- United States

- /

- Biotech

- /

- NasdaqGM:APGE

Does Positive APG333 Data and $345 Million Raise Redefine the Bull Case for Apogee Therapeutics (APGE)?

Reviewed by Sasha Jovanovic

- In recent days, Apogee Therapeutics announced positive interim Phase 1 results for its experimental antibody APG333 and completed a public offering that raised approximately US$345 million through the sale of over 8 million shares.

- This combination of encouraging clinical data and a successful capital raise highlights strong investor interest and confidence in Apogee’s clinical pipeline.

- We’ll explore how the promising potential of APG333 as indicated by interim trial results shapes Apogee Therapeutics’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Apogee Therapeutics' Investment Narrative?

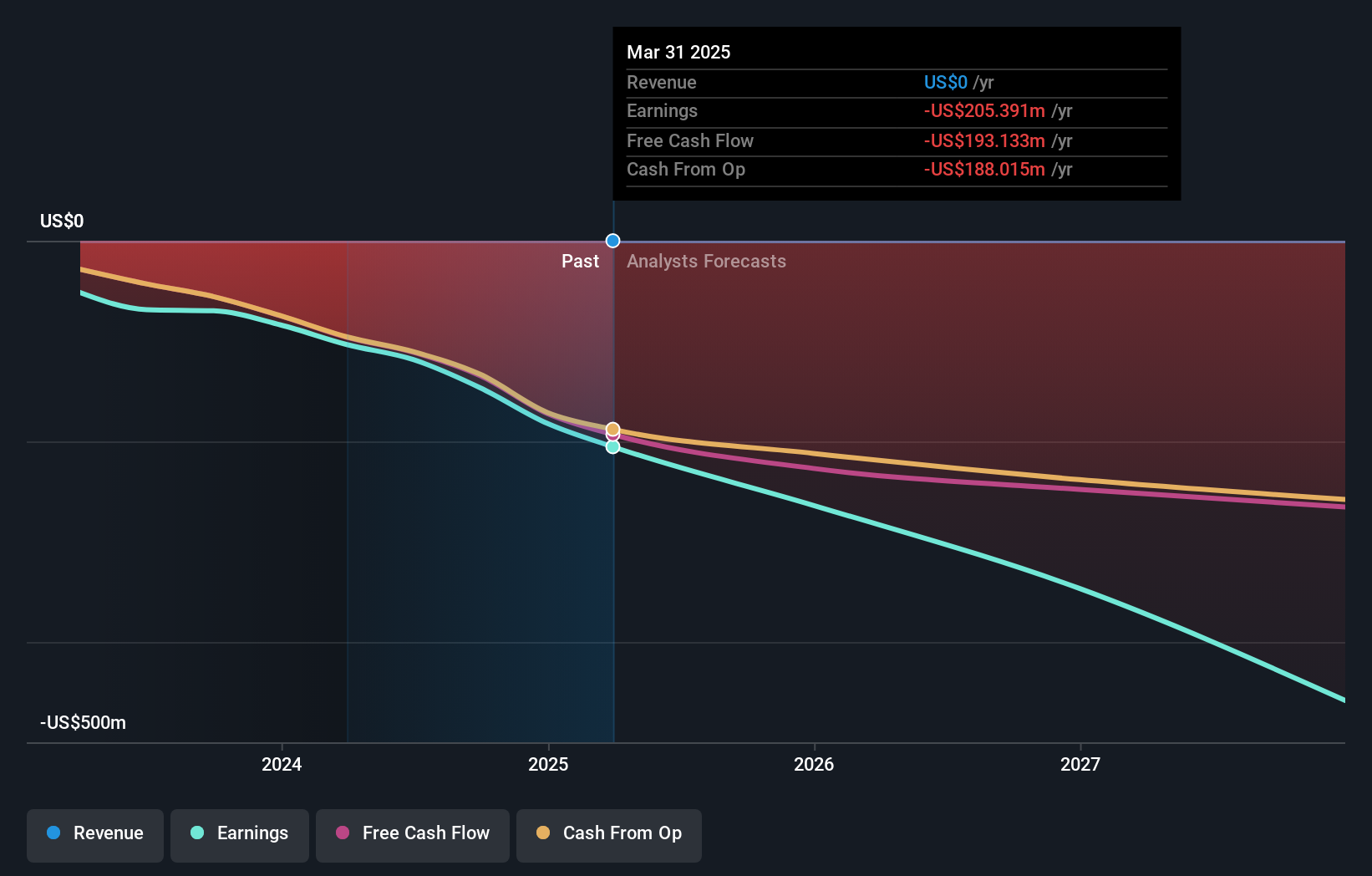

For potential Apogee Therapeutics shareholders, the central thesis remains anchored in the prospect of successful clinical development, particularly for its lead antibody program, APG333. The announcement of positive interim Phase 1 data and completion of a US$345 million capital raise are significant, these events enhance short-term visibility by strengthening the company’s cash position and affirming external interest in its pipeline, even as the business remains pre-revenue and unprofitable. While encouraging clinical results somewhat brighten near-term catalysts, the risk picture has not shifted dramatically. Net losses continue to widen, revenue remains at zero, and earnings are projected to decline further, highlighting ongoing operational pressures. Recent insider selling, including transactions by the CFO, has not appeared to materially sway stock sentiment in the short run. Still, investors should keep a close watch on trial progress and future capital needs. Yet, the pace and outcome of clinical trials could still surprise investors, positively or negatively.

The analysis detailed in our Apogee Therapeutics valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 3 other fair value estimates on Apogee Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Apogee Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apogee Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Apogee Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apogee Therapeutics' overall financial health at a glance.

No Opportunity In Apogee Therapeutics?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APGE

Apogee Therapeutics

A clinical stage biotechnology company, develops novel biologics for the treatment of atopic dermatitis (AD), asthma, eosinophilic esophagitis (EoE), chronic obstructive pulmonary disease (COPD), and other inflammatory and immunology indications.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026