- United States

- /

- Pharma

- /

- NasdaqGM:ANIP

ANI Pharmaceuticals (ANIP): Assessing Valuation Following Strong 2025 Revenue Guidance Update

Reviewed by Kshitija Bhandaru

ANI Pharmaceuticals (ANIP) is on investors’ radar after the company released fresh earnings guidance that projects revenue growth of 33% to 37% for 2025. This is not just another number. This sort of jump recharges the conversation around long-term potential and near-term expectations, prompting shareholders and market watchers alike to reconsider their stance on the stock. Whenever a company puts out guidance this bullish, it tends to reframe the current narrative, especially for those on the fence.

Against this backdrop, shares have moved meaningfully over the past year. Momentum has clearly been on the upswing, with the stock posting a gain of nearly 60% over the past twelve months and over 73% year-to-date. Over the past three months, shares are up 43%. It is also worth mentioning that ANI Pharmaceuticals has delivered steady revenue growth and sharply improved net income in recent years, paving the way for today’s optimistic guidance.

Given these ambitious new targets and strong momentum, is ANI Pharmaceuticals creating an attractive entry point, or is the market already pricing in all this future growth?

Most Popular Narrative: 3% Undervalued

According to the most widely followed narrative, ANI Pharmaceuticals is currently seen as slightly undervalued, with its fair value exceeding the present share price by a small margin based on forward-looking estimates and growth assumptions.

There is significant, untapped growth potential for Cortrophin Gel across core and emerging indications (neurology, nephrology, rheumatology, pulmonology, ophthalmology, and gout). Patient populations remain far below prior peaks, and epidemiological data suggests the addressable market could be several times larger due to an aging population and the rising prevalence of chronic diseases. These factors could support multiyear revenue expansion.

Want to find out what fuels this premium? The most popular valuation model is built on ambitious projections and future performance numbers that most investors would not expect from a company in this sector. The underlying assumptions may surprise you. Get ready to discover which critical growth drivers create the hidden value in play.

Result: Fair Value of $99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on exclusive products and potential pressure on ACTH pricing could pose challenges to ANI’s pathway to sustained earnings growth in the years ahead.

Find out about the key risks to this ANI Pharmaceuticals narrative.Another View: The SWS DCF Model

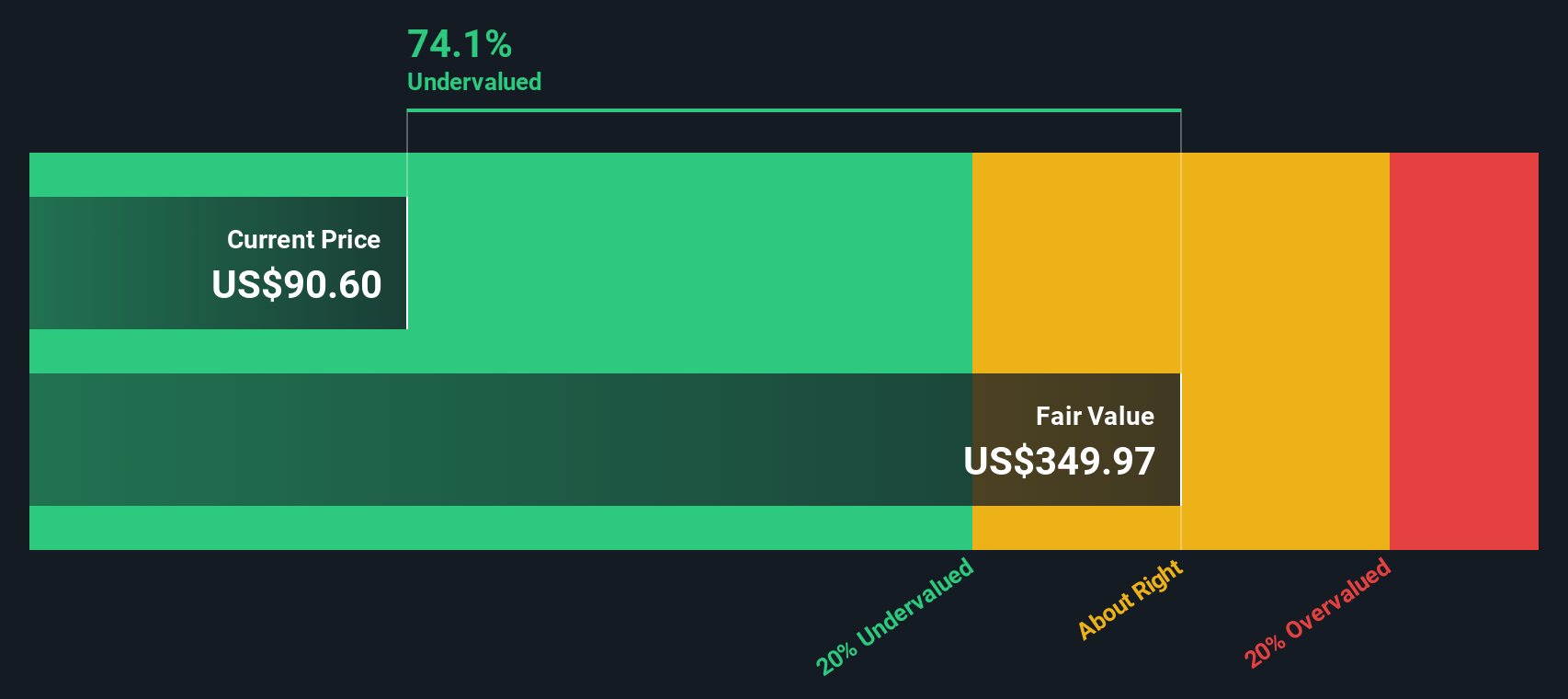

Taking a step back from typical market multiples, our DCF model suggests that ANI Pharmaceuticals may be even more undervalued than analysts indicate. This approach looks at longer-term cash flow potential, rather than focusing on near-term earnings. So which perspective comes closer to the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ANI Pharmaceuticals Narrative

If you see things differently or want to run your own numbers, you can easily create your own take on ANI Pharmaceuticals in just a few minutes. Do it your way

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

You do not have to stop with ANI Pharmaceuticals. The Simply Wall St Screener is your next stop for finding high-potential stocks tailored to your goals. Don’t let the market’s best ideas pass you by.

- Jump on undervalued opportunities and hunt for hidden gems trading well below their fair value by trying out undervalued stocks based on cash flows.

- Expand your search for robust returns among companies paying attractive yields by checking out dividend stocks with yields > 3%.

- Stay ahead in the race for innovation by targeting companies leading transformative breakthroughs in artificial intelligence via AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANIP

ANI Pharmaceuticals

A biopharmaceutical company, develops, manufactures, and markets branded and generic pharmaceutical products in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives