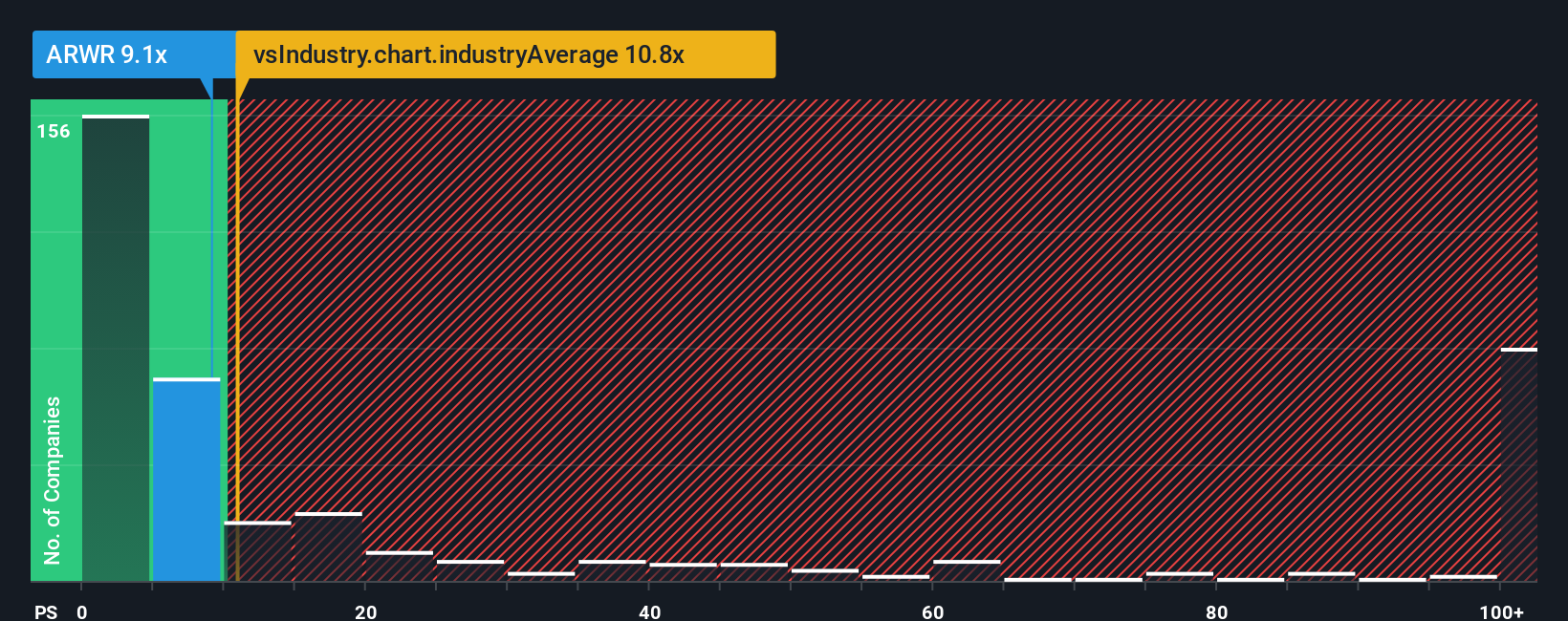

While the popular narrative flags Arrowhead as about 12 percent overvalued, our price to sales work paints a softer picture. At 10.6 times sales, the stock is cheaper than the US biotech average at 11.6 times and well below peers at 15.6 times, yet still above its own fair ratio of 9.9 times. That mix hints at both momentum premium and room for disappointment if growth expectations cool. Which way do you think sentiment ultimately breaks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrowhead Pharmaceuticals Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in minutes: Do it your way.

A great starting point for your Arrowhead Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before momentum shifts again, use the Simply Wall Street Screener to lock onto focused stock ideas that match your strategy and keep you a step ahead.

- Capture overlooked growth potential by scanning these 907 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Level up your innovation exposure by targeting these 26 AI penny stocks at the heart of the AI transformation.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that can power long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026